UK Form 815 2014-2025 free printable template

Show details

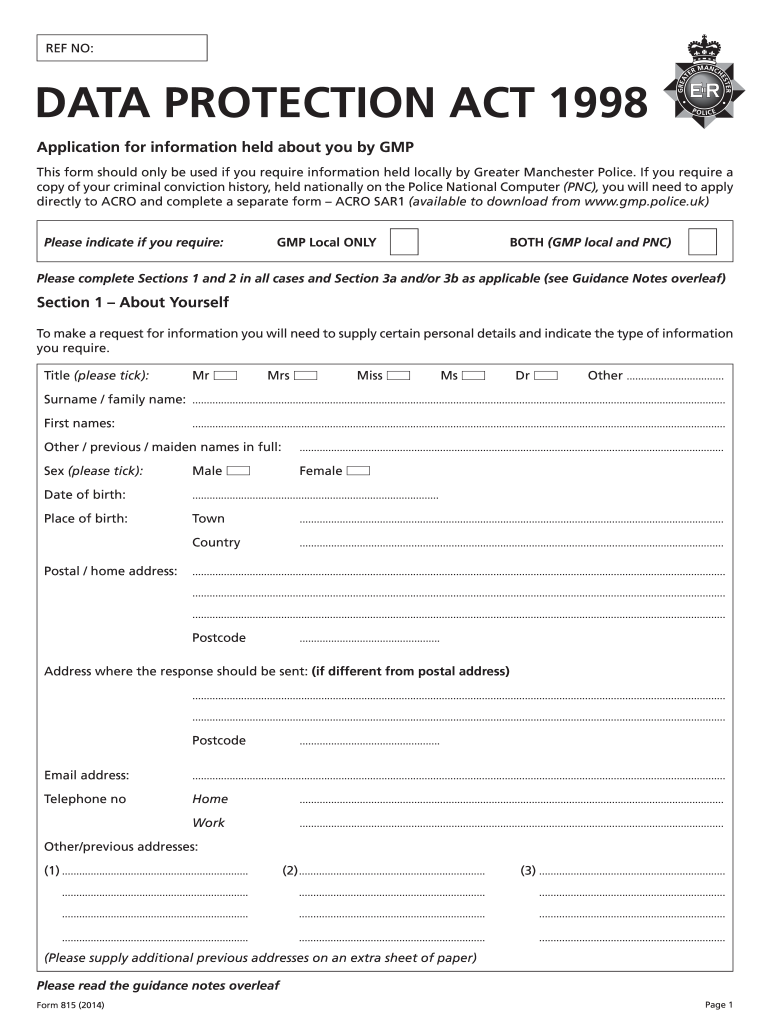

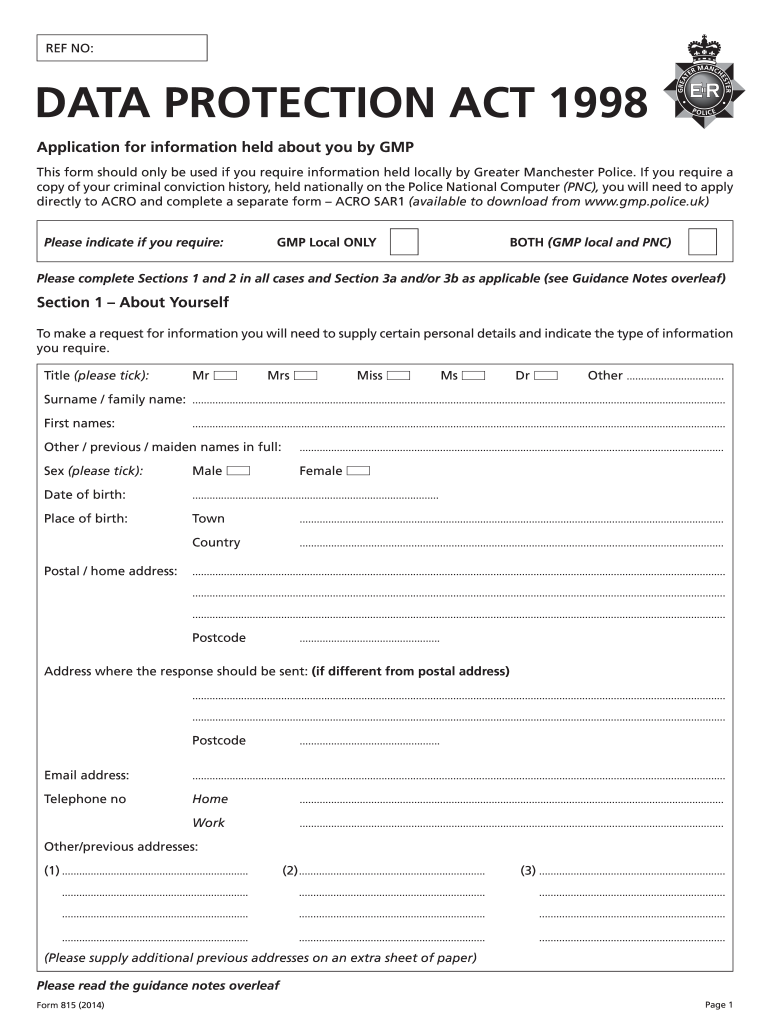

REF NO: DATA PROTECTION ACT 1998 Application for information held about you by GMP This form should only be used if you require information held locally by Greater Manchester Police. If you require

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign UK Form 815

Edit your UK Form 815 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your UK Form 815 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing UK Form 815 online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit UK Form 815. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out UK Form 815

How to fill out UK Form 815

01

Start by downloading the UK Form 815 from the official HM Revenue & Customs website.

02

Read the instructions provided on the first page of the form carefully.

03

Fill out your personal information in the designated sections, including your name, address, and National Insurance number.

04

Input the relevant financial details that apply to your situation, such as income and expenditures.

05

Ensure that all information is accurate and complete to avoid delays.

06

Review the form for errors or omissions before submitting.

07

Submit the form as directed, either online or by mailing it to the appropriate HMRC office.

Who needs UK Form 815?

01

Individuals who need to claim a refund of overpaid tax.

02

People who have left the UK and wish to claim their tax back.

03

Those who receive UK income but reside abroad and may need to report their tax situation.

Fill

form

: Try Risk Free

People Also Ask about

How to get police clearance certificate from local police station?

How to Get a PCC from a Local Police Station? Visit your nearest police station. Answer the queries of a police officer. Submit the self-attested documents mentioned in the official Passport Seva portal. Pay the requisite fee in cash or through a cheque.

What is a UK police report?

A police certificate confirms whether or not you have a criminal record in the United Kingdom and is required as part of the visa process by the respective high commission or embassy. It could also include any foreign criminal history information if it has been made available to the UK.

What is the international criminal record check UK?

The ICPC is a criminal records check against police and intelligence databases in the UK that would reveal any convictions or reasons why someone should not work with children. It is similar to the DBS (Disclosure and Barring Service) check that is available in England and Wales.

Where does GMP cover?

Greater Manchester Police (GMP) was formed in 1974, serving more than 2.5 million people and covering an area of 500 square miles. GMP is split into 11 divisions – Bolton, Bury, North Manchester, Oldham, Rochdale, Salford, South Manchester, Stockport, Tameside, Trafford and Wigan.

How do I get a criminal record certificate UK?

Apply for a basic Disclosure and Barring Service ( DBS ) check to get a copy of your criminal record. This is called 'basic disclosure'.To apply for a basic DBS check you'll need: all your addresses for the last 5 years and the dates you lived there. your National Insurance number. your passport. your driving licence.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my UK Form 815 in Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your UK Form 815 along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

Can I create an electronic signature for signing my UK Form 815 in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your UK Form 815 and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

Can I edit UK Form 815 on an Android device?

You can make any changes to PDF files, such as UK Form 815, with the help of the pdfFiller mobile app for Android. Edit, sign, and send documents right from your mobile device. Install the app and streamline your document management wherever you are.

What is UK Form 815?

UK Form 815 is a tax form used for reporting certain information to HM Revenue and Customs (HMRC) in the UK.

Who is required to file UK Form 815?

Individuals or businesses that have specific tax obligations or income sources subject to UK taxation may be required to file UK Form 815.

How to fill out UK Form 815?

To fill out UK Form 815, one must provide personal or business information, financial details related to the income source, and any other required disclosures as specified by HMRC.

What is the purpose of UK Form 815?

The purpose of UK Form 815 is to ensure accurate reporting of income and tax obligations, helping HMRC to assess taxes correctly.

What information must be reported on UK Form 815?

UK Form 815 typically requires details such as taxpayer identification, income sources, tax deductions claimed, and any other relevant financial information.

Fill out your UK Form 815 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

UK Form 815 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.