Get the free Agreement to Elect Deferral Reduction Under IRC 403b - apps missouristate

Show details

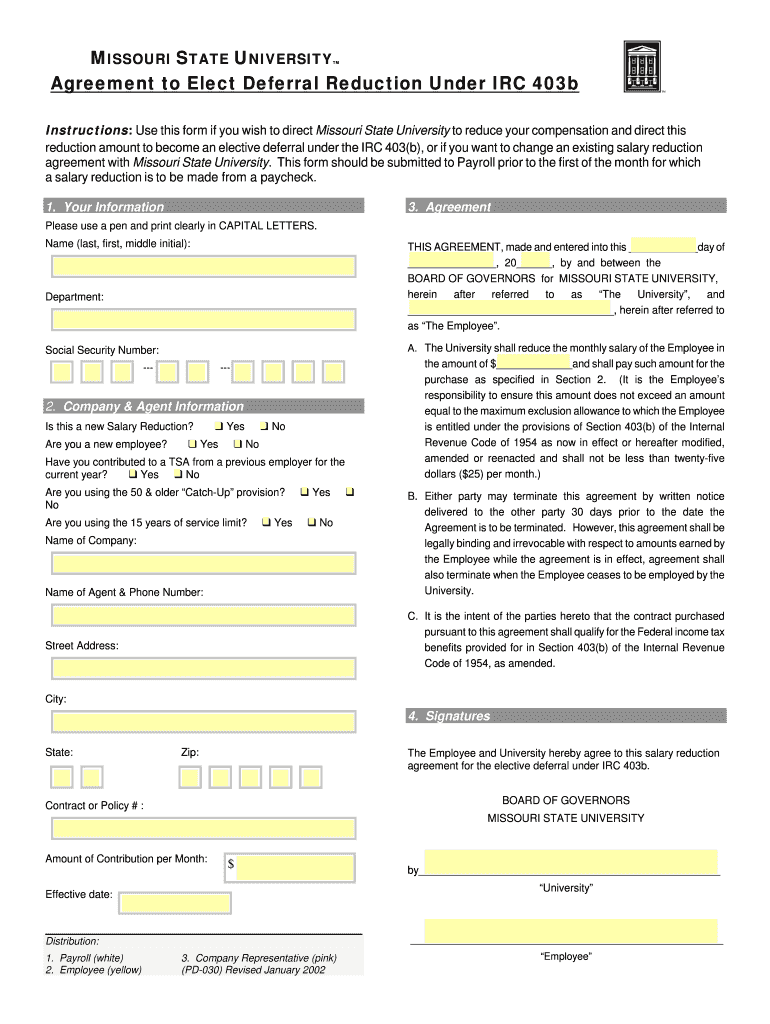

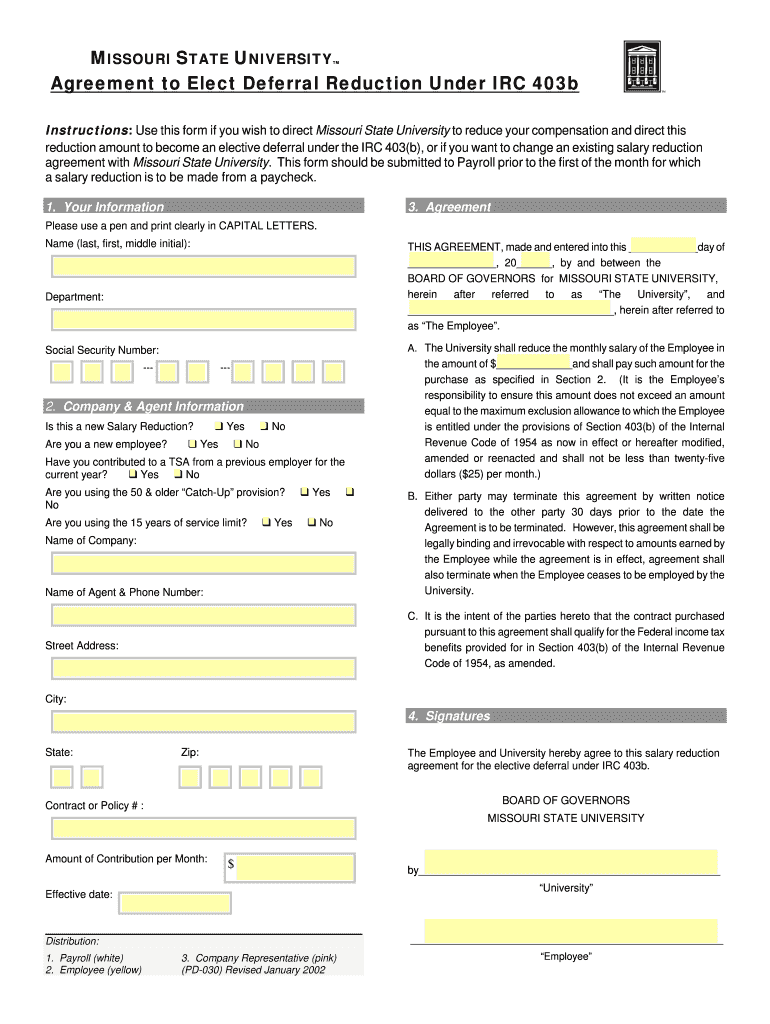

This document serves as an agreement between Missouri State University and the employee to reduce the monthly salary for the purpose of making elective deferrals under IRC 403(b).

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign agreement to elect deferral

Edit your agreement to elect deferral form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your agreement to elect deferral form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit agreement to elect deferral online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit agreement to elect deferral. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out agreement to elect deferral

How to fill out Agreement to Elect Deferral Reduction Under IRC 403b

01

Begin by obtaining the Agreement to Elect Deferral Reduction form from your plan administrator or employer.

02

Fill out your personal information at the top of the form, including your name, employee ID, and contact details.

03

Specify the section of the IRC 403b plan you wish to elect for the deferral reduction.

04

Indicate the percentage or dollar amount of your deferral you wish to reduce.

05

Review any terms and conditions that apply to the deferral reduction.

06

Sign and date the form to indicate your consent to the changes.

07

Submit the completed form to your plan administrator or employer as instructed.

Who needs Agreement to Elect Deferral Reduction Under IRC 403b?

01

Employees who participate in an IRC 403b retirement plan and wish to reduce their deferrals for financial or personal reasons.

02

Employers or plan administrators need this agreement to process the deferral reduction.

Fill

form

: Try Risk Free

People Also Ask about

Which is better, 401(a) or 403(b)?

First, a 403(b) plan may potentially offer a plan participant more flexibility: You can opt out of participating or change your contributions with each paycheck if you like, whereas a 401(a) may have mandatory contributions set by your employer. On the other hand, a 401(a) plan has a much higher contribution limit.

Which is better, a 401(k) or a 403b?

401(k) plans and 403(b) plans offer very similar benefits. As such, one isn't really better than the other. The main difference is that each plan is offered to employees of different types of companies. Another key difference between the plans is that 403(b) plans also offer a $15,000 catch-up.

Can you withdraw money from a 403b?

403(b) account holders can withdraw funds at 59 1/2, job severance, disability, or financial hardship. Early 403(b) withdrawals may face a 10% penalty unless taken after 55 or under rule 72(t) conditions. Rollovers from a 403(b) to another retirement account avoid penalties and expand investment options.

Is a 403b an IRA?

A 403(b) is not an IRA. Both are retirement accounts with similar tax benefits, but they have different contribution limits, and 403(b)s are offered only through employers.

What is the difference between a 401k and a 403b?

403(b) plans and 401(k) plans are very similar but with one key difference: whom they're offered to. While 401(k) plans are primarily offered to employees in for-profit companies, 403(b) plans are offered to not-for-profit organizations and government employees.

What is a 403 B contract exchange?

A contract exchange involves the transfer of a participant's account assets from one 403(b) contract to another 403(b) contract within the same 403(b) plan.

Should I move my 401k to a 403b?

If it offers a good selection of low-cost index funds, then sure, go ahead and roll your old 401k money into the new 403b. If the new 403b plan is mediocre, you would be better off either leaving the old 401k alone or rolling it over to an IRA.

What are 403b deferrals?

Just as with a 401(k) plan, a 403(b) plan lets employees defer some of their salary into individual accounts. The deferred salary is generally not subject to federal or state income tax until it's distributed.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Agreement to Elect Deferral Reduction Under IRC 403b?

The Agreement to Elect Deferral Reduction Under IRC 403b is a legal document that allows an employee to reduce their salary deferral contributions to a 403b retirement plan, typically for tax purposes or financial hardship.

Who is required to file Agreement to Elect Deferral Reduction Under IRC 403b?

Employees participating in a 403b retirement plan who wish to reduce their salary deferral contributions must file the Agreement to Elect Deferral Reduction.

How to fill out Agreement to Elect Deferral Reduction Under IRC 403b?

To fill out the Agreement, the employee must provide personal information, specify the desired reduction amount or percentage of their contributions, and sign the document to confirm their request.

What is the purpose of Agreement to Elect Deferral Reduction Under IRC 403b?

The purpose is to provide a formal mechanism for employees to decrease their contributions to their 403b plan, which can help them manage their finances, especially during times of financial strain.

What information must be reported on Agreement to Elect Deferral Reduction Under IRC 403b?

The Agreement must include the employee's name, identification details, current deferral amounts, the new deferral amount, and the effective date of the reduction.

Fill out your agreement to elect deferral online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Agreement To Elect Deferral is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.