Get the free Perkins Loan Application - Ursuline College - ursuline

Show details

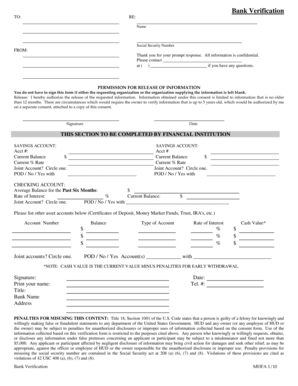

Perkins Loan Application Name: SS#: Address: City State Zip Home Phone #: Work Phone #: Date of Birth: / / Expected Graduation Date: / / Driver's License Number: State of Issue: Bank With: Type(s)

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign perkins loan application

Edit your perkins loan application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your perkins loan application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit perkins loan application online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit perkins loan application. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out perkins loan application

How to fill out a Perkins loan application:

01

Gather necessary documents and information: Before starting the application, make sure you have all the required documents and information readily available. This may include your Social Security number, driver's license or state ID, income tax returns, proof of income, and any other relevant financial documents.

02

Visit the official Perkins loan website: Go to the official website of the institution offering Perkins loans or the U.S. Department of Education's website to access the online application form. Alternatively, you may request a paper application form if available.

03

Provide personal information: Begin by entering your personal information accurately. This may include your name, address, phone number, email address, date of birth, and social security number. Double-check all the information for any errors before proceeding.

04

Fill out the financial information section: Provide detailed information about your financial situation. This may include your income, assets, and any other sources of financial aid or scholarships you may be receiving. Be truthful and accurate in reporting your finances to ensure your eligibility is properly assessed.

05

Indicate school preferences: Specify the schools where you are interested in using the Perkins loan as a form of financial assistance. You may provide multiple school choices if desired. Make sure to research and compare the schools beforehand to make informed decisions.

06

Review and sign the application: Carefully review all the information you have provided on the application form to ensure its accuracy. Once you are satisfied, electronically sign the application or physically sign the paper form if applicable.

07

Submit the application: Submit the completed application online or mail the paper application to the designated address. Ensure you follow the instructions provided to avoid any delays or issues in processing your application.

Who needs a Perkins loan application?

01

Undergraduate students: Perkins loans are available for undergraduate students who demonstrate financial need. These loans can be a valuable resource to help cover the costs of tuition, fees, books, and other educational expenses.

02

Graduate students: Graduate students pursuing certain programs may also be eligible for Perkins loans. However, specific eligibility criteria and loan terms may vary, so it is important to check the requirements set by the institution or the U.S. Department of Education.

03

Individuals with financial need: Perkins loans primarily target students with financial need. These loans aim to assist individuals who may not have access to other forms of financial aid or who require additional assistance to meet the costs of their education.

Note: It is advisable to consult with the financial aid office at your chosen institution or the U.S. Department of Education's website for the most up-to-date and accurate information regarding Perkins loan eligibility and application process.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is perkins loan application?

Perkins loan application is a form used by students to apply for federal Perkins loans, which are low-interest loans for undergraduate and graduate students with exceptional financial need.

Who is required to file perkins loan application?

Students who demonstrate exceptional financial need and are enrolled at participating schools are required to file a Perkins loan application.

How to fill out perkins loan application?

To fill out a Perkins loan application, students must provide information about their financial situation, enrollment status, and academic history. This form is typically available through the student's financial aid office.

What is the purpose of perkins loan application?

The purpose of the Perkins loan application is to determine a student's eligibility for a low-interest federal loan based on their financial need.

What information must be reported on perkins loan application?

Students must report their financial information, including income and assets, as well as their academic history and enrollment status on the Perkins loan application.

How can I modify perkins loan application without leaving Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including perkins loan application, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

Where do I find perkins loan application?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific perkins loan application and other forms. Find the template you need and change it using powerful tools.

How do I fill out perkins loan application on an Android device?

Complete your perkins loan application and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

Fill out your perkins loan application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Perkins Loan Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.