Get the free HSA Qualified HSA Funding Distribution Request

Show details

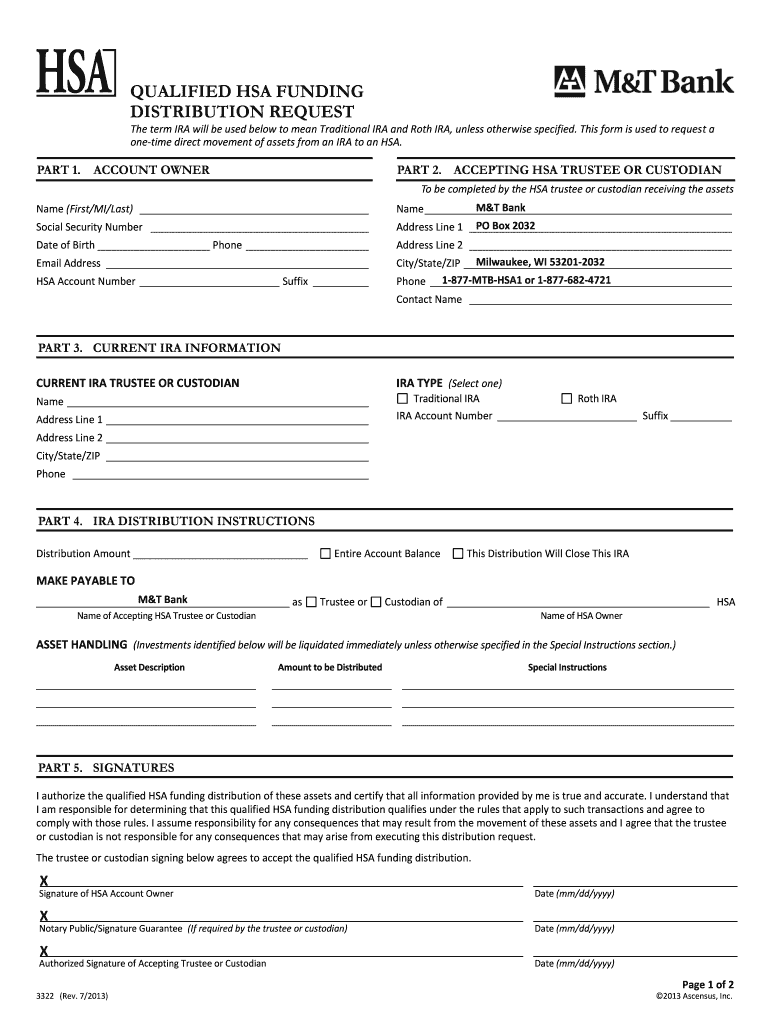

QUALIFIED HSA FUNDING DISTRIBUTION REQUEST The term IRA will be used below to mean Traditional IRA and Roth IRA, unless otherwise specified. This form is used to request a onetime direct movement

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign hsa qualified hsa funding

Edit your hsa qualified hsa funding form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your hsa qualified hsa funding form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit hsa qualified hsa funding online

To use the professional PDF editor, follow these steps below:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit hsa qualified hsa funding. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out hsa qualified hsa funding

How to fill out HSA qualified HSA funding:

01

Determine your eligibility: Before filling out HSA qualified HSA funding, ensure that you meet the eligibility criteria. Generally, individuals who are covered by a high deductible health plan (HDHP) and do not have any other non-HDHP coverage, such as Medicare or other health insurance, can contribute to an HSA.

02

Determine your contribution limits: The contribution limits for HSA funding are set annually by the IRS. Make sure to check the current year's limits before filling out the funding. For example, for 2021, the annual contribution limit is $3,600 for self-only coverage and $7,200 for family coverage.

03

Gather necessary information: Collect all the required information to fill out the funding form. This typically includes personal information, such as your name, address, and Social Security Number, as well as your HSA account details.

04

Choose a funding method: There are several ways to fund your HSA, including payroll deductions, direct bank transfers, or manual contributions. Determine the most convenient and suitable method for you and ensure you have the necessary information to complete the funding process accordingly.

05

Complete the funding form: Once you have all the required information and chosen a funding method, fill out the HSA qualified HSA funding form carefully and accurately. Double-check all the details before submission to avoid any mistakes.

Who needs HSA qualified HSA funding:

01

Individuals covered by a high deductible health plan (HDHP): HSA qualified HSA funding is specifically designed for individuals who have an HDHP. This type of health insurance plan typically has a higher deductible and lower premium compared to traditional health insurance plans.

02

Those looking for tax advantages: HSA qualified HSA funding offers tax advantages to individuals. Contributions made to an HSA are tax-deductible, and any interest or investment gains within the account are tax-free. Additionally, withdrawals used for qualified medical expenses are also tax-free.

03

Individuals seeking to save for future healthcare expenses: With an HSA, you can save and invest funds specifically for future healthcare expenses. The money contributed to an HSA rolls over year after year and can be used to pay for various medical costs, including deductibles, copayments, prescriptions, and even certain non-covered medical services.

04

Those aiming for flexibility and control: HSA qualified HSA funding provides individuals with flexibility and control over their healthcare expenses. Unlike some traditional health insurance plans, where the insurance company determines which services are covered, with an HSA, you have the freedom to choose how and when to use the funds in your account.

In conclusion, filling out HSA qualified HSA funding involves determining eligibility, knowing contribution limits, gathering necessary information, selecting a funding method, and completing the funding form accurately. HSA qualified HSA funding is beneficial for individuals covered by HDHPs who seek tax advantages, want to save for future healthcare expenses, and desire flexibility and control over their healthcare decisions.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get hsa qualified hsa funding?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the hsa qualified hsa funding in seconds. Open it immediately and begin modifying it with powerful editing options.

Can I sign the hsa qualified hsa funding electronically in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your hsa qualified hsa funding in minutes.

How do I fill out hsa qualified hsa funding using my mobile device?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign hsa qualified hsa funding and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

Fill out your hsa qualified hsa funding online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Hsa Qualified Hsa Funding is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.