Get the free Residential Investment Home Loan Interest Rates###

Show details

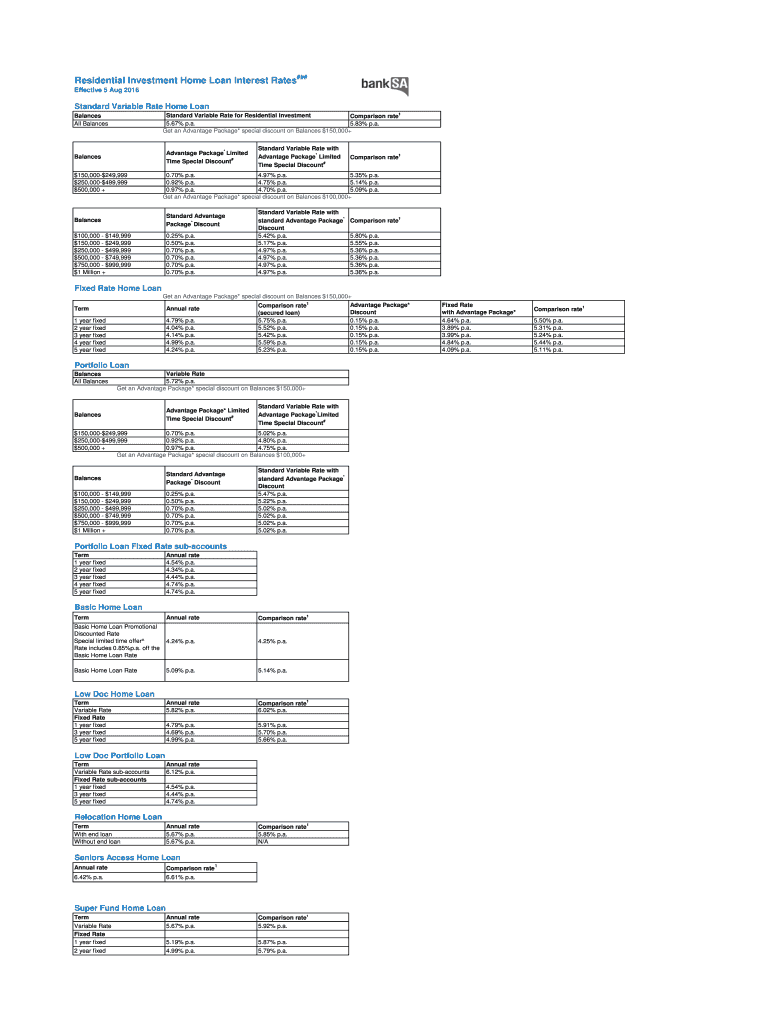

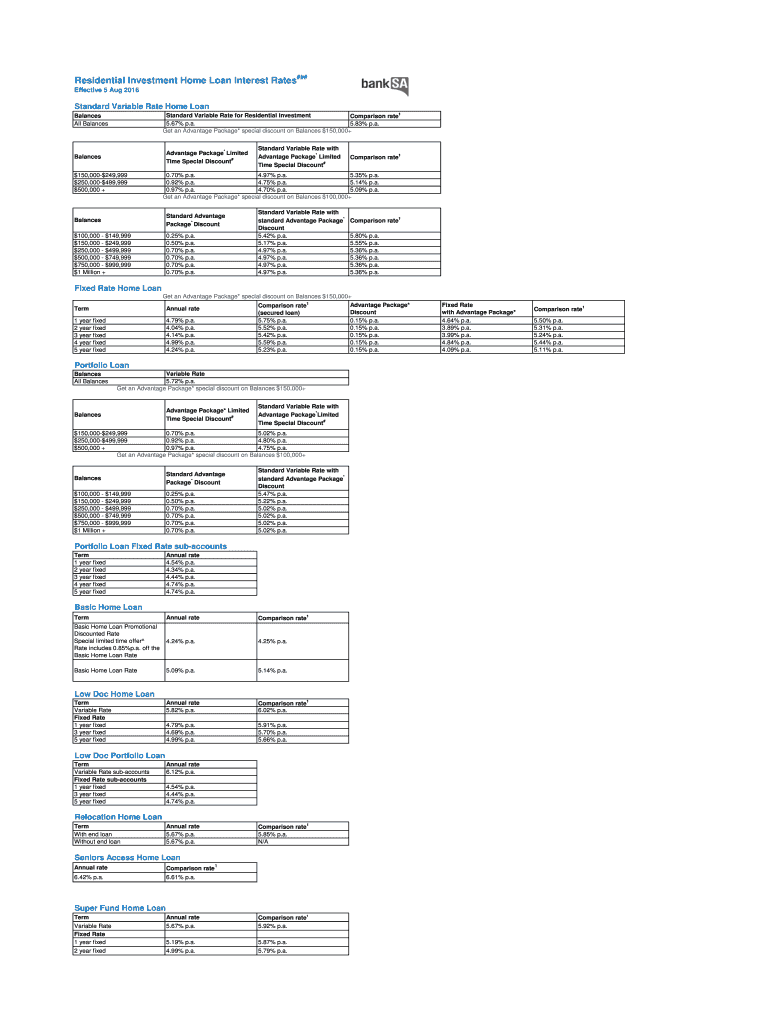

Residential Investment Home Loan Interest Rates###

Effective 5 Aug 2016Standard Variable Rate Home Loan

Standard Variable Rate for Residential Investment

Comparison rate1

5.67% p.a.

5.83% p.a.

Get

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign residential investment home loan

Edit your residential investment home loan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your residential investment home loan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing residential investment home loan online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit residential investment home loan. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out residential investment home loan

How to fill out a residential investment home loan:

01

Gather all necessary documents such as income statements, tax returns, and bank statements.

02

Research and compare different lenders and loan options to find the best fit for your needs.

03

Prepare a budget and determine how much you can afford to borrow and repay each month.

04

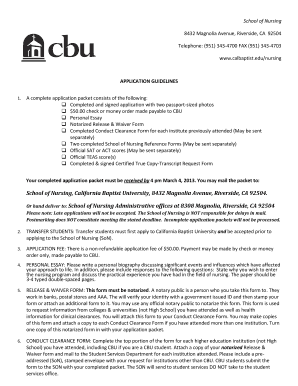

Fill out the loan application form accurately, providing all required information about the property and your financial situation.

05

Submit the completed application along with all supporting documents to the chosen lender.

06

Follow up with the lender regularly to ensure the loan is being processed and to address any additional requirements or questions they may have.

07

Review and understand the terms and conditions of the loan offer, including interest rate, repayment period, and any associated fees.

08

If satisfied with the loan offer, accept it and proceed with any requested next steps, such as a property appraisal or inspection.

09

Work closely with the lender and any other professionals involved in the process, such as real estate agents or lawyers, to finalize the home loan.

10

Once approved, carefully review the loan documents to ensure accuracy before signing.

11

Begin making regular repayments as agreed upon in the loan terms.

Who needs a residential investment home loan?

01

Individuals or couples who are looking to purchase a property solely for investment purposes.

02

Real estate investors or property developers who want to generate rental income or profit from property appreciation.

03

People who already own one or more primary residences and want to diversify their investment portfolio by adding an income-generating property.

04

Buyers who want to take advantage of potential tax benefits associated with owning investment properties.

05

Individuals who have the necessary financial means and are willing to take on the responsibilities of property ownership and management.

06

Those who believe in the long-term potential of real estate as an investment asset class.

07

Buyers who have done thorough research on the local market and have identified promising investment opportunities.

08

Individuals who have a solid plan for generating profits from their investment property, whether through renting, renovating, or selling for a higher price in the future.

09

People who have consulted with financial advisors or experts in real estate investing and have determined that a residential investment home loan is a suitable option for meeting their financial goals.

10

Buyers who have assessed their risk tolerance and are comfortable with the potential upsides and downsides of investing in real estate.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send residential investment home loan for eSignature?

To distribute your residential investment home loan, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

How do I execute residential investment home loan online?

pdfFiller has made it simple to fill out and eSign residential investment home loan. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

How do I fill out the residential investment home loan form on my smartphone?

Use the pdfFiller mobile app to fill out and sign residential investment home loan on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

What is residential investment home loan?

A residential investment home loan is a type of loan that is used to purchase property for the purpose of generating rental income or capital appreciation.

Who is required to file residential investment home loan?

Individuals or entities who have taken out a loan for the purpose of investing in residential properties are required to file a residential investment home loan.

How to fill out residential investment home loan?

To fill out a residential investment home loan, you will need to provide information about the property being purchased, the loan amount, terms of the loan, and details about your investment strategy.

What is the purpose of residential investment home loan?

The purpose of a residential investment home loan is to provide funding for the purchase of property for investment purposes, such as rental income or capital appreciation.

What information must be reported on residential investment home loan?

Information that must be reported on a residential investment home loan includes details about the property being purchased, the loan amount, terms of the loan, and details about the borrower's investment strategy.

Fill out your residential investment home loan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Residential Investment Home Loan is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.