Get the free VARIABLE UNIVERSAL LIFE INSURANCE APPLICATION RIDER WORKSHEET

Show details

Protective Life Insurance Company P.O. Box 830771 Birmingham, AL 35283-0771 VARIABLE UNIVERSAL LIFE INSURANCE APPLICATION RIDER WORKSHEET New Business Required if applying for additional benefits

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign variable universal life insurance

Edit your variable universal life insurance form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your variable universal life insurance form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit variable universal life insurance online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit variable universal life insurance. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

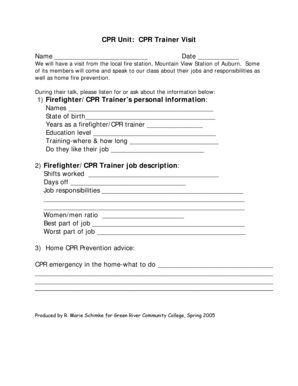

How to fill out variable universal life insurance

How to fill out variable universal life insurance:

01

Research different insurance companies and compare their variable universal life insurance policies. Look for features that align with your financial goals and risk tolerance.

02

Contact the insurance company or a licensed insurance agent to get quotes and ask any questions you may have about the policy.

03

Assess your financial situation and determine how much coverage you need. Consider factors such as outstanding debts, future financial obligations, and income replacement needs.

04

Complete the application form accurately and honestly. Provide the required personal and financial information, including your age, health history, and any prior insurance coverage.

05

Undergo a medical examination if required by the insurance provider. This may include a physical examination, blood tests, and other medical tests to assess your health and determine the premium rates.

06

Review the policy terms and conditions thoroughly before signing. Pay attention to details such as the death benefit amount, premium payment options, investment fund choices, and potential fees or charges.

07

Make the initial premium payment to activate the policy. Set up a suitable payment plan to ensure timely premium payments in the future.

08

Designate beneficiaries who will receive the death benefit upon your passing. Review and update your beneficiary designations periodically, especially after major life events such as marriage, divorce, or the birth of a child.

09

Monitor and manage your policy regularly. Stay informed about the performance of the investment funds within your policy and assess if any adjustments or changes need to be made.

10

Consider consulting with a financial advisor or insurance expert to ensure that variable universal life insurance aligns with your financial goals and meets your long-term needs.

Who needs variable universal life insurance:

01

Individuals who want permanent life insurance protection combined with the potential for cash value growth.

02

People with substantial financial responsibilities such as a mortgage, dependents, or outstanding debts who require long-term coverage.

03

Those who have complex financial situations or high net worth individuals seeking tax-efficient strategies, estate planning, or wealth transfer solutions.

04

Individuals who are comfortable with investment risk and want the ability to allocate their premiums among different investment options.

05

Those looking for a flexible insurance policy that allows for adjustments in death benefit amounts, premium payments, and potential loans or withdrawals from the policy's cash value.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send variable universal life insurance to be eSigned by others?

Once you are ready to share your variable universal life insurance, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

How do I edit variable universal life insurance in Chrome?

Install the pdfFiller Google Chrome Extension to edit variable universal life insurance and other documents straight from Google search results. When reading documents in Chrome, you may edit them. Create fillable PDFs and update existing PDFs using pdfFiller.

How do I edit variable universal life insurance on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share variable universal life insurance on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

What is variable universal life insurance?

Variable universal life insurance is a type of life insurance that allows the policyholder to allocate a portion of their premium payments to a separate account comprised of various investment funds.

Who is required to file variable universal life insurance?

Individuals who are looking for a life insurance policy that offers investment options and flexibility may consider a variable universal life insurance policy.

How to fill out variable universal life insurance?

To fill out a variable universal life insurance policy, individuals must first choose the coverage amount, premium amount, and investment options.

What is the purpose of variable universal life insurance?

The purpose of variable universal life insurance is to provide both a death benefit and a cash value component that can grow over time based on the performance of the investment funds.

What information must be reported on variable universal life insurance?

Information such as personal details of the insured, coverage amount, premium payment schedule, chosen investment options, and beneficiary designation must be reported on variable universal life insurance.

Fill out your variable universal life insurance online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Variable Universal Life Insurance is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.