Get the free SECURITY DEPOSIT ACCOUNT - SUBACCOUNT CHANGE OR CLOSEOUT

Show details

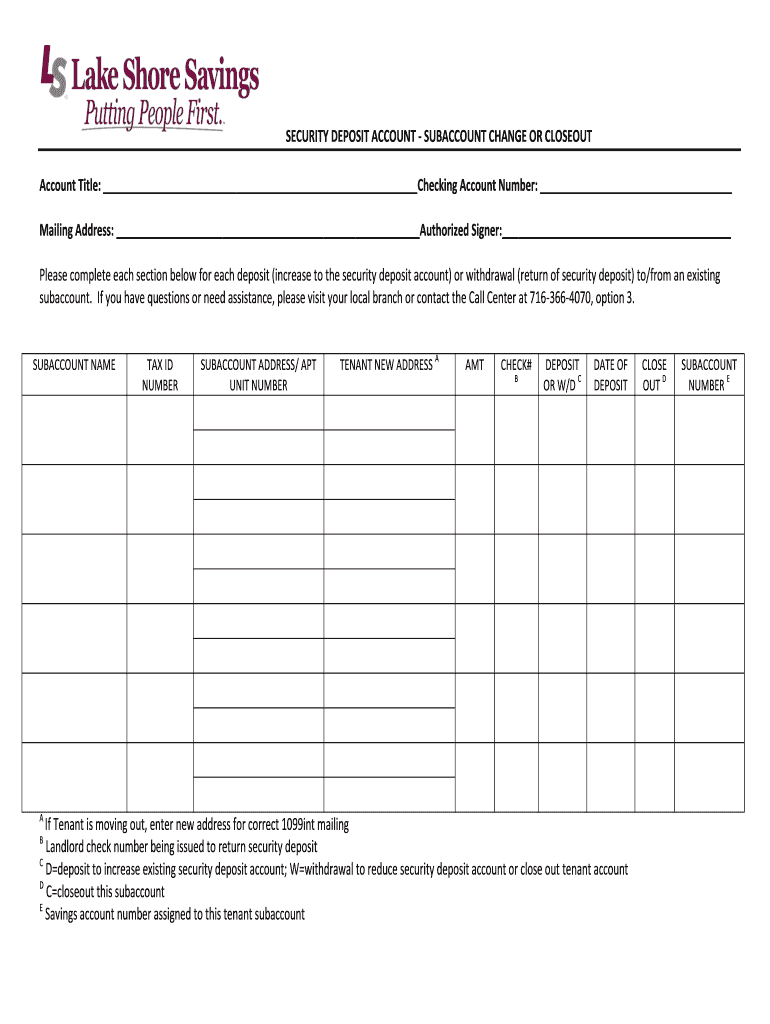

SECURITY DEPOSIT ACCOUNT SUBACCOUNT CHANGE OR CLOSEOUT Account Title: Checking Account Number: Mailing Address: Authorized Signer: Please complete each section below for each deposit (increase to

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign security deposit account

Edit your security deposit account form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your security deposit account form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing security deposit account online

Follow the steps below to benefit from the PDF editor's expertise:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit security deposit account. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, dealing with documents is always straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out security deposit account

How to fill out security deposit account:

01

Start by gathering all the necessary documents and information. This may include the lease or rental agreement, the amount of the security deposit required, and the terms and conditions related to the security deposit.

02

Make sure to accurately calculate the security deposit amount. Typically, it is a fixed amount or a percentage of the monthly rent. Verify this information with the landlord or property manager if unsure.

03

Review the specific requirements for the security deposit account. Some jurisdictions may have specific rules regarding where the security deposit should be held, such as in a separate interest-bearing account or under a specified type of financial institution.

04

Research and choose an appropriate financial institution for the security deposit account. It is important to choose a reputable bank or credit union that meets the requirements set by the jurisdiction.

05

Visit the chosen financial institution and inquire about the necessary steps to open a security deposit account. Provide all the required documents and complete any required forms or applications.

06

Deposit the security deposit amount into the account. Depending on the financial institution and their processes, this can be done via cash, check, or electronic transfer.

07

Keep detailed records of the security deposit transaction. Make sure to obtain a receipt or confirmation from the financial institution as proof of the deposit.

Who needs a security deposit account:

01

Landlords or property owners: They often require security deposit accounts as a way to safeguard against potential damages caused by tenants. It provides them with a financial buffer and ensures that funds are available should any repairs or cleaning be necessary when the lease term ends.

02

Tenants: Tenants may need a security deposit account to comply with their obligations outlined in the rental agreement. It allows them to provide the required security deposit amount and provides a clear record of the transaction.

03

Financial institutions: Banks and credit unions benefit from offering security deposit accounts as it creates potential customer relationships and may generate interest or fees associated with maintaining these accounts.

In summary, filling out a security deposit account involves gathering the necessary documents, calculating the correct amount, choosing a suitable financial institution, opening the account, and depositing the funds. Both landlords and tenants typically need security deposit accounts, while financial institutions offer these accounts as a service.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit security deposit account in Chrome?

Install the pdfFiller Google Chrome Extension to edit security deposit account and other documents straight from Google search results. When reading documents in Chrome, you may edit them. Create fillable PDFs and update existing PDFs using pdfFiller.

How do I fill out security deposit account using my mobile device?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign security deposit account and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

How can I fill out security deposit account on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your security deposit account. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.

What is security deposit account?

A security deposit account is a special type of bank account used to hold funds that serve as collateral or security for a specific purpose, such as a rental property or a loan.

Who is required to file security deposit account?

Landlords, lenders, or other entities who require a security deposit as part of a transaction are typically required to file a security deposit account.

How to fill out security deposit account?

To fill out a security deposit account, one must provide information about the amount of the deposit, the purpose of the deposit, the account holder's information, and any terms and conditions related to the deposit.

What is the purpose of security deposit account?

The purpose of a security deposit account is to protect the depositor by ensuring that funds are set aside for a specific purpose and can be accessed if needed for that purpose.

What information must be reported on security deposit account?

Information that must be reported on a security deposit account includes the amount of the deposit, the purpose of the deposit, the account holder's information, and any terms and conditions related to the deposit.

Fill out your security deposit account online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Security Deposit Account is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.