Get the free Taxing Commercial Sponsorships of College Athletics: A Balanced Proposal - moritzlaw...

Show details

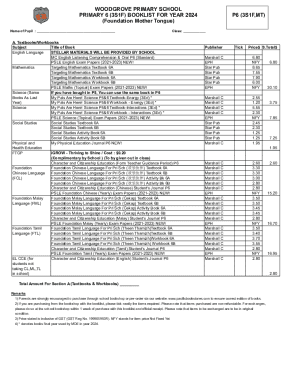

This document discusses the tax implications of commercial sponsorships in college athletics and proposes a balanced approach for taxing sponsorship payments based on the value of advertising benefits

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign taxing commercial sponsorships of

Edit your taxing commercial sponsorships of form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your taxing commercial sponsorships of form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing taxing commercial sponsorships of online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit taxing commercial sponsorships of. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out taxing commercial sponsorships of

How to fill out Taxing Commercial Sponsorships of College Athletics: A Balanced Proposal

01

Begin by reviewing the current regulations regarding commercial sponsorships in college athletics.

02

Identify and outline the benefits of commercial sponsorships for both colleges and sponsors.

03

Create a balanced framework that addresses potential tax implications for these sponsorships.

04

Develop criteria to determine how sponsorship funds should be allocated within athletic departments.

05

Suggest mechanisms for transparency and accountability in financial reporting related to sponsorship income.

06

Evaluate potential impacts on student-athlete programs and community engagement initiatives.

07

Draft the proposal, ensuring clarity and justification for each point.

08

Include suggestions for soliciting feedback from stakeholders, including colleges, sponsors, and students.

09

Revise the proposal based on feedback, focusing on achieving a fair balance between taxation and economic support.

Who needs Taxing Commercial Sponsorships of College Athletics: A Balanced Proposal?

01

College athletic programs seeking to understand the implications of commercial sponsorship taxation.

02

Universities aiming to comply with financial regulations while maximizing funding opportunities.

03

Policy makers interested in creating equitable taxation systems for college athletics.

04

Sponsors looking for clarity on potential tax liabilities associated with their commercial partnerships.

05

Advocates for student-athlete rights who want to ensure financial accountability in sports funding.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Taxing Commercial Sponsorships of College Athletics: A Balanced Proposal?

It is a legislative proposal aimed at establishing a tax framework for commercial sponsorships associated with college athletics, seeking to balance revenue generation for colleges while promoting fairness and transparency in the sponsorship agreements.

Who is required to file Taxing Commercial Sponsorships of College Athletics: A Balanced Proposal?

Colleges and universities that engage in commercial sponsorship agreements related to their athletic programs are required to file under this proposal.

How to fill out Taxing Commercial Sponsorships of College Athletics: A Balanced Proposal?

Filing involves completing specific tax forms provided by the relevant tax authority, detailing the sponsorship agreements, revenue generated, and other required financial information as stipulated in the proposal.

What is the purpose of Taxing Commercial Sponsorships of College Athletics: A Balanced Proposal?

The purpose is to ensure that college athletics sponsorships are subjected to a fair tax system, which can provide funds for educational initiatives while ensuring that sponsorship revenues support the broader mission of colleges and universities.

What information must be reported on Taxing Commercial Sponsorships of College Athletics: A Balanced Proposal?

Reportable information includes details about the sponsorship agreements, the amount of revenue generated, the entities involved, and how the funds are allocated within the athletic and academic programs.

Fill out your taxing commercial sponsorships of online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Taxing Commercial Sponsorships Of is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.