Get the free Business Meal Transaction Form

Show details

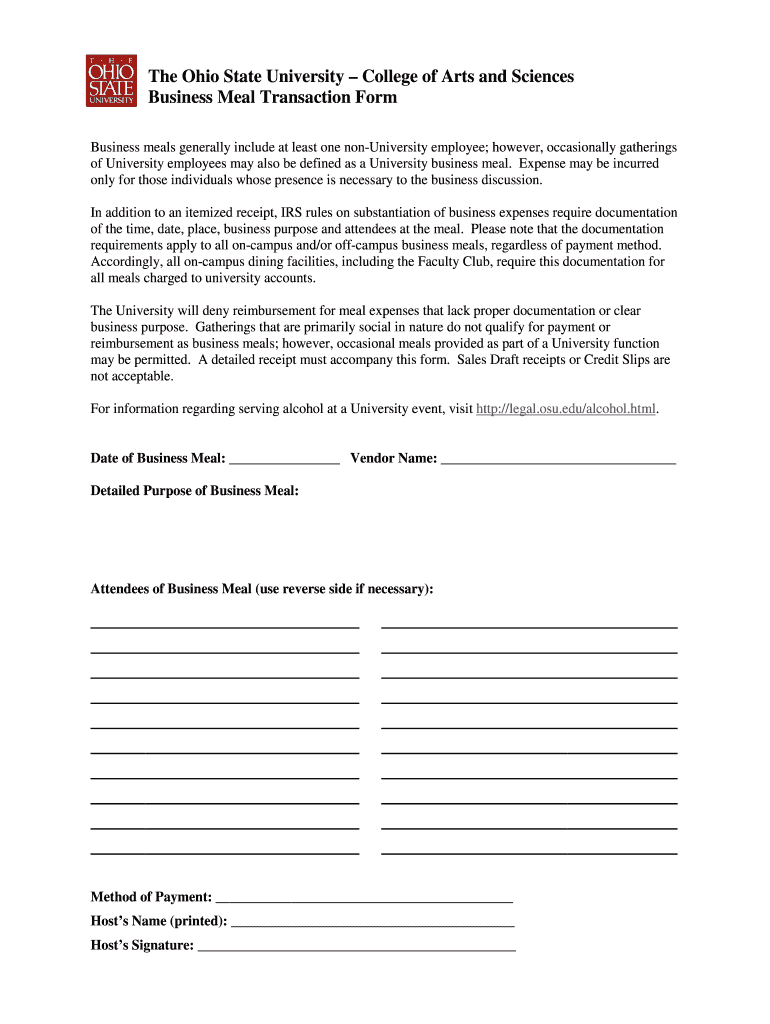

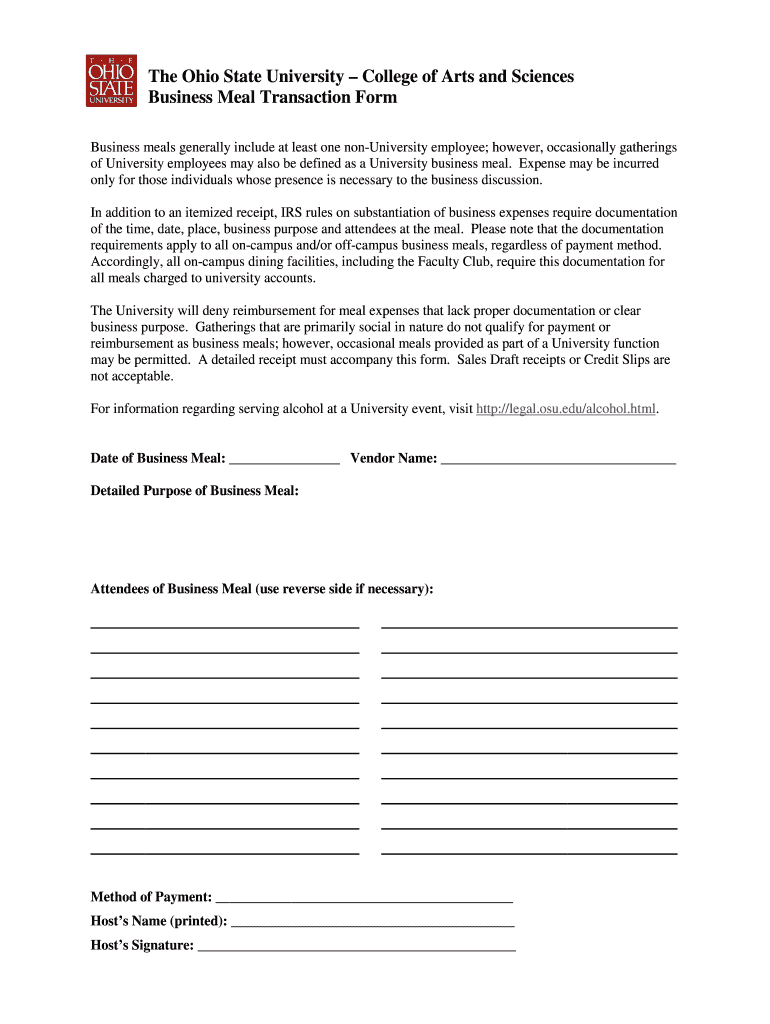

This form is used to document business meals for reimbursement at The Ohio State University, outlining necessary details such as attendees, purpose, and payment method.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign business meal transaction form

Edit your business meal transaction form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your business meal transaction form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit business meal transaction form online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit business meal transaction form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out business meal transaction form

How to fill out Business Meal Transaction Form

01

Obtain the Business Meal Transaction Form from your company's intranet or finance department.

02

Fill in the date of the meal.

03

Enter the names of all attendees, including their job titles and relationships to the company.

04

Specify the purpose of the meal, detailing how it relates to business.

05

Fill in the restaurant name, location, and the total cost of the meal.

06

Attach the receipt and any other required documentation.

07

Sign and date the form to certify its accuracy.

08

Submit the form to your manager or the appropriate department for approval.

Who needs Business Meal Transaction Form?

01

Employees who incur meal expenses while conducting business purposes.

02

Managers or team leaders who are hosting meals for clients or partners.

03

Finance departments for record-keeping and reimbursement purposes.

Fill

form

: Try Risk Free

People Also Ask about

What does the IRS require for meal receipts?

An itemized meal receipt should have the name of the establishment, the date of service, the items purchased, the amount paid for each item, and the tax. If the tip is not included in the total it should be written on the receipt.

What meal expenses are 100% deductible?

Key Takeaways. 100% Deductible Expenses: Includes holiday parties, open house meals, and certain business-critical meals. 50% Deductible Expenses: Includes client meals, business travel meals, and food for in-office meetings. Non-Deductible Expenses: Includes entertainment (e.g., sporting events) and club memberships.

How much does the IRS allow for food expenses?

More In File ExpenseOne PersonTwo Persons Food $458 $820 Housekeeping supplies $44 $75 Apparel & services $87 $157 Personal care products & services $48 $802 more rows • Aug 22, 2024

How do I deduct meals for my business?

Business Meals: You can deduct 50% of the cost of meals directly related to your business activities. This includes meals with clients, prospects, or business partners, as long as the meal is necessary for business purposes.

Can I write off meals as a business expense?

You can deduct a meal expense if: The expense is ordinary and necessary. (An expense is ordinary if it's normal or common within your fiend or business community. And an expense is necessary if it's helpful to your business.)

How do you prove a meal was a business expense?

Proof of meal expense This can be done through a receipt that includes the restaurant's name, an itemized list of food and drinks, and the number of people present at the table. Additionally, employees should note the name of the person they were with and the business purpose of the meal on the receipt.

What does the IRS require for meal receipts?

An itemized meal receipt should have the name of the establishment, the date of service, the items purchased, the amount paid for each item, and the tax. If the tip is not included in the total it should be written on the receipt.

How much does the IRS allow for business meals?

This includes the enhanced business meal deduction. For 2021 and 2022 only, businesses can generally deduct the full cost of business-related food and beverages purchased from a restaurant. Otherwise, the limit is usually 50% of the cost of the meal.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Business Meal Transaction Form?

The Business Meal Transaction Form is a document used to record and report meals and entertainment expenses incurred for business purposes, detailing the nature of the meal and the parties involved.

Who is required to file Business Meal Transaction Form?

Employees, contractors, and businesses who incur meal and entertainment expenses while conducting business activities are typically required to file the Business Meal Transaction Form.

How to fill out Business Meal Transaction Form?

To fill out the Business Meal Transaction Form, one must gather information about the meal, including the date, location, names of attendees, purpose of the meal, and total expenses incurred, then accurately complete the form with this information.

What is the purpose of Business Meal Transaction Form?

The purpose of the Business Meal Transaction Form is to ensure proper documentation and reporting of business-related meal expenses for financial records, tax deductions, and compliance with company policies.

What information must be reported on Business Meal Transaction Form?

The Business Meal Transaction Form must report information such as the date of the meal, names of the participants, the business purpose of the meeting, location, total cost, and any additional details required by the company.

Fill out your business meal transaction form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Business Meal Transaction Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.