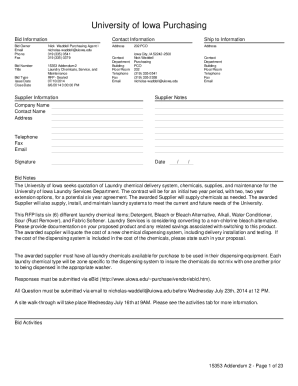

Get the free Indian Students Who Made Over $4,000 Students who are Indian nationals get extra tax...

Show details

Indian Students Who Made Over $4,000 Students who are Indian nationals get extra tax breaks due to a tax treaty with the U.S. government. If you are an Indian national who made over $4,000 in the

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign indian students who made

Edit your indian students who made form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your indian students who made form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit indian students who made online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit indian students who made. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out indian students who made

How to fill out Indian students who made:

01

Begin by collecting the necessary information about the Indian students who made the achievement. This may include their names, age, school or university, date of accomplishment, and any relevant details about the achievement.

02

Use a clear, concise, and professional language to fill out the form or document. Avoid using slang or casual language, as this may detract from the seriousness or professionalism of the achievement.

03

Provide a brief description of the accomplishment, highlighting the significance or impact it may have had. This can help showcase the talents, skills, or abilities of the Indian students who made the achievement.

04

Double-check the accuracy of the information provided before submitting or sharing the document. Ensure that all names are spelled correctly, dates are accurate, and details are properly recorded.

05

If required, include any relevant supporting documents or evidence to validate the achievement. This may include certificates, awards, letters of recommendation, or photographs that showcase the accomplishment.

06

Finally, submit the completed document or form to the appropriate organization, institution, or individual. This may be a school, college, employer, scholarship committee, or any other entity that requires information about Indian students who have achieved something noteworthy.

Who needs Indian students who made:

01

Educational institutions: Schools, colleges, and universities may want to keep a record or showcase the achievements of Indian students who have excelled academically or in other areas such as sports, arts, or leadership.

02

Scholarship committees: Organizations offering scholarships to Indian students may require information about their accomplishments to assess their eligibility and potential.

03

Employers: Companies or employers looking to recruit talented individuals may be interested in knowing about the achievements of Indian students as it reflects their skills, dedication, and potential.

04

Government agencies: Government departments or agencies that support and promote Indian students' achievements may require this information to evaluate the impact of their programs or initiatives.

05

Media and press: Journalists or media outlets may be interested in featuring stories or interviews with Indian students who have made remarkable achievements to inspire others and share their success stories.

06

Community organizations: Local community organizations may want to recognize and celebrate the accomplishments of Indian students to encourage and motivate others within the community.

Overall, filling out information about Indian students who made achievements and sharing it with relevant stakeholders can help recognize their accomplishments, promote their success, and provide opportunities for further growth and development.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit indian students who made from Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your indian students who made into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How can I send indian students who made for eSignature?

When your indian students who made is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

How do I make edits in indian students who made without leaving Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your indian students who made, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

What is indian students who made?

Indian students who made refers to the income tax return filed by Indian students who have earned income during a financial year.

Who is required to file indian students who made?

Indian students who have earned income during a financial year are required to file Indian students who made.

How to fill out indian students who made?

To fill out Indian students who made, Indian students need to gather all income-related documents, report their income and deductions accurately, and file the return online or offline as per the guidelines.

What is the purpose of indian students who made?

The purpose of Indian students who made is to report the income earned by Indian students and calculate the tax liability, if any, ensuring compliance with income tax laws.

What information must be reported on indian students who made?

Indian students need to report their income, deductions, tax-saving investments, and other details as per the income tax laws while filing Indian students who made.

Fill out your indian students who made online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Indian Students Who Made is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.