Get the free Assignment of 2009 Tax Sale Certificate I/WE, , hereby assign the certificate of tax...

Show details

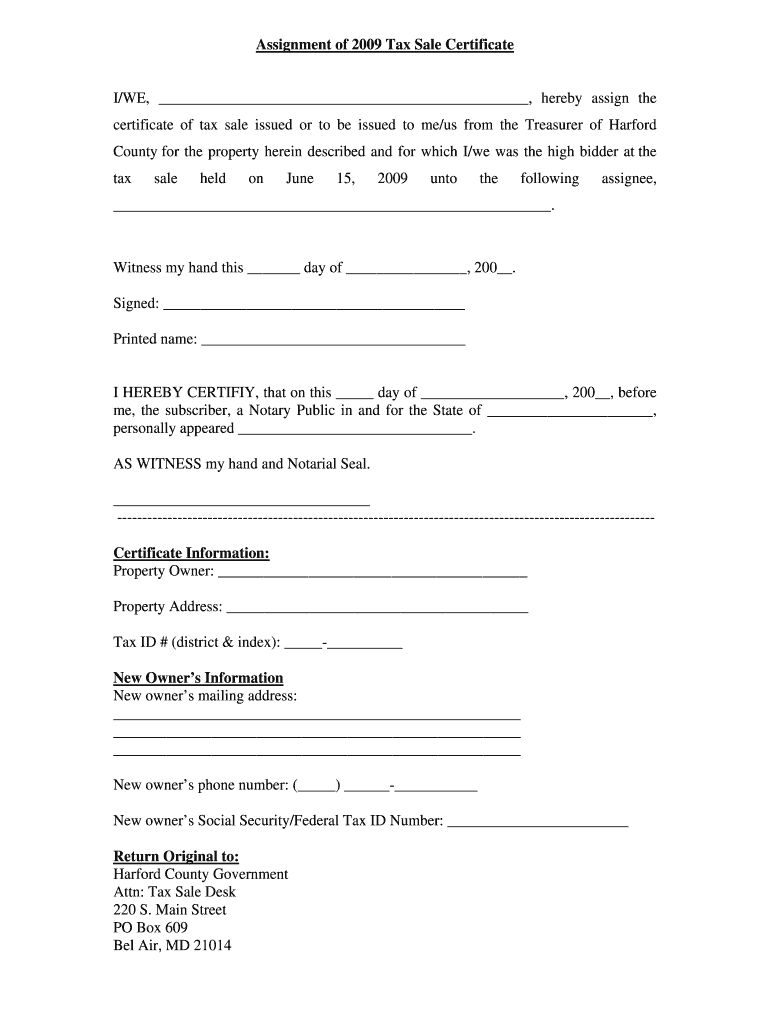

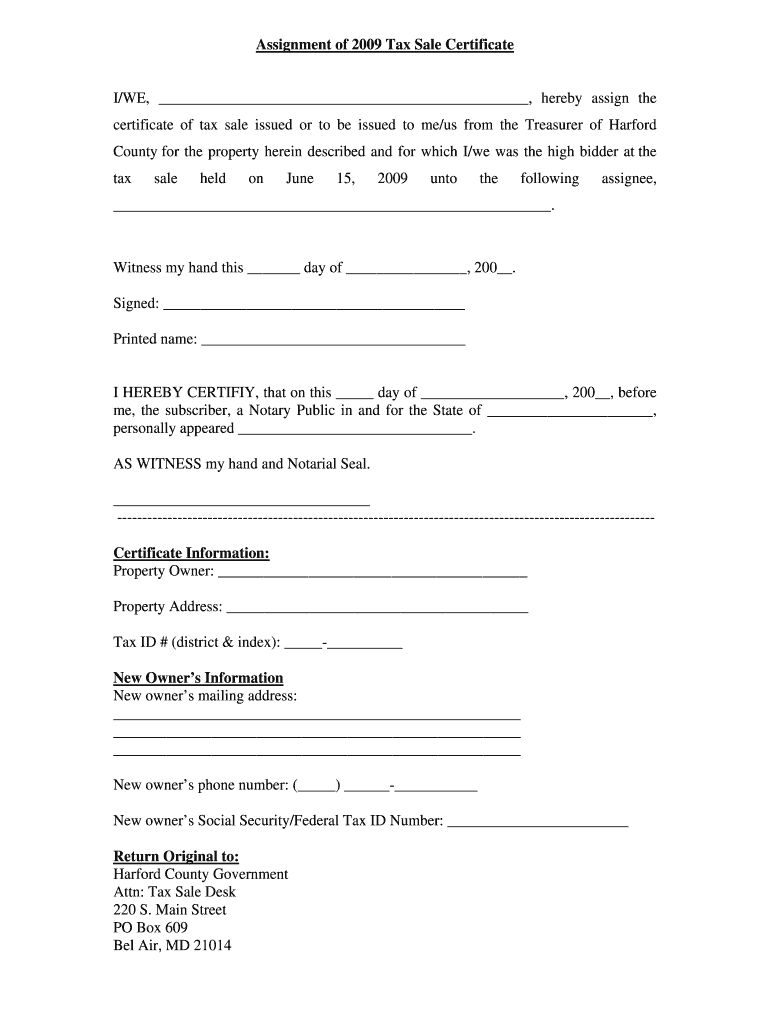

Assignment of 2009 Tax Sale Certificate I/WE, hereby assign the certificate of tax sale issued or to be issued to me/us from the Treasurer of Harford County for the property herein described and for

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign assignment of 2009 tax

Edit your assignment of 2009 tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your assignment of 2009 tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing assignment of 2009 tax online

Use the instructions below to start using our professional PDF editor:

1

Log in to account. Start Free Trial and register a profile if you don't have one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit assignment of 2009 tax. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out assignment of 2009 tax

How to fill out assignment of 2009 tax:

01

Gather all relevant documents: Begin by collecting all the necessary documents for your 2009 tax return. This may include income statements, W-2 forms, 1099 forms, and any other documents related to your finances for that year.

02

Organize your information: Sort through the documents and organize them in a systematic manner. Create a folder or a filing system to keep everything in one place. This will make it easier to refer back to the information as you fill out the assignment.

03

Understand the form: Familiarize yourself with the specific form you need to fill out for your 2009 tax return. In the case of an assignment, it could be a specific form provided by your educational institution or tax preparation software. Read the instructions carefully to ensure you understand how to complete each section.

04

Fill out personal information: Start by entering your personal information accurately, including your name, social security number, address, and any other requested details. Double-check for any errors before moving on to the next step.

05

Report income: One of the fundamental sections of any tax form is reporting your income. Enter all the relevant income information for the year 2009, such as wages, self-employment income, dividends, interest, and any other sources of taxable income. Make sure to include all necessary documentation to support the reported income.

06

Claim deductions and credits: Determine if you are eligible for any deductions or credits for the tax year 2009. This may include deductions for student loan interest, education expenses, or other qualified expenses. Fill out the corresponding sections of the form accurately, ensuring you have the necessary documentation to support these claims.

07

Calculate taxes owed or refund due: Use the information provided on the form and the accompanying instructions to calculate your tax liability or refund for the year 2009. Be sure to follow any specific guidelines or formulas outlined on the form or by your educational institution.

08

Review and submit: Once you have completed all the necessary sections, review your assignment of 2009 tax for accuracy. Double-check all the information and calculations to ensure everything is correct. Make any necessary corrections before submitting the assignment to the appropriate recipient, such as your instructor or tax advisor.

Who needs assignment of 2009 tax?

01

Students studying tax laws: Individuals studying tax laws, accounting, or related subjects may be assigned a project to complete a simulated or hypothetical 2009 tax return. This assignment helps students understand the tax preparation process and apply their knowledge to real-life scenarios.

02

Tax professionals or interns: Tax professionals or interns working in accounting firms or tax preparation services may be tasked with completing an assignment of a 2009 tax return. This can be a part of their training or evaluation process to assess their understanding of tax laws and ability to accurately prepare returns.

03

Individuals completing a tax course: Some individuals may choose to enroll in a tax course or workshop to improve their understanding of taxes and learn how to prepare their own tax returns. As part of these courses, students may be asked to complete assignments, such as a 2009 tax return, to practice their skills and reinforce the concepts learned during the course.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit assignment of 2009 tax from Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including assignment of 2009 tax. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

How do I edit assignment of 2009 tax online?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your assignment of 2009 tax to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

Can I create an electronic signature for the assignment of 2009 tax in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your assignment of 2009 tax in seconds.

What is assignment of tax sale?

Assignment of tax sale is the transfer of ownership of a property from the original owner to the buyer who purchased the property at a tax sale.

Who is required to file assignment of tax sale?

The buyer who purchased the property at a tax sale is required to file the assignment of tax sale.

How to fill out assignment of tax sale?

Assignment of tax sale can be filled out by providing details of the buyer, seller, property, sale date, and sale price.

What is the purpose of assignment of tax sale?

The purpose of assignment of tax sale is to legally transfer ownership of the property from the original owner to the buyer who purchased it at a tax sale.

What information must be reported on assignment of tax sale?

The assignment of tax sale must include details of the buyer, seller, property, sale date, and sale price.

Fill out your assignment of 2009 tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Assignment Of 2009 Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.