Get the free ON WORKING CAPITAL ADVANCE - arts

Show details

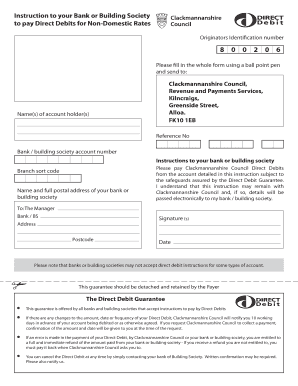

DOCUMENTATION REQUIREMENTS FOR GRANTEES ON WORKING CAPITAL ADVANCE GENERAL GUIDANCE The Working Capital Advance method of funding works like an impress fund, allowing a grantee to be advanced funds,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign on working capital advance

Edit your on working capital advance form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your on working capital advance form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit on working capital advance online

Use the instructions below to start using our professional PDF editor:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit on working capital advance. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out on working capital advance

How to fill out a working capital advance:

01

Start by gathering all the necessary documents and information. This may include financial statements, bank statements, tax returns, and any other documentation that shows the financial health of your business.

02

Review the application form carefully and make sure you understand each section. Pay attention to any specific requirements or instructions provided by the lender.

03

Begin filling out the application form by entering your personal/business information. This usually includes your name, address, contact information, and legal business name (if applicable).

04

Provide information about your business, such as the industry it operates in, the number of years in operation, and your business structure (sole proprietorship, corporation, etc.).

05

Indicate the purpose of the working capital advance. Clearly explain how the funds will be used to improve or grow your business. This may include purchasing inventory, expanding your operations, or covering day-to-day expenses.

06

Fill out the financial information section accurately. This may include your annual revenue, profit margins, debt obligations, and cash flow projections. Include any relevant financial ratios or key performance indicators that highlight the financial stability of your business.

07

Attach any supporting documents requested by the lender. This could include financial statements, tax returns, or any other documents that strengthen your application.

08

Double-check all the information you have provided to ensure accuracy. Mistakes or missing information can lead to delays or a rejection of your application.

09

Submit your completed application along with any required supporting documents to the lender. Follow the application instructions provided by the lender, whether it's submitting it online, via email, or through traditional mail.

Who needs a working capital advance:

01

Small business owners who need immediate access to cash flow to cover operating expenses or unexpected costs.

02

Startups that require additional funds to manage growth, hire new employees, or invest in necessary equipment or inventory.

03

Seasonal businesses that experience fluctuations in revenue and need assistance during slow periods.

04

Business owners who want to take advantage of growth opportunities, such as expanding into new markets or launching new products/services.

In conclusion, filling out a working capital advance application requires careful attention to detail, accurate financial information, and a clear explanation of how the funds will benefit your business. It is an option for small business owners, startups, seasonal businesses, and those looking to seize growth opportunities.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is on working capital advance?

Working capital advance refers to a loan or line of credit that is used to finance day-to-day operations of a business.

Who is required to file on working capital advance?

Businesses or individuals seeking financial assistance for their operating expenses may be required to file for a working capital advance.

How to fill out on working capital advance?

To fill out a working capital advance application, you will need to provide information about your business, financial statements, and requirements of the lender.

What is the purpose of on working capital advance?

The purpose of a working capital advance is to help businesses manage their day-to-day expenses, such as payroll, inventory, and other operational costs.

What information must be reported on on working capital advance?

Information required for a working capital advance may include financial statements, business plan, cash flow projections, and details about the intended use of funds.

How can I modify on working capital advance without leaving Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like on working capital advance, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

How do I execute on working capital advance online?

pdfFiller makes it easy to finish and sign on working capital advance online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

How do I edit on working capital advance on an Android device?

With the pdfFiller Android app, you can edit, sign, and share on working capital advance on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

Fill out your on working capital advance online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

On Working Capital Advance is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.