Get the free Money Management Questionnaire - North Shore Bank

Show details

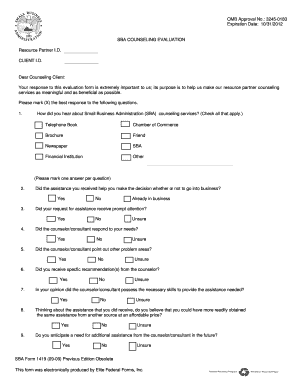

Money Management Questionnaire Welcome to North Shore Bank, please complete the following information and the checklist below: Name: Checking Account #: Savings Account #: Today's Date: Reason for

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign money management questionnaire

Edit your money management questionnaire form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your money management questionnaire form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit money management questionnaire online

Follow the steps down below to use a professional PDF editor:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit money management questionnaire. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out money management questionnaire

How to fill out a money management questionnaire?

01

Start by gathering all necessary financial information, such as income sources, expenses, debts, and assets. This will help you to accurately complete the questionnaire.

02

Read each question carefully and provide honest and accurate answers. Avoid guessing or providing incomplete information. It's essential to be thorough and precise to ensure the effectiveness of the questionnaire.

03

If there's any ambiguity or confusion regarding a particular question, don't hesitate to seek clarification from the person or organization administering the questionnaire. It's crucial to understand the purpose and intended use of each question.

04

Take your time to reflect upon and analyze your financial situation before answering. Consider your short-term and long-term financial goals, any financial challenges you may be facing, and areas where you could potentially improve your financial management.

05

Be consistent in your responses throughout the questionnaire. If you've provided a specific answer in one section, make sure it aligns with your answers in other sections. This will help create a comprehensive and accurate portrayal of your financial situation.

06

Review your answers before submitting the questionnaire. Double-check for any errors, omissions, or contradictions. It's essential to ensure that the information you've provided is complete and accurate.

Who needs a money management questionnaire?

01

Individuals seeking to gain a better understanding of their personal finances can greatly benefit from a money management questionnaire. It allows them to assess their current financial situation, identify areas for improvement, and develop a plan for effective money management.

02

Financial institutions and organizations may use money management questionnaires as part of their application or evaluation processes. By gathering information about an individual's finances, they can assess their creditworthiness, financial stability, and capacity to manage loans or investments.

03

Businesses or organizations providing financial advisory services can use money management questionnaires to evaluate their clients' financial situation. This helps them tailor their recommendations and advice to meet their clients' specific needs and goals.

Overall, a money management questionnaire serves as a valuable tool for personal financial planning, loan applications, investment evaluations, and receiving professional financial advice. It allows individuals, financial institutions, and organizations to gain insights into their financial standing and make informed decisions based on accurate and comprehensive information.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify money management questionnaire without leaving Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including money management questionnaire. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

How can I send money management questionnaire for eSignature?

Once you are ready to share your money management questionnaire, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

Can I edit money management questionnaire on an iOS device?

Use the pdfFiller mobile app to create, edit, and share money management questionnaire from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

What is money management questionnaire?

The money management questionnaire is a document that helps individuals assess their financial habits and strategies for handling money.

Who is required to file money management questionnaire?

Anyone who wants to gain insight into their financial management practices can use a money management questionnaire.

How to fill out money management questionnaire?

To fill out a money management questionnaire, you typically answer a series of questions about your income, expenses, savings goals, and financial behavior.

What is the purpose of money management questionnaire?

The purpose of a money management questionnaire is to help individuals understand their spending habits, identify areas for improvement, and create a plan for better money management.

What information must be reported on money management questionnaire?

Information that may be reported on a money management questionnaire includes income sources, expenses, debt levels, savings goals, and financial priorities.

Fill out your money management questionnaire online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Money Management Questionnaire is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.