Get the free Schedule CR

Show details

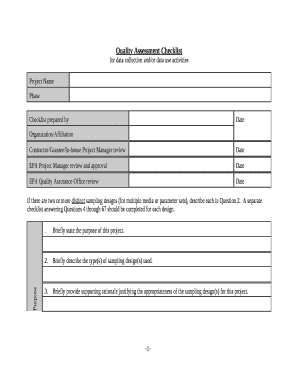

Este formulario se utiliza para calcular los créditos fiscales no reembolsables en Virginia, incluyendo el Crédito de Zona Empresarial, el Crédito de Asistencia Vecinal y otros créditos relacionados

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign schedule cr

Edit your schedule cr form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your schedule cr form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit schedule cr online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit schedule cr. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out schedule cr

How to fill out Schedule CR

01

Obtain the Schedule CR form from the IRS website or your tax preparation software.

02

Fill in your name, Social Security number, and the tax year at the top of the form.

03

Enter the details of the credits you are claiming in the designated sections.

04

If applicable, provide information on any carryforward or carryback of credits from previous years.

05

Calculate the total amount of credits you are claiming at the bottom of the form.

06

Double-check the entries for accuracy and ensure you have supporting documentation.

07

Sign and date the form before submitting it along with your tax return.

Who needs Schedule CR?

01

Individuals or businesses claiming tax credits on their tax return.

02

Taxpayers who have undergone changes that affect their eligibility for tax credits.

03

Anyone who wants to carry forward or carry back unused credits from previous years.

Fill

form

: Try Risk Free

People Also Ask about

Who qualifies for the American Opportunity Tax Credit?

The American Opportunity Tax Credit may be claimed for a student who (1) is enrolled in 6 credits or more, (2) is in one of the first four years of post-secondary education, (3) is enrolled in a program leading to a degree or certificate, and (4) is free of any conviction for a Federal or State felony offense

What is CR tax?

CR Tax means, for any tax year, the amount of Consolidated Tax Liability allocated to a Member pursuant to Article III, Section 3.2 of this Agreement.

Who pays commercial rent taxes?

In commercial leasing, the responsibility for paying property taxes often depends on the lease type. In a gross lease, the landlord usually covers all operating expenses, including taxes. Conversely, with a net lease, tenants may be responsible for a portion of the property taxes.

How to avoid NYC city tax?

Establish Residency Outside of NYC The most straightforward way to avoid NYC city tax is by ensuring you are not considered a resident of the city. NYC residents are subject to local income tax, which can range from 3.078% to 3.876%. To avoid NYC city tax, you must establish residency outside of the city.

What is the schedule CR in Illinois?

What is the purpose of Schedule CR? Schedule CR, Credit for Tax Paid to Other States, allows you to take a credit for income taxes you paid to other states on income you received while a resident of Illinois. You are allowed this credit only if you filed a required tax return with the other state.

What is the difference between Schedule A and Schedule B?

You use Schedule A to itemize deductions on your tax return when your itemized deductions exceed the Standard Deduction. Taxpayers use Schedule B to report interest and dividend income when it exceeds the IRS annual threshold of $1,500 (tax year 2023, 2024, and 2025).

Who is eligible for the NYS property tax relief credit?

The real property tax credit may be available to New York State residents who have household gross incomes of $18,000 or less, and pay either real property taxes or rent for their residences. The amount of the credit for each household will vary depending on income and real property taxes paid (see table to the right).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Schedule CR?

Schedule CR is a tax form used by taxpayers to claim a credit for certain costs or expenses, such as expenditures related to renewable energy or research and development.

Who is required to file Schedule CR?

Taxpayers who are eligible to claim specific tax credits related to research and development, energy efficiency, or other qualifying expenses are required to file Schedule CR.

How to fill out Schedule CR?

To fill out Schedule CR, taxpayers should complete the relevant sections detailing the qualified expenses or activities eligible for the tax credit, attach supporting documentation, and ensure that the form is consistent with the main tax return.

What is the purpose of Schedule CR?

The purpose of Schedule CR is to provide a structured way for taxpayers to report and claim tax credits that aim to incentivize certain expenditures and investments for the benefit of the economy or the environment.

What information must be reported on Schedule CR?

Taxpayers must report information such as the type of credit being claimed, the amount of eligible expenses, and any necessary details that validate the claim for each credit being applied for.

Fill out your schedule cr online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Schedule Cr is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.