Get the free EMPLOYER REPORTING FORM - California Department of - bvnpt ca

Show details

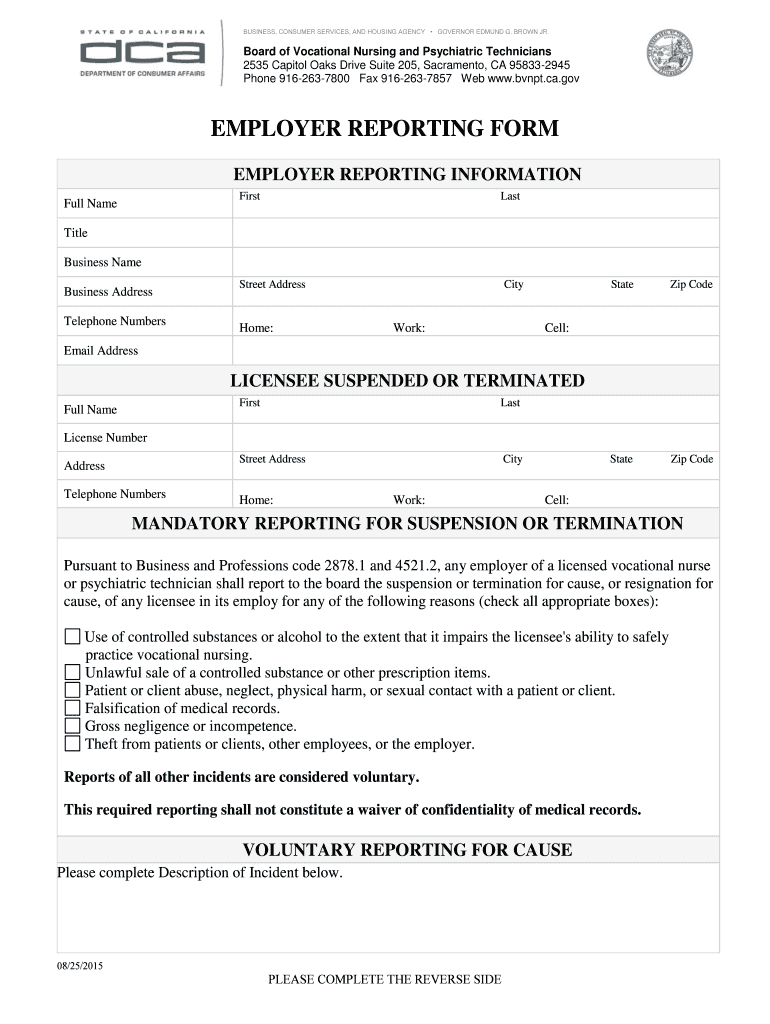

BUSINESS, CONSUMER SERVICES, AND HOUSING AGENCY GOVERNOR EDMUND G. BROWN JR. Board of Vocational Nursing and Psychiatric Technicians 2535 Capitol Oaks Drive Suite 205, Sacramento, CA 958332945 Phone

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign employer reporting form

Edit your employer reporting form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your employer reporting form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing employer reporting form online

Follow the guidelines below to use a professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit employer reporting form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out employer reporting form

How to fill out employer reporting form?

01

Begin by reviewing the instructions: Before starting to fill out the employer reporting form, carefully read and understand the instructions provided. This will help you avoid errors and ensure that you provide the required information accurately.

02

Fill out the basic information: Start by entering your name, employer's name, and other requested details in the designated fields. Make sure to double-check for any spelling or typographical errors.

03

Provide employee details: Include the necessary information about each employee, such as their full name, social security number, address, and employment start/end dates. If there are multiple employees, you may need to attach additional sheets or use the provided templates.

04

Report employee wages: Enter the total wages paid to each employee during the specified reporting period. This should include regular wages, overtime pay, bonuses, commissions, and any other compensation provided. Ensure that you accurately calculate and report each employee's earnings.

05

Include relevant taxes and deductions: Report any applicable taxes, such as federal or state income tax withheld, social security tax, Medicare tax, and any other required deductions. Use the appropriate lines or sections provided on the form to ensure accurate reporting.

06

Complete additional sections, if applicable: Depending on the nature of your business or specific reporting requirements, there may be additional sections on the form that need to be filled out. Common examples include reporting tips, noncash compensation, and fringe benefits. Provide the requested information for each relevant employee.

07

Review and double-check: Once you have filled out all the necessary sections, carefully review the completed form for any errors or omissions. Check if all the information is accurate and properly entered. Making corrections or amendments at this stage is crucial to avoid potential complications or penalties.

08

Sign and submit: After completing the form, sign it using the designated area to certify the information provided. Depending on the submission process, you may need to mail the form to the relevant tax authority, submit it electronically, or follow any other specific instructions.

Who needs employer reporting form?

01

Employers: The primary individuals or entities required to fill out the employer reporting form are employers. This includes businesses, organizations, or individuals who have hired employees and paid wages above the minimum reporting threshold set by the respective tax authority. These employers are responsible for reporting employee wages, taxes, and other relevant information.

02

Tax authorities: The employer reporting form is essential for tax authorities to ensure proper tax compliance, monitor wage levels, and accurately assess the tax liabilities of employees. These forms help tax authorities ensure that both employers and employees are fulfilling their tax obligations and contribute to the effective functioning of the tax system.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit employer reporting form in Chrome?

employer reporting form can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

Can I edit employer reporting form on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share employer reporting form from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

How do I fill out employer reporting form on an Android device?

Use the pdfFiller mobile app to complete your employer reporting form on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

What is employer reporting form?

The employer reporting form is a form used by employers to report information about their employees to the relevant authorities.

Who is required to file employer reporting form?

Employers are required to file the employer reporting form.

How to fill out employer reporting form?

Employers can fill out the employer reporting form by providing all the requested information about their employees.

What is the purpose of employer reporting form?

The purpose of the employer reporting form is to provide accurate information about employees for tax and regulatory purposes.

What information must be reported on employer reporting form?

Employers must report information such as employee wages, taxes withheld, and benefits provided.

Fill out your employer reporting form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Employer Reporting Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.