Get the free Estate Planning Worksheet

Show details

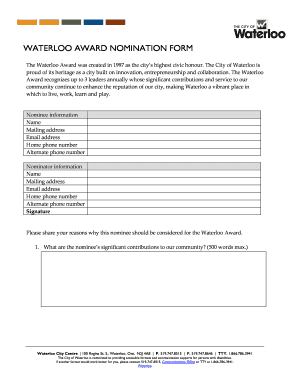

ESTATE PLANNING WORKSHEET I. FAMILIAL INFORMATION A. Names B. Address D. Telephone Numbers E* Prior Marriages F* Children of Prior Marriages G* Prospective Beneficiaries H. Prenuptial Agreement -1- II. FINANCIAL INFORMATION1 Real Estate Provide addresses legal descriptions description of improvements dates acquired cost basis approximate present market value encumbrances manner of holding title joint tenancy separate property unknown. Securities Provide company names addresses and phone...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign estate planning worksheet

Edit your estate planning worksheet form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your estate planning worksheet form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing estate planning worksheet online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit estate planning worksheet. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out estate planning worksheet

How to fill out Estate Planning Worksheet

01

Start with your personal information: Fill in your full name, address, and contact information.

02

List your family details: Include spouse's name, children's names, and any dependents.

03

Identify your assets: Detail all assets including real estate, bank accounts, investments, and personal property.

04

Assign beneficiaries: Specify who will receive your assets and in what proportions.

05

Choose an executor: Designate a trusted individual to oversee the execution of your estate plan.

06

Plan for minor children: Decide guardianship arrangements for your children if applicable.

07

Consider health care decisions: Outline your wishes for medical treatment and appoint a health care proxy.

08

Review and update: Regularly review and amend the worksheet as your circumstances change.

Who needs Estate Planning Worksheet?

01

Anyone with assets or dependents should consider using an Estate Planning Worksheet.

02

Individuals nearing retirement to ensure their wishes are documented.

03

Parents with minor children who need to appoint guardians.

04

Those with specific medical wishes who want to outline health care directives.

05

Anyone wanting to minimize estate taxes and streamline the distribution of their assets.

Fill

form

: Try Risk Free

People Also Ask about

What is the biggest mistake parents make when setting up a trust fund?

' The five or five power is the power of the beneficiary of a trust to withdraw annually $5,000 or five percent of the assets of the trust.

What is the 5 by 5 rule?

The 5x5 Power rule is a way to provide some parameters around the access a beneficiary has to the funds in a trust. It means that in each calendar year, they have access to $5,000 or 5% of the trust assets, whichever's greater. This is in addition to the regular income payout benefit of the trust.

What are the 5 D's of estate planning?

Consideration of the 5 Ds alone—death, disability, divorce, disagreement, and distress—should prompt business owners to initiate the exit and succession planning process, as they represent the certainties that business ownership will eventually transition.

What is the 5 by 5 rule in estate planning?

What are the 7 steps in the estate planning process? Step 1: Define Your Goals and Objectives. Step 2: Create or Update Your Will. Step 3: Establish Trusts. Step 4: Designate Beneficiaries. Step 5: Plan for Incapacity. Step 6: Address Taxation. Step 7: Regularly Review and Update.

What are the 7 steps in the estate planning process?

Assets that are jointly owned or have survivorship rights, such as joint tenancy or tenancy by the entirety, do not need to be included in your will. Upon your passing, these assets will automatically transfer to the surviving owner(s) without going through probate.

What is considered high net worth for estate planning?

What are the steps involved in the planning process? Developing of objectives. Developing tasks that are required to meet those objectives. Determining resources needed to implement those tasks. Creating a timeline. Determining tracking and assessment method. Finalising the plan.

What are the seven steps in the estate planning process?

Sign up for Kiplinger's Free E-Newsletters ClassificationLiquid Assets Held Mass Affluent $100,000 to $1 million High-Net-Worth Individual (HNWI) At least $1 million Very-High-Net-Worth Individual (VHNWI) At least $5 million Ultra-High-Net-Worth Individual (UHNWI) At least $30 million1 more row

What is the 5 or 5 rule in estate planning?

The 5×5 rule is a straightforward, yet powerful, mental tool that helps you manage stress and maintain a healthy perspective on life's challenges. The essence of the rule is this: if something won't matter in five years, don't spend more than five minutes worrying about it. This approach really simplifies rumination.

What is the 5 by 5 rule in estate planning?

Here are the key steps to take. Step 1: Find a Qualified Attorney. Step 2: Take Stock of Your Assets. Step 3: Identify Key Individuals. Step 4: Know the Key Documents You Need. Step 5: Manage Your Documents. Step 6: Don't Neglect the Softer Side of Estate Planning. Step 7: Plan to Keep Your Plan Current.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Estate Planning Worksheet?

An Estate Planning Worksheet is a document that helps individuals outline and organize their wishes regarding the distribution of their assets and the handling of their affairs after death or incapacitation.

Who is required to file Estate Planning Worksheet?

Any individual who wants to ensure that their financial and personal affairs are managed according to their wishes after their death or incapacitation may benefit from filling out an Estate Planning Worksheet.

How to fill out Estate Planning Worksheet?

To fill out an Estate Planning Worksheet, individuals should gather information about their assets, beneficiaries, debts, and any specific wishes regarding their medical care, guardianship for dependents, and distribution of their estate. They then complete the worksheet by providing this information in the designated sections.

What is the purpose of Estate Planning Worksheet?

The purpose of an Estate Planning Worksheet is to facilitate the planning process by helping individuals clarify their preferences, identify their assets, and organize their wishes, which can subsequently be used in preparing legal documents such as wills and trusts.

What information must be reported on Estate Planning Worksheet?

The information that should be reported on an Estate Planning Worksheet typically includes personal information, a list of assets and liabilities, names of beneficiaries, guardianship details for dependents, and directives for healthcare and end-of-life decisions.

Fill out your estate planning worksheet online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Estate Planning Worksheet is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.