Get the free COOPER INVESTORS RETAIL FUNDS APPLICATION FORM

Show details

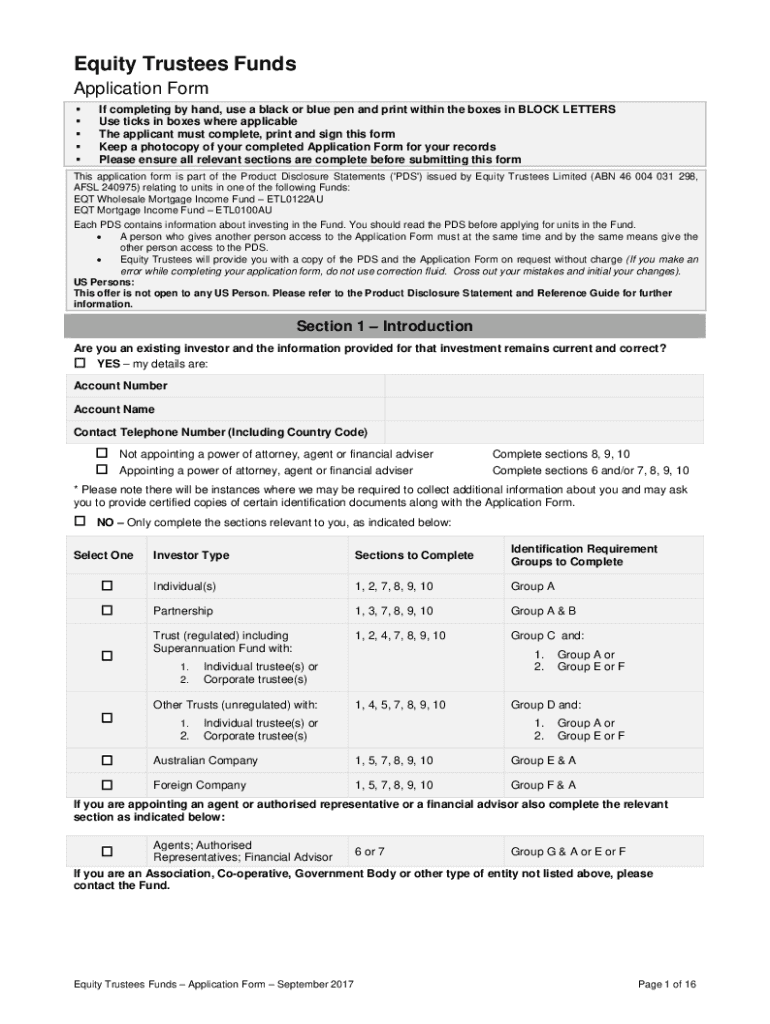

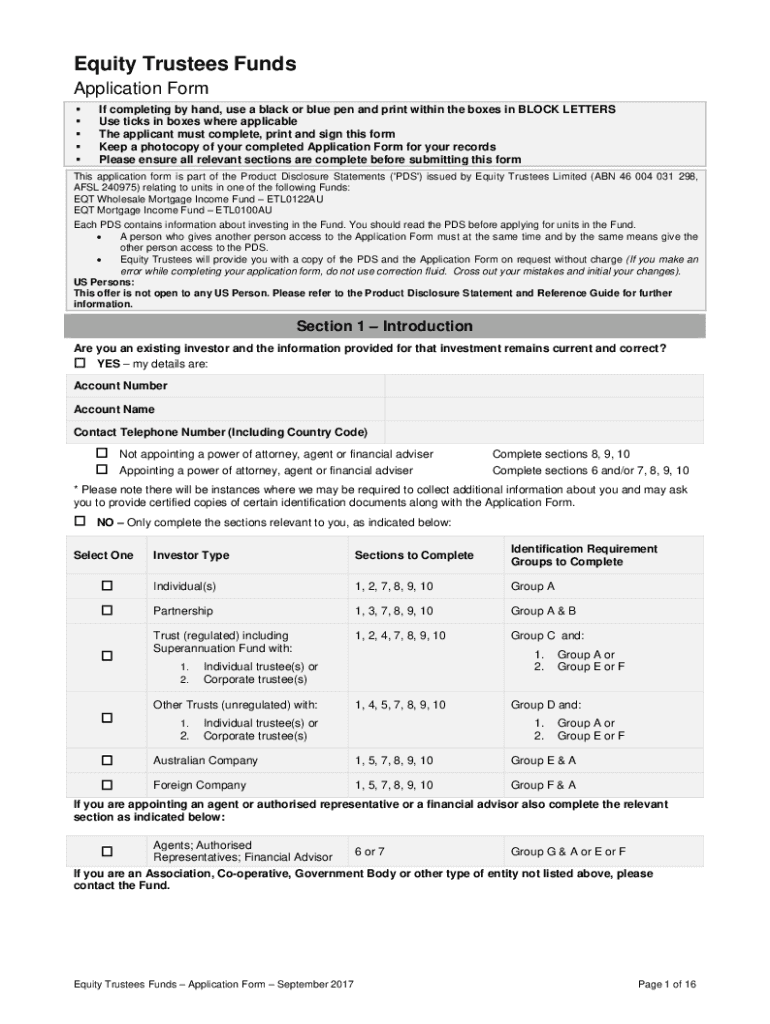

Equity Trustees Funds Application Form If completing by hand, use a black or blue pen and print within the boxes in BLOCK LETTERS Use ticks in boxes where applicable The applicant must complete, print

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign cooper investors retail funds

Edit your cooper investors retail funds form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your cooper investors retail funds form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit cooper investors retail funds online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit cooper investors retail funds. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out cooper investors retail funds

How to fill out cooper investors retail funds:

01

Obtain the necessary forms: Start by contacting Cooper Investors or visiting their website to locate the specific forms required for opening a retail fund account. These forms typically include an application form, a risk profile questionnaire, and a relevant product disclosure statement (PDS).

02

Provide personal information: Fill out the application form with accurate and up-to-date personal details, including your full name, date of birth, address, contact information, and tax file number (TFN).

03

Determine your risk profile: Cooper Investors may ask you to complete a risk profile questionnaire to assess your investment objectives and tolerance for risk. Answer the questions honestly to ensure that the investment approach aligns with your financial goals and risk appetite.

04

Read and understand the PDS: Carefully review the PDS provided by Cooper Investors. This document contains essential information about the fund, including investment strategies, fees, risks, and other terms and conditions. Make sure you fully understand the details before proceeding.

05

Complete beneficiary details (if applicable): If you intend to nominate beneficiaries for your retail fund, provide their relevant information, such as names, dates of birth, and contact details. Beneficiaries will receive the fund's proceeds in the event of your death.

06

Consider seeking professional advice: If you are unsure about any aspect of filling out the forms or the suitability of Cooper Investors retail funds for your financial situation, it may be beneficial to consult a financial advisor or seek professional advice.

Who needs Cooper Investors retail funds?

01

Individual Investors: Anyone looking to invest their money in a professionally managed portfolio of assets may consider Cooper Investors retail funds. These funds provide access to a diversified range of securities, including equities, bonds, and cash.

02

Long-term investors: Cooper Investors retail funds aim to achieve long-term capital growth. Therefore, individuals with a medium to long-term investment horizon are more likely to benefit from investing in these funds. Short-term investors seeking quick gains may find other investment options more suitable.

03

Investors seeking active management: Cooper Investors employs an active investment management approach, where experienced fund managers make investment decisions based on in-depth research and analysis. If you prefer a more hands-on approach compared to passive index-tracking funds, Cooper Investors retail funds could be a suitable choice.

04

Those with a moderate risk appetite: While individual risk tolerance varies, Cooper Investors retail funds generally cater to investors with a moderate risk appetite. The funds may offer exposure to growth assets such as stocks but can also have some exposure to defensive assets like bonds and cash to mitigate risk.

05

Investors seeking transparency: Cooper Investors has a commitment to transparency and regularly communicates with investors. Fundholders receive regular updates, performance reports, and insights into the fund's investment activities, allowing for informed decision-making.

Please note that this information is for illustrative purposes only, and it is essential to conduct thorough research and consider your own financial circumstances before making any investment decisions.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my cooper investors retail funds directly from Gmail?

cooper investors retail funds and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

How can I modify cooper investors retail funds without leaving Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your cooper investors retail funds into a dynamic fillable form that you can manage and eSign from anywhere.

How do I edit cooper investors retail funds in Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your cooper investors retail funds, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

What is cooper investors retail funds?

Cooper Investors Retail Funds are investment funds that are tailored for retail investors, typically managed by Cooper Investors Pty Limited.

Who is required to file cooper investors retail funds?

Investment managers or entities managing Cooper Investors Retail Funds are required to file the necessary documentation.

How to fill out cooper investors retail funds?

Cooper Investors Retail Funds can be filled out by providing information on the fund's performance, holdings, expenses, and other relevant financial data.

What is the purpose of cooper investors retail funds?

The purpose of Cooper Investors Retail Funds is to provide retail investors with access to professionally managed investment portfolios to help them achieve their financial goals.

What information must be reported on cooper investors retail funds?

Information such as fund performance, portfolio holdings, fees, expenses, and any other relevant financial data must be reported on Cooper Investors Retail Funds.

Fill out your cooper investors retail funds online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Cooper Investors Retail Funds is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.