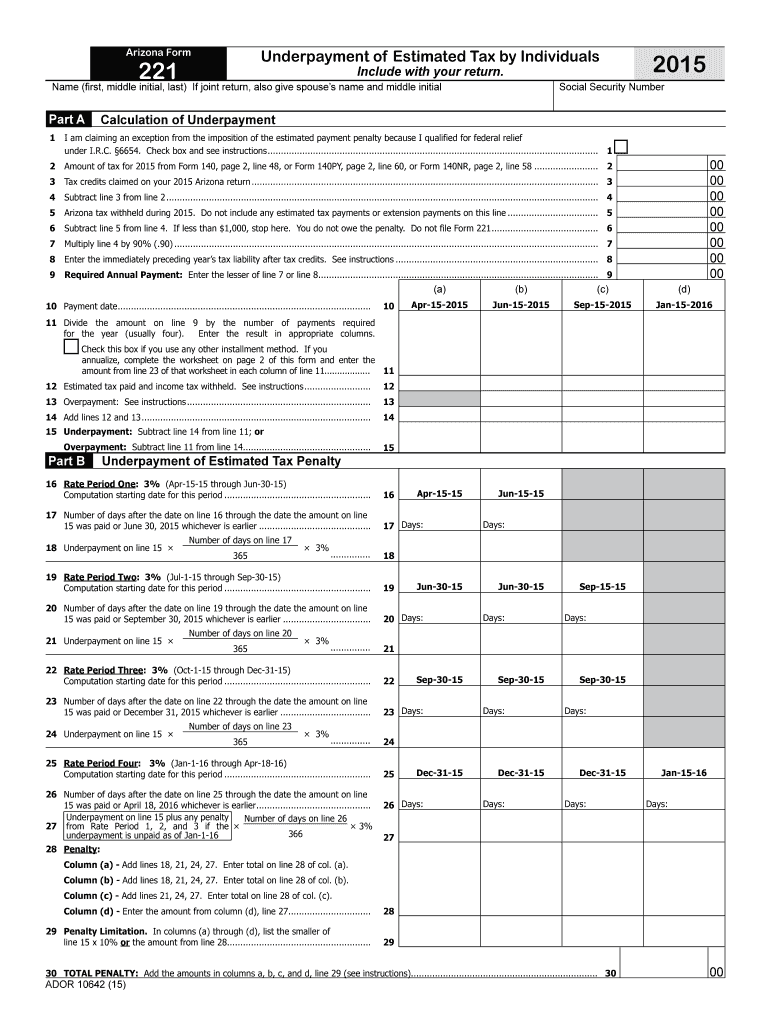

Get the free Arizona Form 221 Underpayment of Estimated Tax by Individuals 2015

Instructions and Help about arizona form 221 underpayment

How to edit arizona form 221 underpayment

How to fill out arizona form 221 underpayment

Latest updates to arizona form 221 underpayment

All You Need to Know About arizona form 221 underpayment

What is arizona form 221 underpayment?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about arizona form 221 underpayment

What should I do if I realize I've made a mistake after filing my Arizona form 221 underpayment?

If you discover an error after submitting your Arizona form 221 underpayment, you can file an amended return to correct the mistake. It's essential to follow the state's guidelines on amendments, which typically involve providing clarifying information about the changes made. Ensure that you keep records of both the original and amended submissions for your records.

How can I track the status of my Arizona form 221 underpayment filing?

To track the status of your Arizona form 221 underpayment, you can visit the Arizona Department of Revenue's website, which often provides resources for checking the status of filed forms. Be sure to have your personal identification information handy, as you may need it to verify your submission. If there are errors, they may also provide specific error codes along with instructions.

Are there special considerations for nonresidents filing the Arizona form 221 underpayment?

Yes, nonresidents have specific considerations when filing the Arizona form 221 underpayment, including how their income is sourced within the state. It's crucial for nonresidents to understand the applicable rules regarding income allocation and any additional documentation that may be required alongside their submission. Consulting with a tax professional familiar with Arizona tax law can be beneficial.

What should I do if my Arizona form 221 underpayment was rejected after e-filing?

If your Arizona form 221 underpayment is rejected after e-filing, carefully review the rejection notice for details on the specific errors encountered during processing. Follow the provided guidance to correct any issues, and re-submit your form as soon as possible to avoid potential penalties. Make sure to keep a record of the rejection notice for your files.