Get the free Divisional Investment Base Funding Planning Form - mnsu

Show details

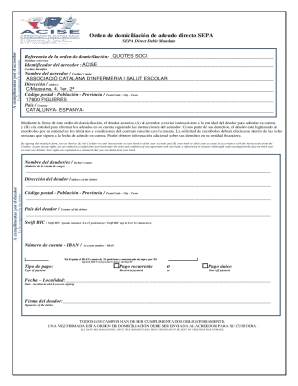

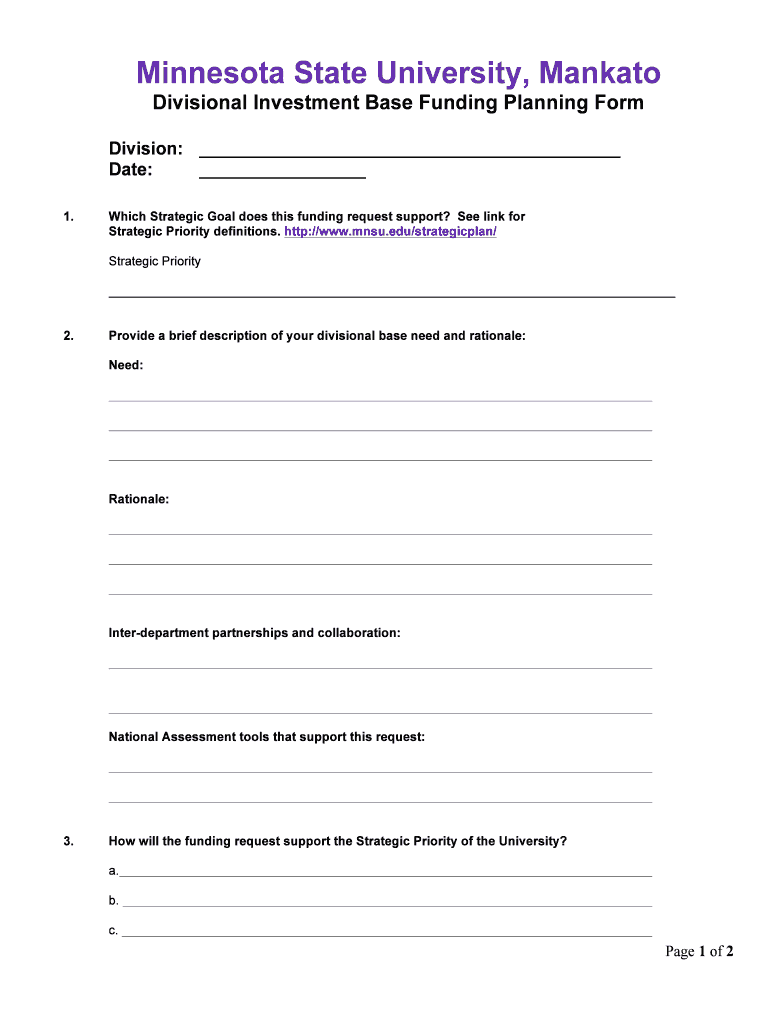

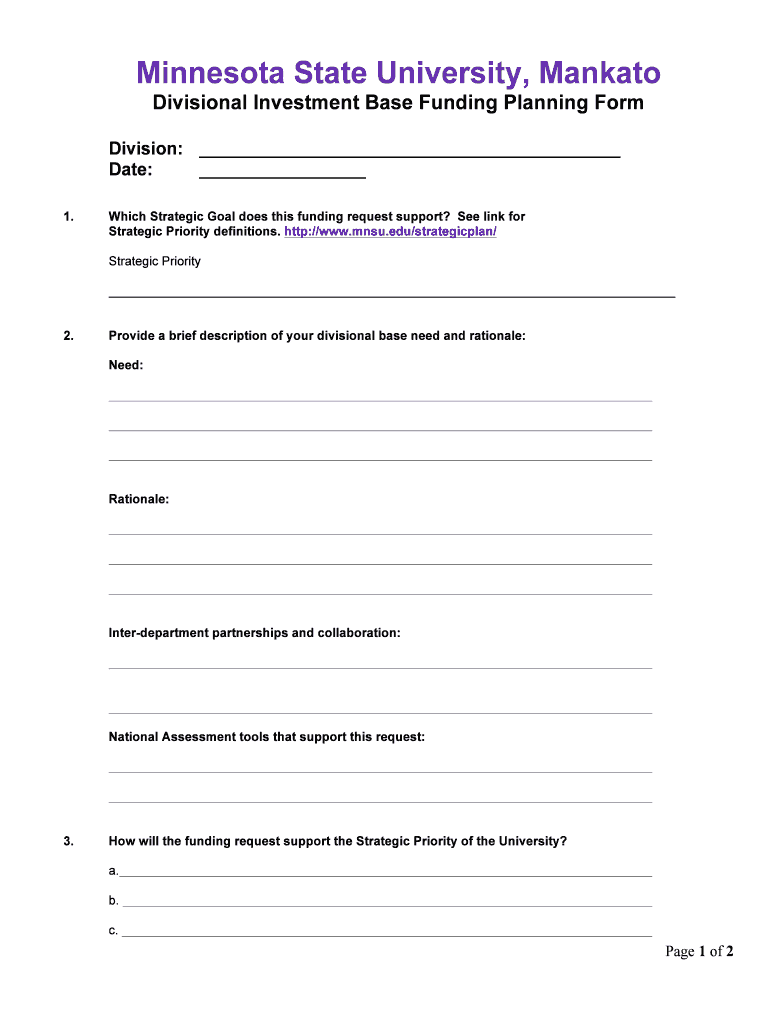

This document is used for requesting funding to support strategic goals at Minnesota State University, Mankato, detailing the requirements, rationale, and budget for the funding.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign divisional investment base funding

Edit your divisional investment base funding form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your divisional investment base funding form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing divisional investment base funding online

To use our professional PDF editor, follow these steps:

1

Log in to account. Start Free Trial and register a profile if you don't have one yet.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit divisional investment base funding. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

The use of pdfFiller makes dealing with documents straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out divisional investment base funding

How to fill out Divisional Investment Base Funding Planning Form

01

Start by gathering necessary financial data related to your division's current investments.

02

Identify upcoming projects that require funding and estimate their costs.

03

Fill out each section of the form, starting with the division name and contact information.

04

Provide a detailed description of each project requiring funding, including objectives and expected outcomes.

05

List the estimated costs for each project, ensuring accuracy and justifications for each amount.

06

Include a timeline for project completion and any necessary milestones.

07

Attach any supporting documentation that may strengthen the funding request.

08

Review the form for completeness and accuracy before submission.

Who needs Divisional Investment Base Funding Planning Form?

01

Division heads and managers seeking funding for new projects.

02

Financial officers responsible for approving investment allocations.

03

Teams engaged in project planning and execution within the division.

Fill

form

: Try Risk Free

People Also Ask about

Who uses form PF?

You're required to file Form PF if you meet the following criteria: You're registered with the SEC as an investment adviser. You manage one or more private funds (hedge, PE, VC, etc.) Your private fund assets total at least $150 million.

How do I write a proposal for funding?

how to write a proposal for funding: Key elements Start with a strong executive summary. Define the problem or need. Present your solution. Outline your goals and objectives. Detail your budget and funding needs. Demonstrate your organization's capability. Include a Timeline. Explain your sustainability plan.

How often is form PF filed?

Smaller private fund advisers file Form PF on an annual basis, while Large Hedge Fund Advisers file quarterly within 60 days after the advisers' fiscal quarter-end. Large Hedge Fund Advisers must report more information about Qualifying Hedge Funds than other hedge funds they may also manage.

Who must file PF quarterly?

Smaller private fund advisers file Form PF on an annual basis, while Large Hedge Fund Advisers file quarterly within 60 days after the advisers' fiscal quarter-end. Large Hedge Fund Advisers must report more information about Qualifying Hedge Funds than other hedge funds they may also manage.

What is a PF submit form?

That includes knowing which documents you're required to submit to the Securities and Exchange Commission. SEC Form PF is a requirement for investment advisors who manage private funds. It's important to understand when filing this form is necessary and what type of information you'll need to provide to the SEC.

Who must file a form pf?

Who is required to file a Form PF? All investment advisers, commodity pool operators and commodity trading advisers (CTAs) registered with the SEC with at least $150 million in private funds under management must periodically file Form PF. Private funds with assets under $150 million are not required to file.

What is the form PF summary?

Form PF is a regulatory filing that certain private fund advisers must file with the U.S. Securities and Exchange Commission (SEC). The Treasury's Financial Stability Oversight Council (FSOC) uses detailed information from Form PF to gain visibility into the behaviors and risk profiles of private funds.

Who must file form PF?

Who is required to file a Form PF? All investment advisers, commodity pool operators and commodity trading advisers (CTAs) registered with the SEC with at least $150 million in private funds under management must periodically file Form PF.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Divisional Investment Base Funding Planning Form?

The Divisional Investment Base Funding Planning Form is a document used by organizations to outline and manage funding allocations for various divisions, ensuring that investments align with strategic priorities and resource availability.

Who is required to file Divisional Investment Base Funding Planning Form?

Typically, division heads or managers within an organization are required to file the Divisional Investment Base Funding Planning Form, especially those responsible for budget planning and investment management.

How to fill out Divisional Investment Base Funding Planning Form?

To fill out the form, individuals must gather relevant financial data, define funding needs for their divisions, detail expected outcomes, and provide justifications for requested amounts before submitting the completed form to the appropriate financial authority.

What is the purpose of Divisional Investment Base Funding Planning Form?

The purpose of the form is to facilitate structured planning for funding requests, promote accountability within divisions, and ensure that financial resources are directed towards initiatives that contribute to the organization's overall strategic goals.

What information must be reported on Divisional Investment Base Funding Planning Form?

The form typically requires information such as division name, funding request amount, description of funding needs, anticipated outcomes, justification for funding, and any additional data that supports the investment proposal.

Fill out your divisional investment base funding online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Divisional Investment Base Funding is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.