Get the free Authorization For Payroll Deduction/Reduction - mtholyoke

Show details

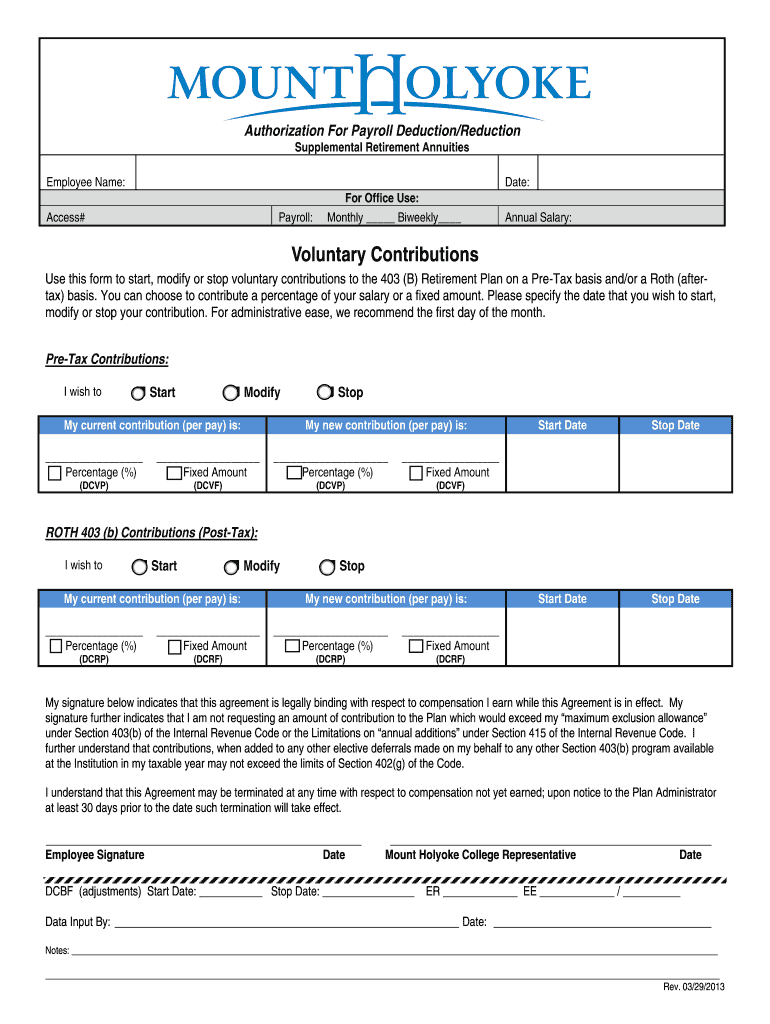

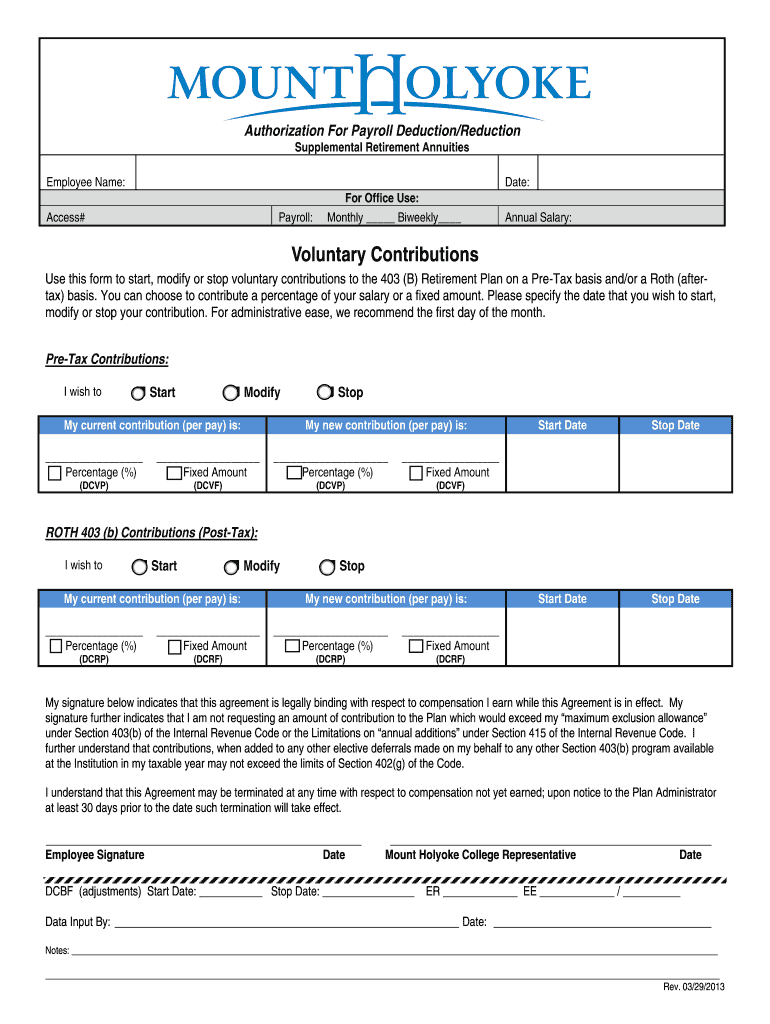

This document is used to start, modify, or stop voluntary contributions to the 403 (B) Retirement Plan on a Pre-Tax or Roth (Post-Tax) basis. It requires the employee's salary information and contribution

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign authorization for payroll deductionreduction

Edit your authorization for payroll deductionreduction form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your authorization for payroll deductionreduction form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit authorization for payroll deductionreduction online

In order to make advantage of the professional PDF editor, follow these steps:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one yet.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit authorization for payroll deductionreduction. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Dealing with documents is simple using pdfFiller. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out authorization for payroll deductionreduction

How to fill out Authorization For Payroll Deduction/Reduction

01

Obtain the Authorization For Payroll Deduction/Reduction form from your HR department or company intranet.

02

Carefully read through the instructions provided on the form to understand the requirements.

03

Fill out your personal information, including your name, employee ID, and department.

04

Specify the amount you wish to have deducted or reduced from your paycheck.

05

Indicate the reason for the payroll deduction, such as for benefits or loan repayments.

06

Review the authorization terms to ensure you understand the agreement.

07

Sign and date the form to authorize the deduction or reduction.

08

Submit the completed form to your HR department for processing.

Who needs Authorization For Payroll Deduction/Reduction?

01

Employees who wish to authorize deductions for benefits, contributions, or loans.

02

Individuals looking to set up payroll deductions for charitable contributions.

03

Employees requesting reductions in their paycheck for various authorized reasons.

Fill

form

: Try Risk Free

People Also Ask about

How to change payroll deductions?

Submit a new Form W-4 to your employer if you want to change the withholding from your regular pay. Complete Form W-4P to change the amount withheld from pension, annuity, and IRA payments. Then submit it to the organization paying you.

What is the authorization form for payroll deduction?

The Form CD88 must be co mpleted (typed or hand written in legible form) as outlined below to add, change the amount, or delete the employee's deduction. The State Controller is hereby authorized to add, delete, or change the payroll deduction for the below-named employee.

How do you record payroll deductions?

For employee deductions, debit the payroll clearing account and credit the relevant payable accounts. These entries will later be posted to your general ledger as part of your regular accounting process.

What should I put for adjustments on W4?

Step 4: Other Adjustments (a): Other income (not from jobs). Additional income that might not be subject to withholding, like dividends or retirement income. (b): Deductions. Itemized deductions like mortgage interest and charitable contributions that will exceed your standard deduction. (c): Extra withholding.

How do I adjust payroll deductions?

Submit a new Form W-4 to your employer if you want to change the withholding from your regular pay. Complete Form W-4P to change the amount withheld from pension, annuity, and IRA payments. Then submit it to the organization paying you.

How do I correct a mistake on my payroll taxes?

You can e-file corrected employment tax returns Form 941-X, Form 943-X, and Form 945-X. The Form 940 e-file program allows you to electronically file an amended Form 940. Modernized e-File (MeF) for employment taxes offers a secure and accurate way to file the amended returns electronically.

Do payroll deductions have to be approved by the employee in writing?

Labor Code Section 224 clearly prohibits any deduction from an employee's wages which is not either authorized by the employee in writing or permitted by law, and any employer who resorts to self-help does so at its own risk as an objective test is applied to determine whether the loss was due to dishonesty,

What is a payroll deduction agreement?

Payroll deductions are wages withheld from an employee's total earnings for the purpose of paying taxes, garnishments and benefits, like health insurance. These withholdings constitute the difference between gross pay and net pay and may include: Income tax.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Authorization For Payroll Deduction/Reduction?

Authorization For Payroll Deduction/Reduction is a document that allows an employee to authorize deductions from their paycheck for specific purposes, such as contributions to retirement plans or payment of union dues.

Who is required to file Authorization For Payroll Deduction/Reduction?

Typically, employees who wish to have specific amounts deducted from their paychecks for purposes such as benefits, savings plans, or union dues are required to file this authorization.

How to fill out Authorization For Payroll Deduction/Reduction?

To fill out the Authorization For Payroll Deduction/Reduction, an employee should provide their personal and employment information, specify the amount to be deducted, identify the purpose of the deduction, and sign the document to confirm their consent.

What is the purpose of Authorization For Payroll Deduction/Reduction?

The purpose of Authorization For Payroll Deduction/Reduction is to ensure that employees have a formal process for consenting to deductions from their salaries, ensuring transparency and compliance with their wishes regarding payroll activities.

What information must be reported on Authorization For Payroll Deduction/Reduction?

Information that must be reported includes the employee's name, employee ID, the amount to be deducted, the frequency of deductions, the purpose of the deduction, and the employee's signature.

Fill out your authorization for payroll deductionreduction online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Authorization For Payroll Deductionreduction is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.