Get the free Supervised Lender New Branch Application - osbckansas

Show details

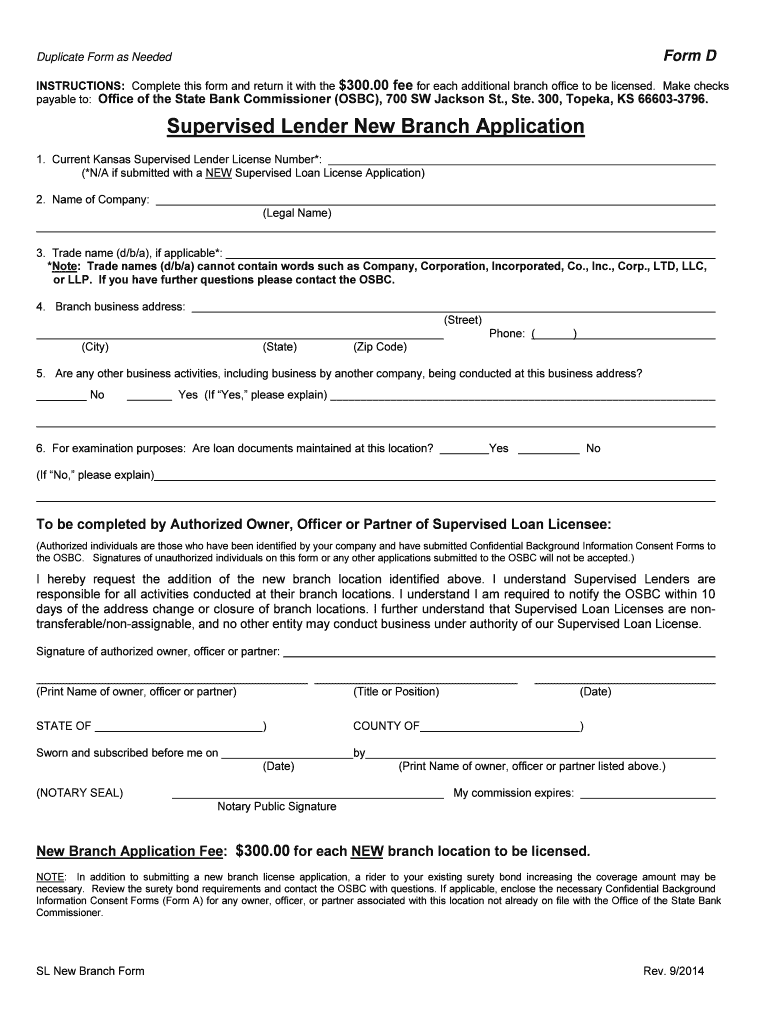

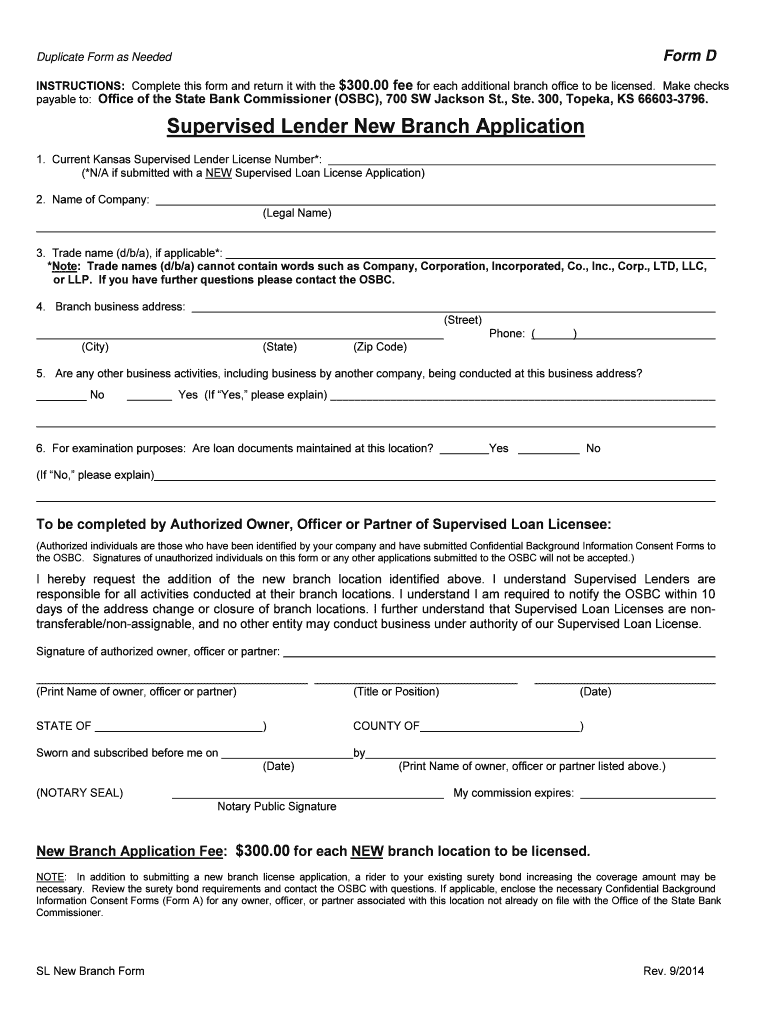

Form D Duplicate Form as Needed INSTRUCTIONS: Complete this form and return it with the $300.00 fee for each additional branch office to be licensed. Make checks payable to: Office of the State Bank

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign supervised lender new branch

Edit your supervised lender new branch form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your supervised lender new branch form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit supervised lender new branch online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit supervised lender new branch. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out supervised lender new branch

How to fill out a supervised lender new branch:

01

Determine eligibility: Before starting the process, ensure that you meet the necessary eligibility requirements to establish a supervised lender new branch. This may involve having a valid license, adequate financial resources, and meeting any specific criteria set by the regulatory authorities.

02

Gather required documentation: Compile all the necessary documents that need to be submitted along with the application. This typically includes completed application forms, business plans, financial statements, proof of insurance, organizational documents, and any additional information requested by the regulatory authorities.

03

Fill out the application forms: Carefully complete all the required application forms, providing accurate and detailed information about the new branch. Double-check the forms for any errors or missing information before submitting them.

04

Submit the application: Once you have filled out all the necessary forms and gathered the required documentation, submit the completed application to the relevant regulatory authorities. Be sure to follow any specific submission instructions provided, such as submitting electronically or by mail.

05

Pay the applicable fees: Along with the application, there may be certain fees that need to be paid. Ensure that you include the required payment in the correct format, such as a check or online payment, and follow any instructions regarding fee submission provided by the regulatory authorities.

06

Await review and approval: After submitting the application, it will undergo a review process by the regulatory authorities. This process may involve conducting background checks, evaluating the business plan, verifying financial stability, and assessing compliance with relevant laws and regulations. The length of the review period can vary, so be patient during this time.

07

Comply with any additional requirements: If there are any additional requirements or requests for information from the regulatory authorities during the review process, promptly respond and provide the necessary documents or clarifications. Compliance with these requests will help expedite the approval process.

08

Communicate with the regulatory authorities: Throughout the process, maintain open communication with the regulatory authorities. Stay updated on the progress of your application, inquire about any required follow-ups or next steps, and address any concerns or questions they may have.

Who needs a supervised lender new branch?

Supervised lender new branches are typically needed by financial institutions or entities that want to expand their lending operations geographically. This could include banks, credit unions, mortgage lenders, non-bank lenders, and other financial service providers. Establishing a new branch allows these entities to better serve their customers, reach new markets, and enhance their lending capabilities. However, the specific need for a supervised lender new branch will depend on the business strategy, goals, and growth plans of each individual financial institution or entity.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my supervised lender new branch in Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your supervised lender new branch as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

How do I make changes in supervised lender new branch?

With pdfFiller, it's easy to make changes. Open your supervised lender new branch in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

Can I edit supervised lender new branch on an iOS device?

Use the pdfFiller mobile app to create, edit, and share supervised lender new branch from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

What is supervised lender new branch?

Supervised lender new branch refers to a new physical location or office of a supervised lender that is established to provide services to customers.

Who is required to file supervised lender new branch?

Supervised lenders are required to file a supervised lender new branch if they open a new branch location for their lending operations.

How to fill out supervised lender new branch?

To fill out supervised lender new branch, supervised lenders need to provide detailed information about the new branch location, services offered, and any changes to their operations.

What is the purpose of supervised lender new branch?

The purpose of supervised lender new branch is to inform regulatory authorities about the expansion of a supervised lender's operations and ensure compliance with lending regulations.

What information must be reported on supervised lender new branch?

The information reported on supervised lender new branch includes the new branch location, services offered, changes to operations, and compliance with regulatory requirements.

Fill out your supervised lender new branch online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Supervised Lender New Branch is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.