Get the free Budget and Audit Information - Welcome to Prowers County, Colorado

Show details

Powers County Competitive Bid Form Page 1 of 2 POWERS COUNTY ADMINISTRATION OFFICE 301 SOUTH MAIN STREET, SUITE 215 LAMAR, COLORADO 810522857 (719) 3368025 FAX: (719) 3362255 COMPETITIVE BID (CB)

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign budget and audit information

Edit your budget and audit information form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your budget and audit information form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing budget and audit information online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit budget and audit information. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out budget and audit information

Point by point steps to fill out budget and audit information:

01

Start by gathering all the necessary financial documents and statements, including income and expense records, bank statements, invoices, and receipts.

02

Organize the information into relevant categories, such as revenue, expenses, assets, and liabilities. This will help in creating a clear and structured budget and audit report.

03

Begin with the budget information. Evaluate your current financial status and determine your financial goals. Allocate funds to different categories based on your priorities and financial needs. Consider factors such as fixed expenses, variable expenses, savings, and investments.

04

Enter the budgeted amounts for each category in the designated sections of the budget template or software. Ensure accuracy and double-check all the calculations.

05

Include a brief explanation or justification for each budgeted item to provide context and accountability. This helps auditors understand the reasoning behind your financial decisions.

06

After completing the budget information, move on to the audit information. This involves documenting and providing evidence for every financial transaction made during the specified period.

07

Begin by reconciling your bank statements with your financial records. Make any necessary adjustments or corrections to ensure the accuracy of the data.

08

List all the income sources and categorize them appropriately. Include details such as the source name, date, amount, and any associated documentation.

09

Similarly, document all expenses, including fixed costs (rent, salaries) and variable costs (utilities, supplies). Include detailed information for each expense, such as the payee's name, date, amount, and supporting invoices or receipts.

10

Ensure that all financial transactions are properly recorded. Use appropriate accounting software or tools to maintain accuracy and consistency in the audit information.

11

Once all the budget and audit information is completed, review the reports for any errors or discrepancies. Cross-verify the information with your financial records and make necessary adjustments if required.

Who needs budget and audit information?

01

Businesses and organizations: Budget and audit information is crucial for businesses and organizations to monitor and manage their financial performance, make informed decisions, and comply with legal and regulatory requirements. It helps in evaluating the financial health, identifying areas of improvement, and ensuring transparency.

02

Government agencies: Budget and audit information is required by government agencies to track public spending and ensure accountability. It helps in evaluating the efficiency and effectiveness of public funds utilization.

03

Investors and lenders: Budget and audit information is essential for investors and lenders to assess the financial stability and potential risks associated with an entity. It helps in making investment decisions, determining creditworthiness, and analyzing the financial viability of a business or organization.

04

Internal stakeholders: Budget and audit information is necessary for internal stakeholders such as management, board members, and employees to understand the company's financial position, performance, and future prospects. It aids in strategic planning, resource allocation, and performance evaluation.

05

External stakeholders: Budget and audit information also benefits external stakeholders such as customers, suppliers, and vendors. It assures them of the financial reliability and credibility of the entity they are engaged with, fostering trust and confidence in the business relationship.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is budget and audit information?

Budget and audit information refers to financial documents that detail the planned expenses and revenue of an organization, as well as an independent examination of the organization's financial statements.

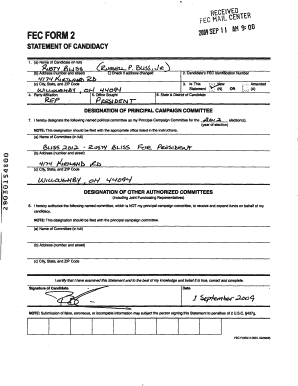

Who is required to file budget and audit information?

Non-profit organizations are typically required to file budget and audit information with regulatory bodies, as well as any other entity that receives public funding or donations.

How to fill out budget and audit information?

Budget and audit information should be filled out by financial professionals or accountants using the organization's financial records and documents.

What is the purpose of budget and audit information?

The purpose of budget and audit information is to provide transparency and accountability regarding an organization's financial activities to stakeholders, donors, and regulatory bodies.

What information must be reported on budget and audit information?

Budget and audit information must include details about sources of income, planned expenses, actual expenses, financial performance, and any potential discrepancies or irregularities.

How do I execute budget and audit information online?

pdfFiller has made it easy to fill out and sign budget and audit information. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

How do I edit budget and audit information in Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your budget and audit information, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

How can I edit budget and audit information on a smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing budget and audit information.

Fill out your budget and audit information online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Budget And Audit Information is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.