Get the free Mortgage Company New Branch Application - osbckansas

Show details

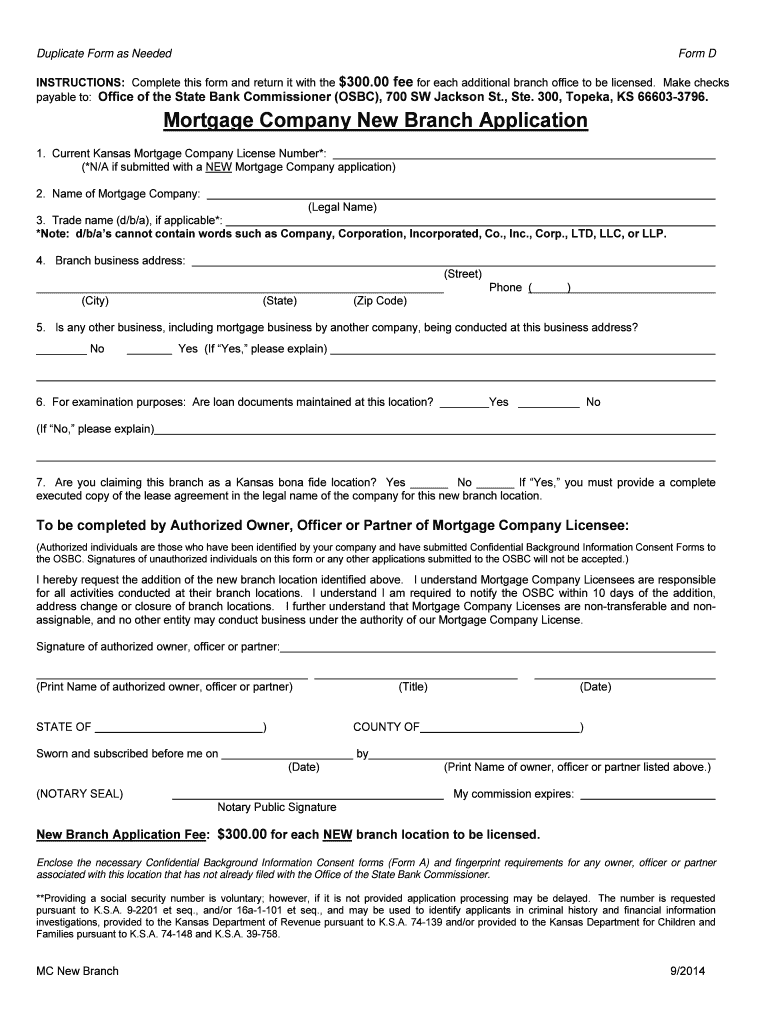

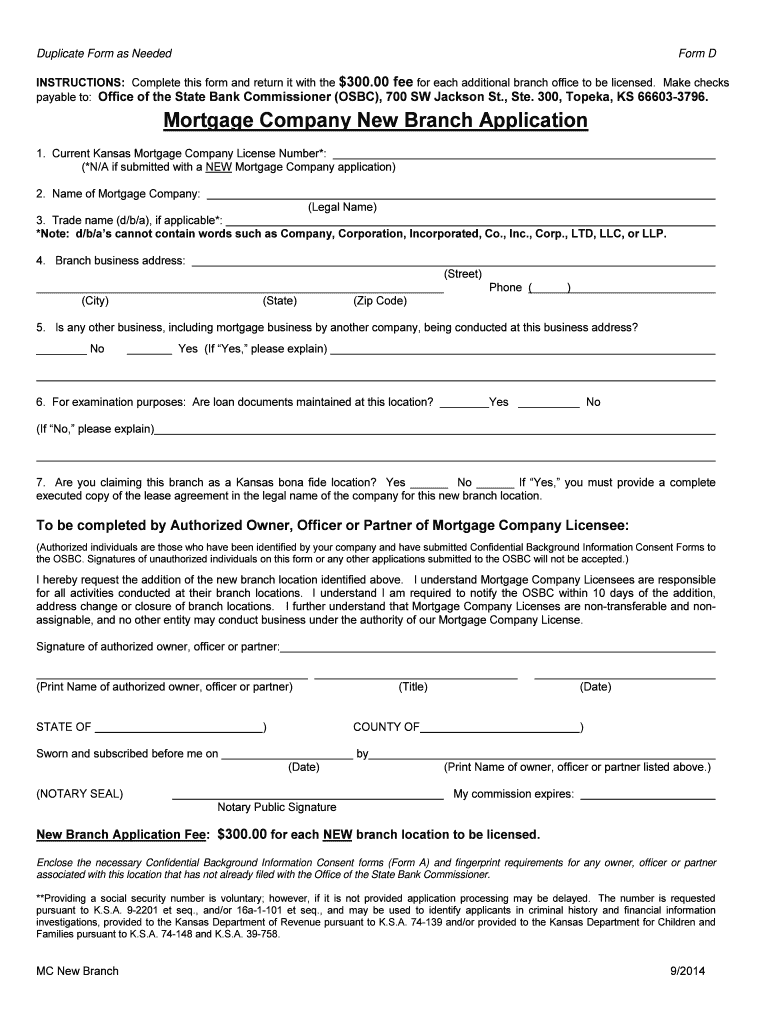

Duplicate Form as Needed Form D INSTRUCTIONS: Complete this form and return it with the $300.00 fee for each additional branch office to be licensed. Make checks payable to: Office of the State Bank

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign mortgage company new branch

Edit your mortgage company new branch form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your mortgage company new branch form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing mortgage company new branch online

To use the professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit mortgage company new branch. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out mortgage company new branch

How to fill out mortgage company new branch:

01

Research and analyze the market demand for a new branch in the targeted location. Consider factors such as population growth, housing market trends, and competition in the area.

02

Conduct a feasibility study to evaluate the cost, potential profitability, and risks associated with opening a new branch. This study should include analyzing the financial projections, market data, and regulatory requirements.

03

Develop a comprehensive business plan outlining the objectives, strategies, and operational details for the new branch. This plan should also include a budget, marketing strategy, and staffing requirements.

04

Secure the necessary funding to establish and operate the new branch. This may involve seeking investment from stakeholders, applying for business loans, or utilizing internal resources.

05

Identify a suitable location for the new branch. Consider factors such as accessibility, proximity to target customers, and compatibility with the company's branding.

06

Obtain all the necessary permits, licenses, and certifications required to legally operate a mortgage company in the chosen location. This may involve complying with state and federal regulations, obtaining a mortgage license, and ensuring the branch meets zoning requirements.

07

Recruit and train a competent team to staff the new branch. This may involve hiring loan officers, underwriters, processors, and support staff. Provide them with thorough training on company procedures, compliance requirements, and the products and services offered.

08

Set up an efficient and user-friendly technological infrastructure for the new branch. This includes implementing mortgage origination software, establishing secure communication systems, and ensuring data protection measures are in place.

09

Develop a marketing strategy to promote the new branch and attract potential customers. This may involve advertising through online platforms, partnering with local real estate agents, and organizing community events.

10

Continuously monitor the performance of the new branch and make necessary adjustments to ensure success. Stay informed about industry trends, customer feedback, and evolving regulatory requirements to stay competitive in the market.

Who needs mortgage company new branch:

01

Established mortgage companies looking to expand their reach and tap into new markets.

02

Financial institutions aiming to diversify their product offerings and provide mortgage services to their existing customer base.

03

Real estate agencies interested in offering holistic services to their clients by incorporating a mortgage company within their business model.

04

Entrepreneurs or investors seeking to enter the mortgage industry and establish their own mortgage company branch.

05

Individuals in regions with a growing demand for mortgages, where a new branch can fill a gap in the market and meet the needs of local borrowers.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find mortgage company new branch?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific mortgage company new branch and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

How do I complete mortgage company new branch online?

pdfFiller has made it easy to fill out and sign mortgage company new branch. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

How do I complete mortgage company new branch on an Android device?

Use the pdfFiller mobile app to complete your mortgage company new branch on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

What is mortgage company new branch?

A new branch of a mortgage company is a physical location where the company conducts business related to mortgage services.

Who is required to file mortgage company new branch?

Mortgage companies are required to file a new branch with the appropriate regulatory authorities.

How to fill out mortgage company new branch?

The form for filing a mortgage company new branch can typically be found on the regulatory authority's website, and must be completed with all relevant information about the new branch.

What is the purpose of mortgage company new branch?

The purpose of a mortgage company new branch is to expand the company's presence in a certain area, offer more convenient services to customers, and potentially increase market share.

What information must be reported on mortgage company new branch?

Information such as the address of the new branch, contact information, names of branch managers, and any other relevant details about the branch's operations must be reported.

Fill out your mortgage company new branch online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Mortgage Company New Branch is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.