Get the free Additional Unsubsidized L oan Request for Dependents Students

Show details

Additional Unsubsidized Loan Request for Dependents Students Student Name: RU ID Number: If your parents applied for a Federal Direct Parent PLUS through www.studentloans.gov but their application

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign additional unsubsidized l oan

Edit your additional unsubsidized l oan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your additional unsubsidized l oan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing additional unsubsidized l oan online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit additional unsubsidized l oan. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out additional unsubsidized l oan

How to fill out additional unsubsidized loan:

01

Gather necessary information: Before filling out the loan application, gather all the required information such as your social security number, driver's license, employment history, and financial information like income and expenses.

02

Research loan options: Understand the various types of loans available and determine whether an additional unsubsidized loan is the right choice for you. Consider factors like interest rates, repayment terms, and eligibility requirements.

03

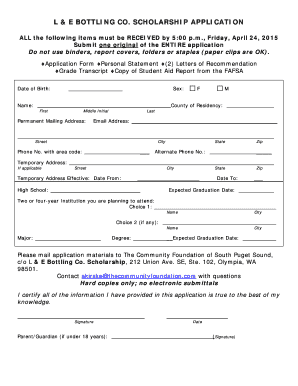

Complete the Free Application for Federal Student Aid (FAFSA): To be eligible for any federal student loan, including unsubsidized loans, you must submit the FAFSA. The FAFSA collects information about your financial situation and helps determine your eligibility for federal aid.

04

Review your financial aid award letter: Once you've submitted the FAFSA, you'll receive a financial aid award letter from your school. This letter will detail the types and amounts of financial aid you're eligible for, including any additional unsubsidized loans.

05

Accept or decline the loan: Review the terms and conditions of the additional unsubsidized loan offered to you. Consider factors such as interest rates, repayment options, and loan limits. If you decide to accept the loan, inform your school's financial aid office.

06

Complete the Master Promissory Note (MPN): To formally accept the additional unsubsidized loan, you may need to complete an MPN. The MPN is a legally binding document that outlines the terms and conditions of your loan.

07

Receive loan disbursement: After completing all the necessary steps, your additional unsubsidized loan amount will be disbursed by your school. The funds will typically be sent directly to your school to cover tuition, fees, and other education-related expenses.

Who needs additional unsubsidized loan:

01

Graduate or professional students: Graduate or professional students often require additional funding for their higher education expenses beyond what is covered by subsidized loans. An additional unsubsidized loan can help bridge the financial gap.

02

Undergraduate students without demonstrated financial need: Unlike subsidized loans, unsubsidized loans are not based on financial need. So, undergraduate students who don't qualify for subsidized loans or whose financial aid package falls short may need to consider additional unsubsidized loans.

03

Independent students: Independent students, who are financially responsible for their education without parental support, may need additional unsubsidized loans to cover the cost of attendance.

04

Students with high education costs: Some students may have high education expenses due to attending schools with higher tuition fees or pursuing certain professional programs. In such cases, additional unsubsidized loans might be necessary to meet these higher costs.

Remember, it is important to carefully evaluate your financial situation and determine if an additional unsubsidized loan is the appropriate choice for your education funding needs. Consider exploring other financial aid options, scholarships, or part-time work opportunities to minimize your need for loans.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is additional unsubsidized loan?

Additional unsubsidized loan is a type of student loan in which the borrower is responsible for all interest that accrues, even while in school.

Who is required to file additional unsubsidized loan?

Students who have exhausted their subsidized loan options or who need to borrow more money for educational expenses may be required to file for additional unsubsidized loan.

How to fill out additional unsubsidized loan?

To fill out an additional unsubsidized loan, students must complete the Free Application for Federal Student Aid (FAFSA) and indicate their interest in the unsubsidized loan option.

What is the purpose of additional unsubsidized loan?

The purpose of additional unsubsidized loans is to provide students with additional funding for educational expenses that may not be covered by other financial aid options.

What information must be reported on additional unsubsidized loan?

Students must report their personal and financial information, as well as details about their school and the amount of loan funding needed.

How can I edit additional unsubsidized l oan from Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including additional unsubsidized l oan. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

How can I send additional unsubsidized l oan to be eSigned by others?

When you're ready to share your additional unsubsidized l oan, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

Can I edit additional unsubsidized l oan on an Android device?

You can make any changes to PDF files, such as additional unsubsidized l oan, with the help of the pdfFiller mobile app for Android. Edit, sign, and send documents right from your mobile device. Install the app and streamline your document management wherever you are.

Fill out your additional unsubsidized l oan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Additional Unsubsidized L Oan is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.