Get the free APPLICATION FOR ASSET RETIREMENT (FORM AM0001) - controller osu

Show details

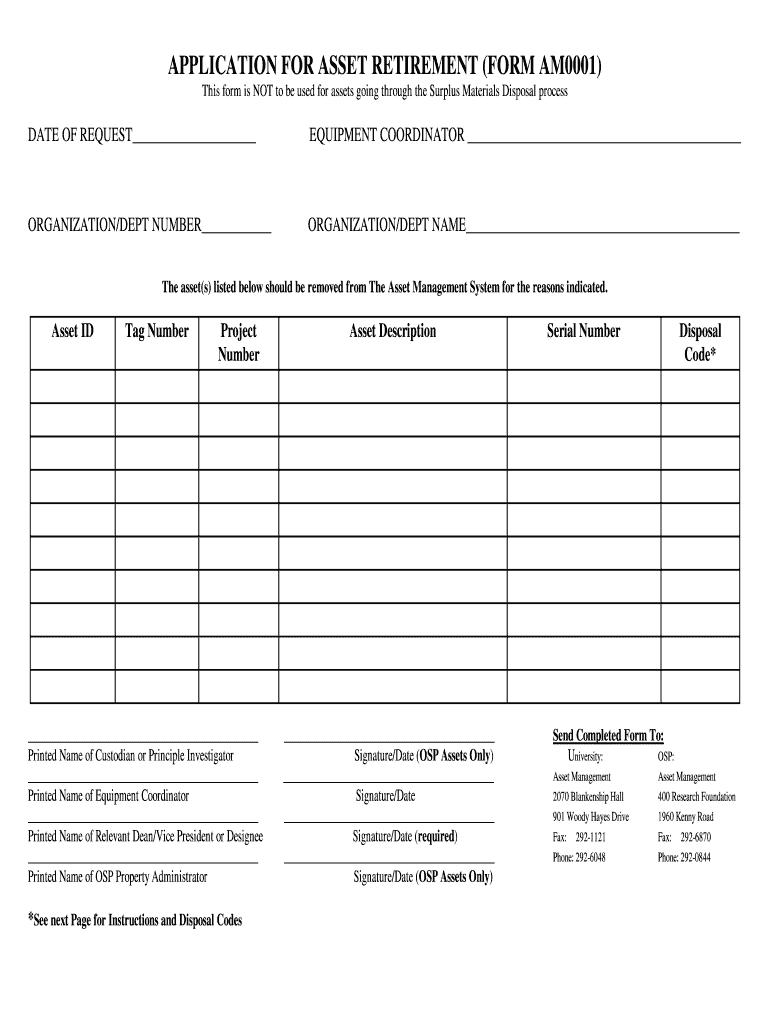

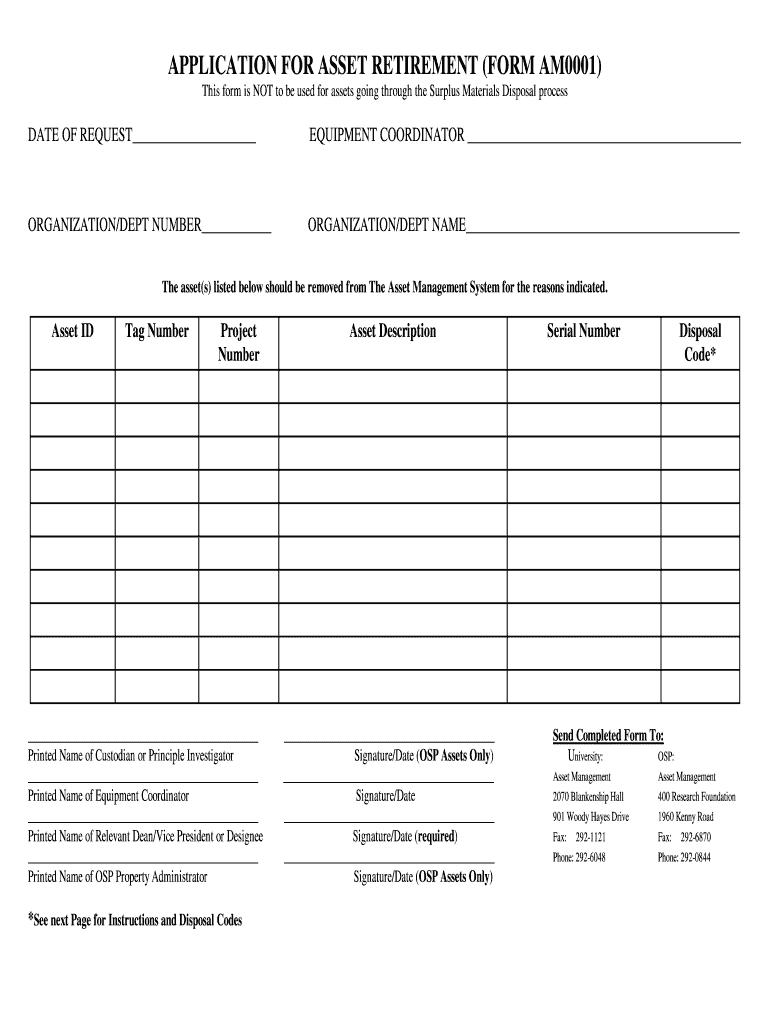

This form is used to request the removal of assets from The Asset Management System and is not for assets going through the Surplus Materials Disposal process.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign application for asset retirement

Edit your application for asset retirement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your application for asset retirement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit application for asset retirement online

To use the services of a skilled PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit application for asset retirement. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out application for asset retirement

How to fill out APPLICATION FOR ASSET RETIREMENT (FORM AM0001)

01

Begin by downloading or obtaining a copy of the APPLICATION FOR ASSET RETIREMENT (FORM AM0001).

02

Provide your personal information in the designated fields, including your name, address, and contact details.

03

Fill in the details of the asset you wish to retire, including the asset ID, description, and location.

04

Specify the reason for retirement of the asset in the provided section.

05

Attach any required supporting documentation, such as maintenance records or disposal plans.

06

Review the application for accuracy and completeness.

07

Sign and date the application form in the designated area.

08

Submit the completed form to the relevant department or authority as instructed.

Who needs APPLICATION FOR ASSET RETIREMENT (FORM AM0001)?

01

Organizations or individuals who are looking to officially retire or dispose of physical assets.

02

Companies that need to document the retirement of assets for accounting or regulatory compliance.

03

Municipalities or government agencies managing public assets that require formal retirement documentation.

Fill

form

: Try Risk Free

People Also Ask about

What is the difference between a stock transfer and an asset transfer?

An asset sale occurs when a business sells all or a portion of its assets. The seller, or target company, in this type of deal, is still legally the owner of the company, but no longer owns the assets sold. In a stock sale, the buyer acquires equity from the target company's shareholders.

How to book an asset retirement obligation?

Accounting for Asset Retirement Obligations Step 1) Record Initial Liability at Present Value. Step 2) Record accretion expense and increase ARO liability. Step 3) Record depreciation expense and accumulated ARC. Step 4) Record entry when asset is retired or decommissioned.

What are the requirements for asset retirement obligation?

An ARO should be recognized when the following criteria are met: a) there is a legal obligation to incur retirement costs in relation to a tangible capital asset; b) the past transaction or event giving rise to the liability has occurred (acquisition, construction, development or normal use of a TCA); c) it is expected

What are the reasons for asset transfer?

Asset transfers can occur for a variety of reasons, such as in the case of an inheritance, a gift, a business acquisition, or a divorce settlement. Additionally, companies may transfer assets as part of a restructuring or to merge with another company.

What is an example of an asset retirement obligation?

Consider an oil-drilling company that acquires a 40-year lease on a parcel of land. Five years into the lease, the company finishes constructing a drilling rig. This item must be removed, and the land must be cleaned up once the lease expires in 35 years.

What is a transfer of assets form?

What Is a Transfer of Assets Form? An asset transfer form enables you to rollover funds from one retirement account type to another. Depending on your investment goals, you can move all or part of your funds. Accurately completing the transfer request form allows you to maintain your assets' tax advantages.

What is an asset transfer?

A transfer of assets is when property, money, or ownership rights are moved from one account to another. When there is a change in ownership, such as when an investor sells real estate holdings, a transfer may call for an exchange of money.

What is an asset transfer form?

An asset transfer form enables you to rollover funds from one retirement account type to another. Depending on your investment goals, you can move all or part of your funds. Accurately completing the transfer request form allows you to maintain your assets' tax advantages.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is APPLICATION FOR ASSET RETIREMENT (FORM AM0001)?

APPLICATION FOR ASSET RETIREMENT (FORM AM0001) is a form used to formally request the retirement of an asset, typically by an organization or individual that wishes to remove the asset from their financial records.

Who is required to file APPLICATION FOR ASSET RETIREMENT (FORM AM0001)?

Organizations or individuals who own assets that they intend to retire or dispose of are required to file APPLICATION FOR ASSET RETIREMENT (FORM AM0001). This may include businesses, non-profits, or governmental entities.

How to fill out APPLICATION FOR ASSET RETIREMENT (FORM AM0001)?

To fill out APPLICATION FOR ASSET RETIREMENT (FORM AM0001), the filer must provide identifying information about the asset, reason for retirement, date of retirement, and any necessary supporting documentation as per the guidelines provided with the form.

What is the purpose of APPLICATION FOR ASSET RETIREMENT (FORM AM0001)?

The purpose of APPLICATION FOR ASSET RETIREMENT (FORM AM0001) is to officially document the retirement of an asset, ensuring compliance with accounting standards and regulatory requirements while providing a clear record for financial reporting.

What information must be reported on APPLICATION FOR ASSET RETIREMENT (FORM AM0001)?

The information that must be reported on APPLICATION FOR ASSET RETIREMENT (FORM AM0001) includes the asset identification number, description of the asset, reason for retirement, date of retirement, and any necessary attachments that validate the retirement request.

Fill out your application for asset retirement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Application For Asset Retirement is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.