Get the free Prime Contractors Exemption Certificate - state sd

Show details

SDE Form 1346 Complete and use the button at the end to print for mailing. V6 HELP Prime Contractors Exemption Certificate RV068 Revised 11/15 South Dakota Department of Revenue 445 E. Capitol Avenue

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign prime contractors exemption certificate

Edit your prime contractors exemption certificate form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your prime contractors exemption certificate form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit prime contractors exemption certificate online

Follow the guidelines below to use a professional PDF editor:

1

Log in to account. Start Free Trial and register a profile if you don't have one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit prime contractors exemption certificate. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out prime contractors exemption certificate

How to fill out prime contractors exemption certificate:

01

Obtain the prime contractors exemption certificate form from the relevant authority. This form is usually available on their official website or can be obtained by visiting their office.

02

Provide your personal information on the form. This may include your name, address, contact details, and any other required identification information.

03

Fill in your company or organization details. If you are representing a business, ensure you include the legal name of the company, address, tax identification number, and any other relevant details as requested.

04

Indicate your status as a prime contractor. This section usually asks you to specify the type of work you engage in and provide a brief description of your business activities. Make sure to accurately describe your services or construction work.

05

State the reason for requesting an exemption. Here, briefly explain why you believe you are eligible for a prime contractors exemption certificate. This may include mentioning any applicable statutes or regulations that support your claim.

06

Provide any supporting documentation, if required. The form may ask for additional documents to support your exemption request, such as proof of licensure or certifications.

07

Review the completed form for accuracy and completeness. Double-check all the information provided to ensure there are no errors or omissions.

08

Sign and date the form. By signing the form, you certify that all the information provided is true and accurate to the best of your knowledge.

09

Submit the completed form to the designated authority. Follow the instructions provided to submit the form, whether it is through an online portal, mail, or in-person delivery.

Who needs prime contractors exemption certificate:

01

Contractors engaged in construction projects. Prime contractors who perform construction work as their primary business activity often require a prime contractors exemption certificate to avail certain benefits or exemptions.

02

Government entities and public agencies. These organizations may have specific requirements for contractors working on government-funded projects. A prime contractor exemption certificate may be necessary to meet these requirements and maintain eligibility.

03

Contractors operating in states with tax exemption programs. Some states provide tax exemptions or other benefits to prime contractors in specific industries or under certain conditions. In order to take advantage of these programs, a prime contractors exemption certificate may be needed.

Remember, specific eligibility requirements and regulations may vary depending on your jurisdiction, so it is essential to consult the relevant authority or seek professional advice to ensure compliance and eligibility.

Fill

form

: Try Risk Free

People Also Ask about

Is construction labor taxable in South Dakota?

Contractor's excise tax is imposed on the gross receipts of all prime contractors engaged in construction services or realty improvement projects in South Dakota (SDCL 10-46A). The gross receipts would include the tax collected from the consumer.

Does a exemption certificate expire?

Certificates are valid for up to three years.

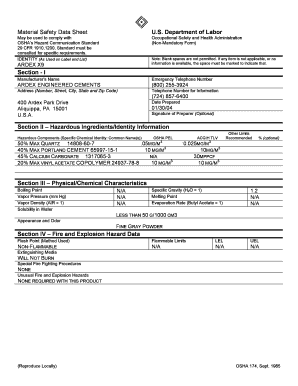

What is a prime contractor exemption certificate in South Dakota?

Prime Contractor's Exemption Certificate If a subcontractor hires another subcontractor, the prime contractor must issue the exemption certificate. The exemption certificate must show the prime contractor's excise tax license number, the project location, and description.

What items are exempt from sales tax in South Dakota?

In South Dakota, certain items may be exempt from the sales tax to all consumers, not just tax-exempt purchasers. Several examples of items that exempt from South Dakota sales tax are prescription medications, farm machinery, advertising services, replacement parts, and livestock.

How long does a sales tax exemption certificate last in South Dakota?

Sellers must keep exemption certificates in their records for three years. If the purchaser doesnʼt provide the seller with a properly completed exemption certificate, the seller must collect sales tax.

Is installation labor taxable in South Dakota?

Are services subject to sales tax in South Dakota? "Goods" refers to the sale of tangible personal property, which are generally taxable. "Services" refers to the sale of labor or a non-tangible benefit. In South Dakota, services are taxable unless specifically exempted.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is prime contractors exemption certificate?

Prime contractors exemption certificate is a legal document that allows a prime contractor to claim an exemption from certain taxes on purchases for a construction project.

Who is required to file prime contractors exemption certificate?

Prime contractors who want to claim an exemption from certain taxes on purchases for a construction project are required to file prime contractors exemption certificate.

How to fill out prime contractors exemption certificate?

Prime contractors can fill out the exemption certificate by providing their company information, project details, and certifying that the exemption applies.

What is the purpose of prime contractors exemption certificate?

The purpose of prime contractors exemption certificate is to allow prime contractors to claim an exemption from certain taxes on purchases made for a construction project.

What information must be reported on prime contractors exemption certificate?

Prime contractors must report their company information, project details, and certify that the exemption applies on the exemption certificate.

How do I modify my prime contractors exemption certificate in Gmail?

prime contractors exemption certificate and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

How do I make edits in prime contractors exemption certificate without leaving Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing prime contractors exemption certificate and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

How do I fill out prime contractors exemption certificate using my mobile device?

Use the pdfFiller mobile app to fill out and sign prime contractors exemption certificate. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

Fill out your prime contractors exemption certificate online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Prime Contractors Exemption Certificate is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.