Get the free Business Credit Card - FirstMerit Bank

Show details

Credit Card Rewards The FirstMerit Business Credit Card Rewards Program is available for all MasterCard business credit cards, and there is no cost to participate or enroll. Program details and enrollment

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign business credit card

Edit your business credit card form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your business credit card form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit business credit card online

To use the professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit business credit card. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out business credit card

01

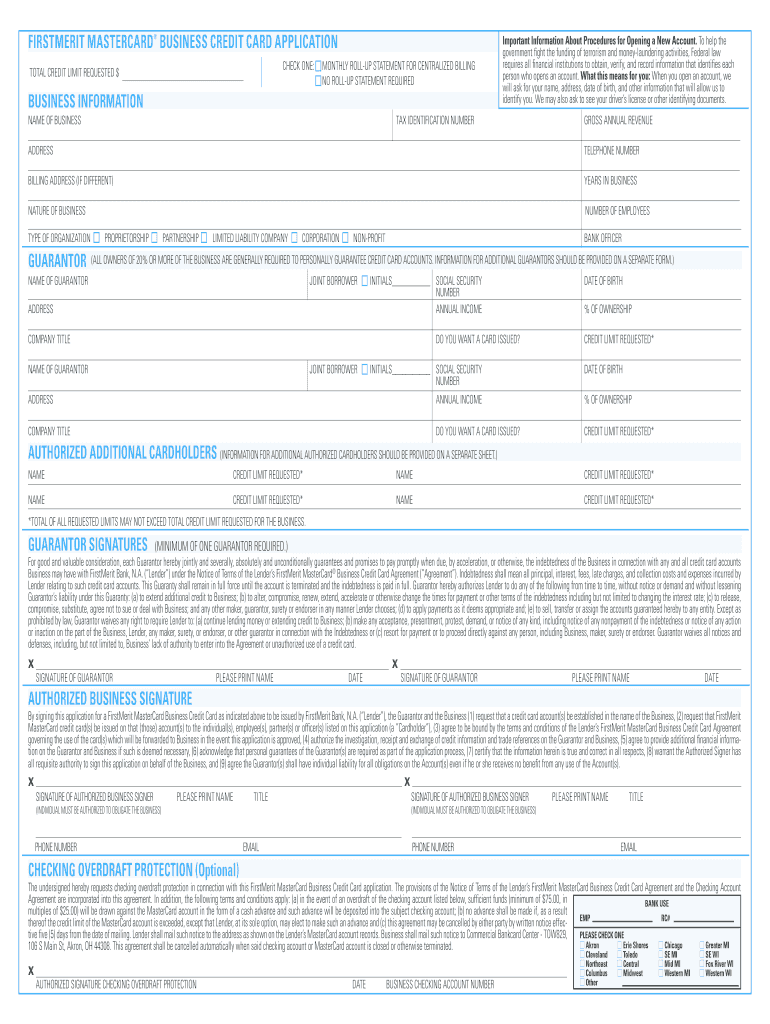

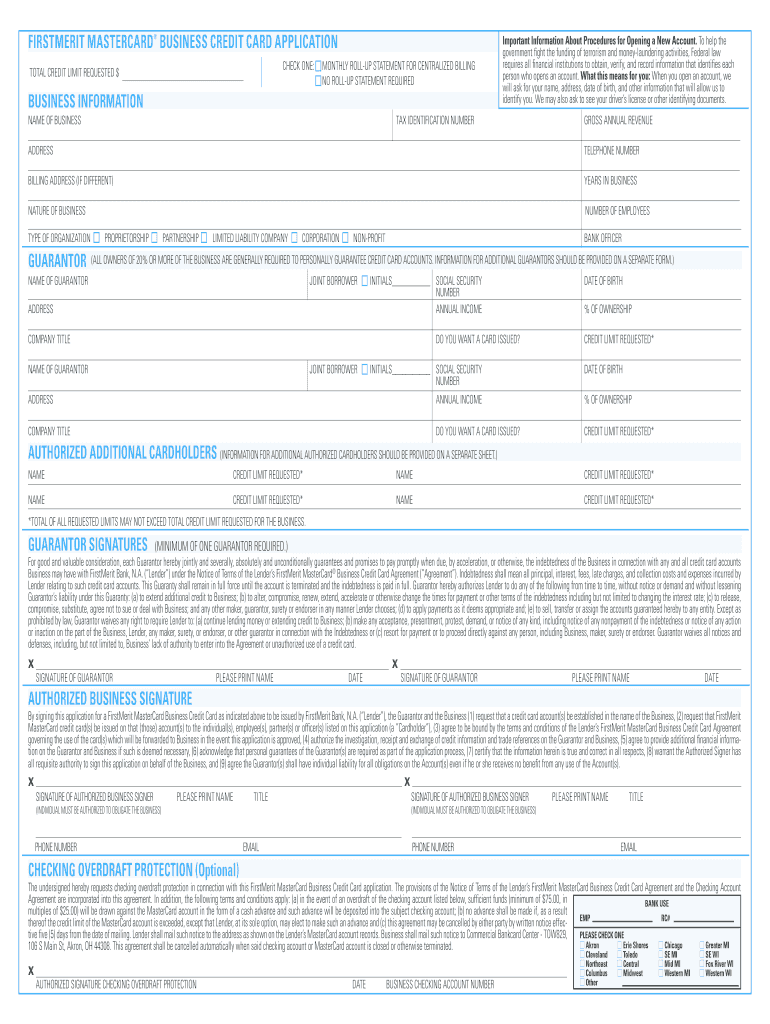

To fill out a business credit card application form, start by gathering all the necessary information. This typically includes your company's legal name, address, phone number, and tax identification number.

02

Next, provide the personal information of the primary cardholder, such as their full name, date of birth, social security number, and contact information.

03

Indicate the desired credit limit for the business credit card. This is the maximum amount of credit you would like to have available on the card.

04

If you have any additional cardholders who will be issued cards under the same business credit account, provide their personal information as well.

05

Review and understand the terms and conditions associated with the business credit card. Pay close attention to interest rates, annual fees, grace periods, and any promotional offers.

06

Carefully read through the privacy and security policies of the credit card issuer. Understand how your information will be used and protected.

07

Once you have filled out the application accurately, submit it to the credit card issuer through the designated channel. This could be via mail, online submission, or in-person at a bank branch.

Who needs business credit card?

01

Business owners: Small business owners, entrepreneurs, and self-employed individuals often benefit from having a business credit card. It helps separate personal and business expenses and simplifies accounting.

02

Startups and established businesses: Both startups and established businesses can utilize business credit cards to manage cash flow, make necessary purchases, and build credit history for the business.

03

Employees with authorized spending: Businesses may issue additional cards to authorized employees, allowing them to make company purchases while keeping track of expenses and controlling spending limits.

04

Limited liability company (LLC) owners: LLC owners can use business credit cards to separate personal and business expenses, maintain legal protection for their personal assets, and improve their business creditworthiness.

05

Frequent business travelers: Business credit cards often offer travel-related benefits and rewards, making them advantageous for individuals who frequently travel for business purposes.

Remember, it is important to assess your personal financial situation and consult with a financial advisor to determine if a business credit card is the right choice for your specific needs.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get business credit card?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the business credit card in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

How do I make changes in business credit card?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your business credit card to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

How do I fill out business credit card using my mobile device?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign business credit card and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

What is business credit card?

A business credit card is a credit card specifically designed for business use, allowing businesses to make purchases, track expenses, and manage cash flow.

Who is required to file business credit card?

Business owners or employees who are authorized to use the business credit card are required to file it for accounting and tax purposes.

How to fill out business credit card?

To fill out a business credit card, one must provide detailed information about the company, the cardholder, and the expenses incurred on the card.

What is the purpose of business credit card?

The purpose of a business credit card is to provide a convenient way for businesses to make purchases, manage expenses, and separate personal and business finances.

What information must be reported on business credit card?

Information such as the date of purchase, amount spent, merchant name, and business purpose of the expense must be reported on a business credit card statement.

Fill out your business credit card online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Business Credit Card is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.