Get the free ADJUSTMENTS MADE TO RECORDED SELLING PRICES OR FAIR MARKET VALUE IN ARRIVING AT ASSE...

Show details

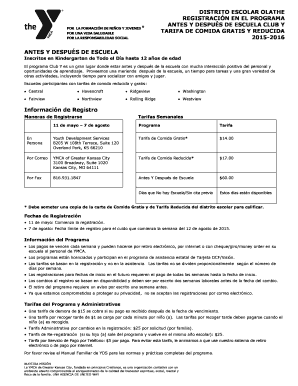

DR493 R. 11/12 Rule 12D16.002 Florida Administrative Code Eff. 11/12 ADJUSTMENTS MADE TO RECORDED SELLING PRICES OR FAIR MARKET VALUE IN ARRIVING AT ASSESSED VALUE Sections 193.011(8) and 192.001(18),

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign adjustments made to recorded

Edit your adjustments made to recorded form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your adjustments made to recorded form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit adjustments made to recorded online

Follow the guidelines below to benefit from a competent PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit adjustments made to recorded. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out adjustments made to recorded

To fill out adjustments made to recorded, follow these points:

01

Begin by reviewing the recorded information carefully. Identify any errors, discrepancies, or omissions that need to be rectified or adjusted.

02

Prepare a detailed list or report highlighting the adjustments required. This can be in the form of a spreadsheet, document, or any other suitable format for easy reference.

03

Prioritize the adjustments based on their significance or impact on the accuracy of the recorded information. This will help in efficiently addressing the most critical adjustments first.

04

Gather all relevant supporting documents or evidence that justify the adjustments being made. This may include invoices, receipts, bank statements, or any other official records that provide accurate information.

05

Consult with the appropriate individuals or departments involved in the recorded information to discuss and validate the adjustments. This could include supervisors, finance personnel, or other concerned stakeholders.

06

Obtain any necessary approvals or authorizations required to make the adjustments. This may involve seeking permission from higher management or adhering to specific protocols within the organization.

07

Ensure proper documentation of the adjustments made. This includes recording the date, time, and the person responsible for making the adjustment. This documentation will serve as a record and aid in future reference or audit purposes.

08

Implement the adjustments in the recorded information accurately and promptly. Double-check the amended data to ensure that all changes have been appropriately reflected.

09

Communicate the adjustments made to all relevant parties involved, especially those who might depend on the accuracy of the recorded information. This ensures transparency and avoids any misunderstandings or misconceptions.

10

Regularly review and monitor the adjusted recorded information to confirm that the required corrections have been effectively made and that the overall accuracy has been restored.

Who needs adjustments made to recorded?

Adjustments made to recorded are typically required by individuals or entities responsible for maintaining accurate and reliable records. This may include:

01

Accounting or finance departments: Adjustments are often necessary to rectify errors in financial statements, ensure compliance with accounting standards, or accurately reflect financial performance.

02

Auditors or external regulatory bodies: Adjustments are made to recorded information to address any discrepancies or non-compliance identified during audits or inspections.

03

Data analysts or researchers: Adjustments may be needed to refine recorded data for accurate analysis, modeling, or research purposes.

04

Organizations or businesses: Adjustments are made to ensure that the recorded information is a true and fair representation of events, transactions, or activities that have occurred within the organization.

05

Individuals or professionals: Adjustments to recorded information might be required for personal records, tax filings, or any situation where accurate documentation is essential.

Overall, adjustments made to recorded serve the purpose of maintaining accuracy, reliability, and integrity in various domains, benefiting stakeholders who rely on detailed and precise information.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is adjustments made to recorded?

Adjustments made to recorded refer to changes or modifications made to previously recorded financial transactions.

Who is required to file adjustments made to recorded?

All entities or individuals who have made changes to their recorded financial data are required to file adjustments made to recorded.

How to fill out adjustments made to recorded?

Adjustments made to recorded can be filled out by providing detailed descriptions of the changes made, the reasons for the adjustments, and the impact on the financial statements.

What is the purpose of adjustments made to recorded?

The purpose of adjustments made to recorded is to ensure that financial statements are accurate and reflect the true financial position of an entity.

What information must be reported on adjustments made to recorded?

Information such as the nature of the adjustment, the amount of the adjustment, and the impact on financial statements must be reported on adjustments made to recorded.

Can I create an electronic signature for signing my adjustments made to recorded in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your adjustments made to recorded right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

How can I edit adjustments made to recorded on a smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing adjustments made to recorded.

How do I edit adjustments made to recorded on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign adjustments made to recorded right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

Fill out your adjustments made to recorded online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Adjustments Made To Recorded is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.