Get the free Bank Secrecy Act An Auditors Perspective

Show details

Sunflower Webinar Series Bank Secrecy Act: An Auditors Perspective January 26, 2016 2:304:30 p.m. CT With all the recent regulatory changes focusing on lending and deposit compliance issues, it's

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign bank secrecy act an

Edit your bank secrecy act an form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your bank secrecy act an form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing bank secrecy act an online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit bank secrecy act an. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out bank secrecy act an

How to fill out Bank Secrecy Act (BSA) form:

01

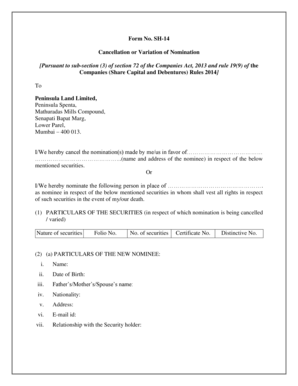

Ensure you have the correct form: The first step is to obtain the appropriate Bank Secrecy Act form from your financial institution or online. Different institutions may have different versions of the form, so make sure you have the correct one.

02

Provide accurate personal information: Start by entering your full name, address, and social security number (or taxpayer identification number) in the designated sections of the form. Ensure the information provided is accurate and up to date.

03

Enter the transaction details: The BSA form typically requires detailed information regarding transactions that exceed a certain predetermined threshold. Provide the required details for each specific transaction, such as the date, amount, type of transaction, and parties involved.

04

Describe the nature of the transaction: In this section, you will be asked to describe the nature of the transaction. Provide a clear and concise description that accurately reflects the purpose or reason behind the transaction. This information helps financial institutions assess any potential risks associated with the transaction.

05

Indicate the source of funds: One crucial aspect of the BSA form is identifying the source of funds involved in the transaction. Specify where the funds originated from, whether from personal savings, employment income, investments, loans, or any other source.

06

Sign and date the form: Once you have completed filling out the Bank Secrecy Act form, carefully read through it to ensure all the information provided is accurate and complete. Sign and date the form at the designated section, indicating that the information provided is true to the best of your knowledge.

Who needs Bank Secrecy Act (BSA) form?

01

Financial institutions: Banks, credit unions, money service businesses, casinos, and other financial institutions are required by law to implement and adhere to the Bank Secrecy Act (BSA). They are responsible for collecting and filing BSA forms from their customers.

02

Account holders engaging in certain transactions: Individuals or businesses involved in transactions that exceed certain thresholds set by the Financial Crimes Enforcement Network (FinCEN) may be required to complete a Bank Secrecy Act form. This includes cash transactions, wire transfers, and other activities that may be considered suspicious or potentially linked to money laundering or other illegal activities.

03

Compliance officers and personnel: Staff members within financial institutions who are responsible for compliance, risk management, or anti-money laundering efforts need to be familiar with the Bank Secrecy Act and its reporting requirements. They play a crucial role in ensuring compliance and preventing financial crimes.

Note: The Bank Secrecy Act (BSA) is a United States federal law, so its applicability may vary in different countries. It is essential to consult with local regulatory bodies or legal experts to determine the specific requirements in your jurisdiction.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is bank secrecy act an?

The Bank Secrecy Act (BSA) is a law that requires financial institutions to assist the U.S. government in detecting and preventing money laundering.

Who is required to file bank secrecy act an?

Financial institutions such as banks, credit unions, and money service businesses are required to file Bank Secrecy Act reports.

How to fill out bank secrecy act an?

Financial institutions must fill out Bank Secrecy Act reports electronically through the Financial Crimes Enforcement Network (FinCEN) website.

What is the purpose of bank secrecy act an?

The purpose of the Bank Secrecy Act is to safeguard the U.S. financial system from illicit activities such as money laundering and terrorist financing.

What information must be reported on bank secrecy act an?

Bank Secrecy Act reports must include information about suspicious transactions, large cash deposits or withdrawals, and transactions involving foreign entities.

How can I edit bank secrecy act an from Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including bank secrecy act an, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

How do I execute bank secrecy act an online?

pdfFiller makes it easy to finish and sign bank secrecy act an online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

Can I create an electronic signature for signing my bank secrecy act an in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your bank secrecy act an and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

Fill out your bank secrecy act an online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Bank Secrecy Act An is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.