Get the free RESERVA MINIMA DE LIQUIDEZ - bcefinec

Show details

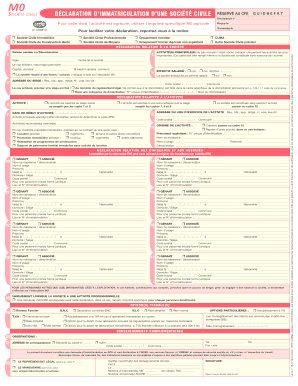

FORMULA RIO NICO PARA SOLICITOR LA CREATING DE IDENTIFICATION DE USUALLY PARA EL Accesses A SERVICES BARRIOS RESERVE MINIMA DE LIQUID EZ HOMBRE DE LA INSTITUTION: NUMBER DE CTA. CTE. EN BCE: DATES

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign reserva minima de liquidez

Edit your reserva minima de liquidez form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your reserva minima de liquidez form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit reserva minima de liquidez online

Follow the steps below to use a professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit reserva minima de liquidez. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

Dealing with documents is simple using pdfFiller. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out reserva minima de liquidez

How to fill out reserva minima de liquidez?

01

First, gather all necessary financial documents, including bank statements, balance sheets, income statements, and cash flow statements.

02

Calculate your current liquidity ratio by dividing your liquid assets by your current liabilities. This will help determine whether you have enough liquidity to meet your financial obligations.

03

Determine the minimum liquidity requirement set by the relevant regulatory authority or institution. This requirement may vary depending on the industry or country.

04

Compare your current liquidity ratio with the minimum requirement. If your ratio is lower than the requirement, you need to take steps to increase your liquidity.

05

Identify potential sources of liquidity, such as cash reserves, lines of credit, or short-term investments. Evaluate the feasibility and accessibility of these sources.

06

Develop a plan to increase your liquidity, if necessary. This may involve reducing expenses, increasing revenue, negotiating better payment terms with suppliers, or obtaining additional financing.

07

Monitor your liquidity regularly to ensure it remains above the minimum requirement. Make adjustments to your plan if needed.

08

Document all steps taken to fill out reserva minima de liquidez for future reference and compliance purposes.

Who needs reserva minima de liquidez?

01

Financial institutions: Banks, credit unions, and other financial institutions are typically required to maintain a minimum level of liquidity to ensure they can meet deposit withdrawals and other financial obligations.

02

Insurance companies: Insurance companies need to have adequate liquid assets to honor policyholder claims and maintain stability in the event of unexpected losses.

03

Businesses: Certain industries or countries may have regulations requiring businesses to maintain a minimum level of liquidity to protect creditors and ensure financial stability. Additionally, businesses may proactively establish their own reserve requirements to mitigate financial risks.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send reserva minima de liquidez for eSignature?

When you're ready to share your reserva minima de liquidez, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

How do I make edits in reserva minima de liquidez without leaving Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing reserva minima de liquidez and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

Can I edit reserva minima de liquidez on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign reserva minima de liquidez right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

What is reserva minima de liquidez?

Reserva minima de liquidez is the minimum liquidity reserve required by financial institutions to ensure they have enough funds to meet their financial obligations.

Who is required to file reserva minima de liquidez?

Financial institutions such as banks, credit unions, and other regulated entities are required to file reserva minima de liquidez.

How to fill out reserva minima de liquidez?

Reserva minima de liquidez can be filled out by submitting the required financial information and documentation to the regulatory authorities.

What is the purpose of reserva minima de liquidez?

The purpose of reserva minima de liquidez is to ensure the stability and solvency of financial institutions by requiring them to maintain a minimum level of liquidity.

What information must be reported on reserva minima de liquidez?

Information such as current liquidity levels, funding sources, and projections for future liquidity needs must be reported on reserva minima de liquidez.

Fill out your reserva minima de liquidez online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Reserva Minima De Liquidez is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.