Get the free Working After Retirement - KPERS - kpers

Show details

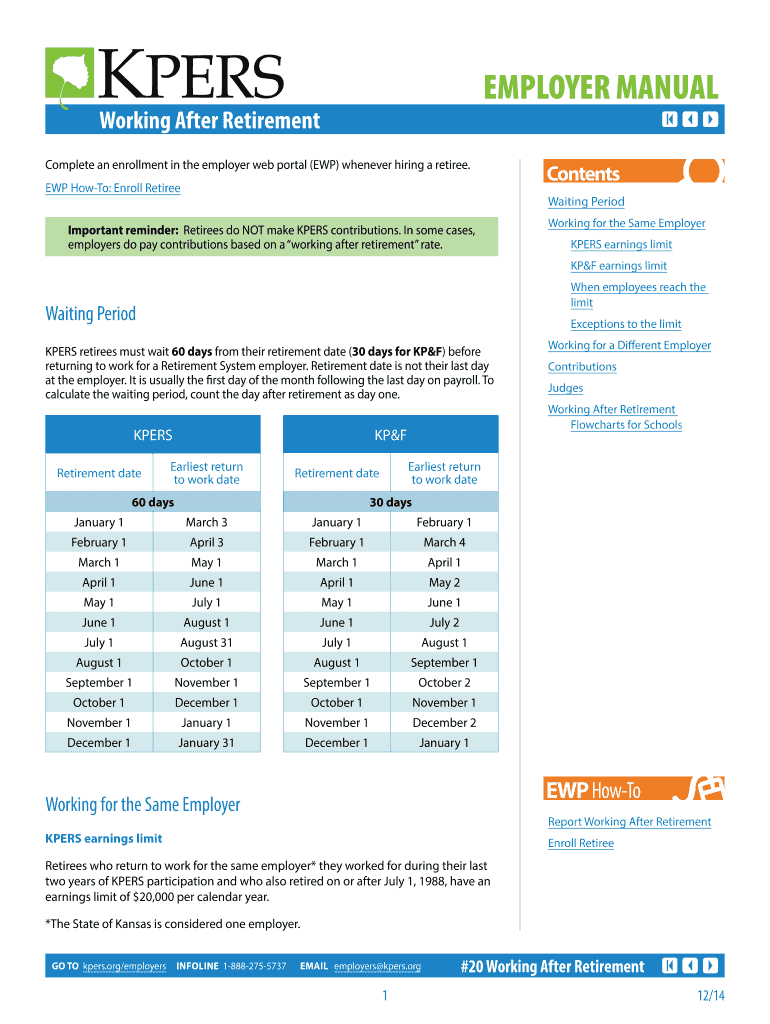

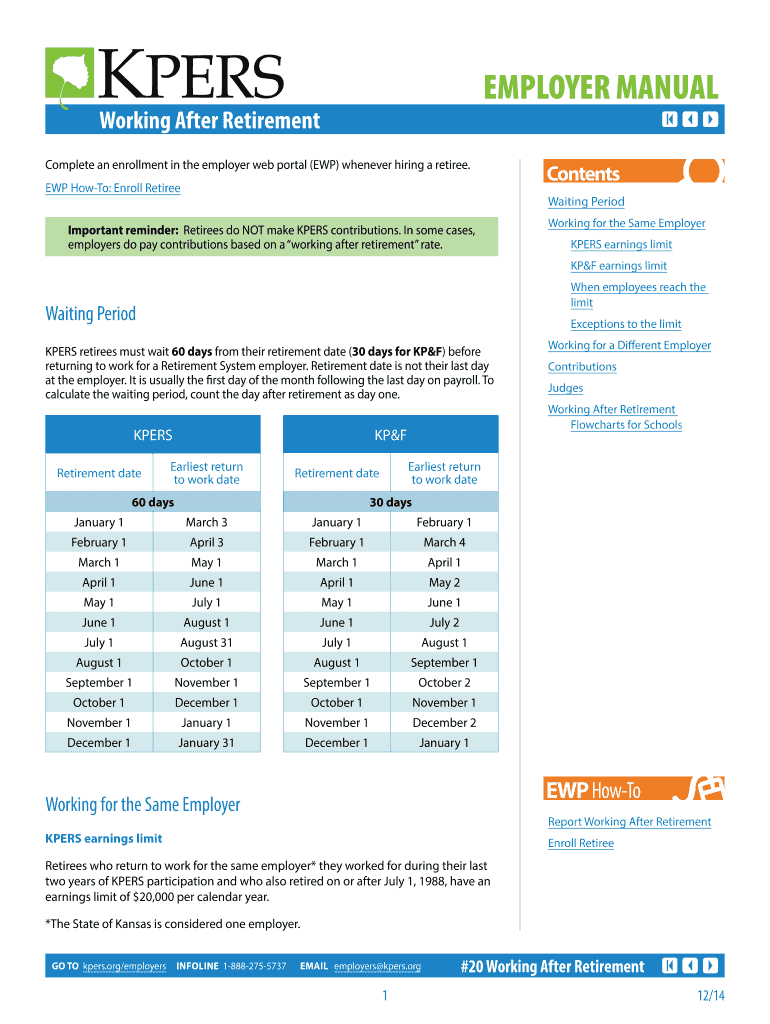

EMPLOYER MANUAL Working After Retirement Complete an enrollment in the employer web portal (EWP) whenever hiring a retiree. EWP How-to: Enroll Retiree Contents Waiting Period Important reminder: Retirees

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign working after retirement

Edit your working after retirement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your working after retirement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing working after retirement online

Follow the guidelines below to use a professional PDF editor:

1

Log in to your account. Click Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit working after retirement. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out working after retirement

How to fill out working after retirement:

01

Evaluate your financial situation: Before deciding to work after retirement, assess your current financial status and determine if you have enough savings and investments to support yourself. Consider factors such as ongoing expenses, healthcare costs, and any outstanding debts.

02

Determine your desired work schedule: Decide how many hours you are willing to commit to work after retirement. Determine if you want to work full-time, part-time, or opt for more flexible arrangements like freelance work or consulting gigs.

03

Explore different job opportunities: Research various job options that align with your skills, interests, and experience. Consider seeking employment in industries or fields that you are passionate about or explore new avenues that you have always wanted to pursue.

04

Update your resume and skills: Revise your resume to highlight your relevant experience and emphasize your transferable skills. Consider taking up additional courses or certifications to enhance your skills and improve your employability in the job market.

05

Network and connect with others: Reach out to your professional network, attend industry events, and utilize online platforms to connect with potential employers or colleagues in your desired field. Networking can often open doors to new opportunities and help you find fulfilling work after retirement.

06

Prepare for interviews: Brush up on your interview skills and prepare for potential job interviews. Practice common interview questions, research the company, and demonstrate enthusiasm for the role. Highlight the benefits of hiring someone with your experience, such as your reliability, strong work ethic, and extensive knowledge.

07

Assess the impact on your retirement benefits: Understand the implications that working after retirement may have on your pension, social security, healthcare benefits, or other retirement benefits you are entitled to. Consult with a financial advisor or the relevant institutions to gain clarity on any potential adjustments or changes.

Who needs working after retirement:

01

Individuals seeking financial stability: Some retirees may choose to work after retirement to supplement their retirement income. This can be particularly beneficial for those who faced unexpected financial challenges or who did not save enough for retirement.

02

Individuals desiring mental stimulation: Many retirees find themselves missing the mental engagement and stimulation that work provides. Working after retirement can help individuals stay mentally active, maintain a sense of purpose, and continue lifelong learning.

03

Individuals seeking social connections: Working after retirement can provide an opportunity to connect with new people, build relationships, and establish new social networks. This can be especially important for retirees who may feel isolated or miss the social interactions they had in their previous careers.

04

Individuals looking to pursue new passions: Some retirees choose to work after retirement as a way to pursue their passions or explore new hobbies. This allows them to engage in meaningful work that aligns with their interests and brings them joy in their post-retirement years.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete working after retirement online?

Easy online working after retirement completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

Can I sign the working after retirement electronically in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your working after retirement in minutes.

How do I edit working after retirement straight from my smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing working after retirement, you need to install and log in to the app.

What is working after retirement?

Working after retirement refers to when an individual continues to work and earn income after reaching the retirement age.

Who is required to file working after retirement?

Individuals who are receiving retirement benefits and continue to work must report their post-retirement earnings.

How to fill out working after retirement?

To fill out working after retirement, individuals must report their earnings from employment on the appropriate forms provided by the retirement benefits administrator.

What is the purpose of working after retirement?

The purpose of working after retirement is to allow individuals to continue earning income while also receiving retirement benefits.

What information must be reported on working after retirement?

Information that must be reported on working after retirement includes the amount of income earned, the source of the income, and any changes to employment status.

Fill out your working after retirement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Working After Retirement is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.