US Courts Official Form 207 2015 free printable template

Show details

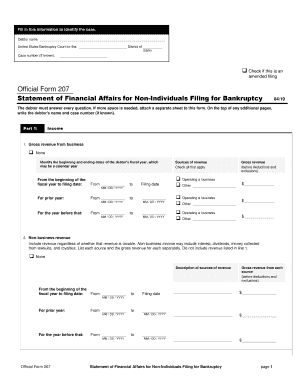

Fill in this information to identify the case: Debtor name United States Bankruptcy Court for the: District of (State) Case number (If known): Check if this is an amended filing Official Form 207

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign US Courts Official Form 207

Edit your US Courts Official Form 207 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your US Courts Official Form 207 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit US Courts Official Form 207 online

Follow the guidelines below to benefit from a competent PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit US Courts Official Form 207. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

US Courts Official Form 207 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out US Courts Official Form 207

How to fill out US Courts Official Form 207

01

Obtain the US Courts Official Form 207 from the official website or the courthouse.

02

Read the instructions provided with the form carefully.

03

Start by filling out your personal information, including your name, address, and contact details in the designated fields.

04

Provide information regarding the case, such as the case number, type of the case, and the court's name.

05

Fill out the details required for the specific purpose of the form, ensuring that all dates and information are accurate.

06

Review the form for completeness and accuracy before signing.

07

Sign and date the form at the specified section.

08

Submit the form as directed, whether electronically or in person at the appropriate court.

Who needs US Courts Official Form 207?

01

Individuals involved in legal proceedings that require a formal request or statement to be submitted to the court.

02

Attorneys representing clients in court cases.

03

Anyone seeking to formally communicate with the court regarding a specific case.

Fill

form

: Try Risk Free

People Also Ask about

What is a Form 108 Statement of intention?

Another one of the myriad documents that you must complete when you file for bankruptcy is Official Form 108, called the "Statement of Intention." This document tells the bankruptcy trustee, the judge, and your creditors what you intend to do with certain property and certain leases.

What is the statement of financial affairs?

The statement of financial affairs (SOFA) is intended to capture a historical view of the debtor's finances. Once completed, the SOFA provides creditors with a summary of the debtor's financial history, transactions, and operations over certain periods of time before the petition date.

What is an official Form 107?

Official Form 107. Statement of Financial Affairs for Individuals Filing for Bankruptcy.

How do I form a limited partnership in Texas?

To form a limited partnership, the partners must enter into a partnership agreement and file a certificate of formation with the secretary of state. In a limited partnership, there will be one or more general partners and one or more limited partners.

Do limited partnerships have to be registered in Texas?

File the Texas Franchise Tax and reports Unless exempt, limited partnerships in Texas are subject to the state's franchise tax and must submit a tax filing each year, even if not tax is owed.

What happens to unsecured creditors in Chapter 11?

Most Chapter 11 debtors receive a moratorium on the payment of most of their general unsecured debts for the period between the filing of the case and the confirmation of a plan. This period usually lasts for six to twelve months.

What happens to unsecured creditors?

Unlike secured creditors, unsecured creditors lend you money without taking collateral. As a result, they do not have the automatic right to take specific property if you stop making payments. Instead, they must sue you and obtain a court judgment against you.

What is the SOFA statement of financial affairs?

The statement of financial affairs (SOFA) is intended to capture a historical view of the debtor's finances. Once completed, the SOFA provides creditors with a summary of the debtor's financial history, transactions, and operations over certain periods of time before the petition date.

What is Form 207?

Official Form 207. Statement of Financial Affairs for Non-Individuals Filing for Bankruptcy.

What is the priority of unsecured creditors in Chapter 11?

The “absolute priority rule” implies that if a Creditor of the highest priority (i.e. Secured Creditor), is paid in full under the Chapter 11 plan, then those of a lower priority (i.e. general Unsecured Creditor), must also be paid.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find US Courts Official Form 207?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the US Courts Official Form 207 in seconds. Open it immediately and begin modifying it with powerful editing options.

How do I execute US Courts Official Form 207 online?

pdfFiller has made filling out and eSigning US Courts Official Form 207 easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

Can I create an electronic signature for the US Courts Official Form 207 in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your US Courts Official Form 207 in seconds.

What is US Courts Official Form 207?

US Courts Official Form 207 is a financial disclosure form used by individuals in bankruptcy proceedings to report their income, expenses, assets, liabilities, and other financial information.

Who is required to file US Courts Official Form 207?

Individuals who are filing for bankruptcy protection under Chapter 7 or Chapter 13 are required to file US Courts Official Form 207 as part of their bankruptcy petition.

How to fill out US Courts Official Form 207?

To fill out US Courts Official Form 207, a debtor must provide accurate financial information including their income sources, monthly expenses, assets, and liabilities. It is important to follow the instructions provided with the form to ensure all necessary information is included.

What is the purpose of US Courts Official Form 207?

The purpose of US Courts Official Form 207 is to provide the bankruptcy court with a clear picture of the debtor's financial situation, allowing the court to assess their eligibility for bankruptcy relief and determine how to handle their debts.

What information must be reported on US Courts Official Form 207?

US Courts Official Form 207 requires the reporting of various financial details including the debtor's income, monthly expenses, total assets and their value, total liabilities, and any other relevant financial information that impacts the bankruptcy case.

Fill out your US Courts Official Form 207 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

US Courts Official Form 207 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.