Get the free super-fast instalment loan application form

Show details

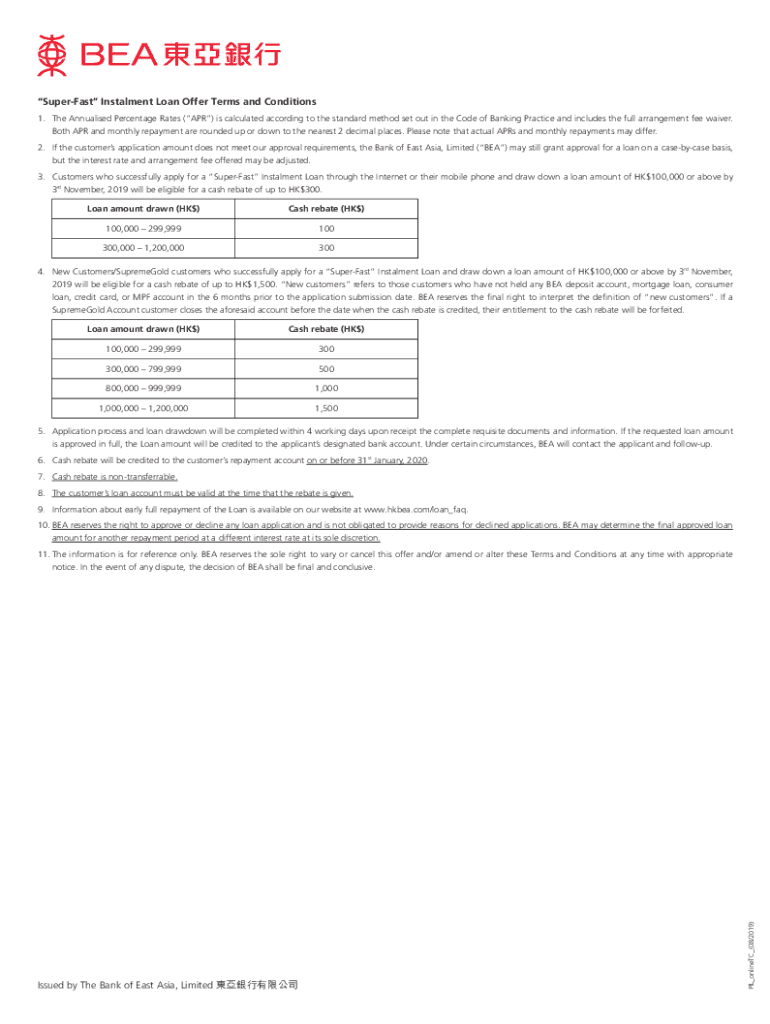

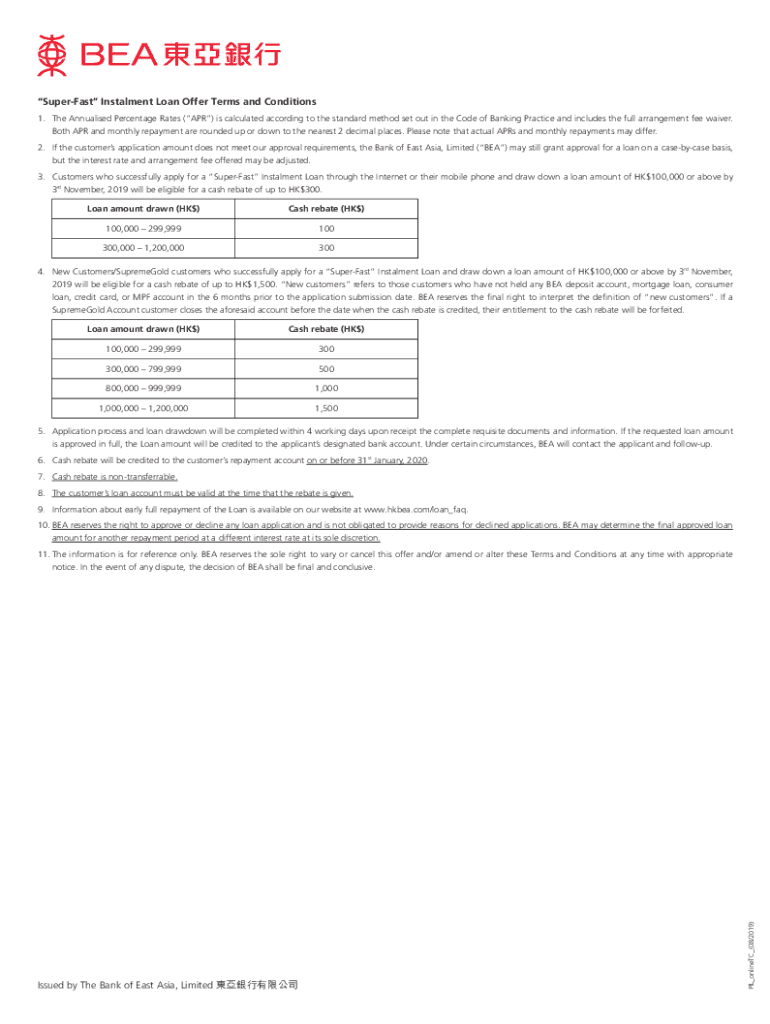

SuperFast Installment Loan Offer Terms and Conditions 1. The Annualized Percentage Rates (APR) is calculated according to the standard method set out in the Code of Banking Practice and includes the

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign super-fast instalment loan application

Edit your super-fast instalment loan application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your super-fast instalment loan application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit super-fast instalment loan application online

To use the professional PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit super-fast instalment loan application. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out super-fast instalment loan application

How to fill out a super-fast installment loan application:

01

Start by gathering all the necessary documents and information. This typically includes identification proof, proof of income, bank statements, and any other relevant financial documents.

02

Research various lenders or financial institutions that offer super-fast installment loans. Compare their interest rates, loan terms, and eligibility criteria to find the best option for your needs.

03

Read through the application form carefully and understand all the questions and requirements. Pay special attention to the details such as the loan amount, repayment period, and any additional fees or charges.

04

Fill in your personal information accurately, including your full name, contact details, and residential address. Make sure to double-check the spelling and accuracy of all the details provided.

05

Provide the necessary financial information, such as your monthly income, employment status, and any other relevant details about your financial situation. Be honest and transparent while disclosing this information.

06

If required, provide references or guarantors who can vouch for your financial credibility and repayment ability. Make sure to obtain their consent beforehand and provide their accurate contact details.

07

Review the application form thoroughly before submitting it. Ensure that all the information provided is correct and complete. Any errors or missing information may delay the loan approval process.

08

Submit the application form along with all the required documents either online or in person, depending on the lender's preferred method. Keep a copy of the complete application and supporting documents for your records.

Who needs a super-fast installment loan application?

01

Individuals facing unexpected financial emergencies: A super-fast installment loan application can be beneficial for those who require immediate funds to address unexpected expenses like medical bills, home repairs, or car repairs.

02

Small business owners or entrepreneurs: Sometimes entrepreneurs or small business owners need quick access to funds for business expansion, purchasing equipment, or managing cash flow. A super-fast installment loan application can be a viable solution for them.

03

Individuals with low credit scores: People with lower credit scores may find it challenging to get approved for traditional loans. In such cases, a super-fast installment loan application may be a viable option for those who need quick access to funds but have limited borrowing options.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my super-fast instalment loan application directly from Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your super-fast instalment loan application and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

How can I send super-fast instalment loan application for eSignature?

When your super-fast instalment loan application is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

How do I complete super-fast instalment loan application on an Android device?

On an Android device, use the pdfFiller mobile app to finish your super-fast instalment loan application. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

What is super-fast instalment loan application?

The super-fast instalment loan application is a quick and convenient way to apply for a loan with a simplified process.

Who is required to file super-fast instalment loan application?

Anyone in need of a loan and meets the eligibility criteria can file a super-fast instalment loan application.

How to fill out super-fast instalment loan application?

To fill out the super-fast instalment loan application, applicants need to provide personal and financial information, as well as choose the loan amount and repayment terms.

What is the purpose of super-fast instalment loan application?

The purpose of the super-fast instalment loan application is to help individuals secure a loan quickly and conveniently.

What information must be reported on super-fast instalment loan application?

Applicants must report personal information, financial information, desired loan amount, and repayment terms on the super-fast instalment loan application.

Fill out your super-fast instalment loan application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Super-Fast Instalment Loan Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.