Get the free Administrative Adjustment Request - washco-md

Show details

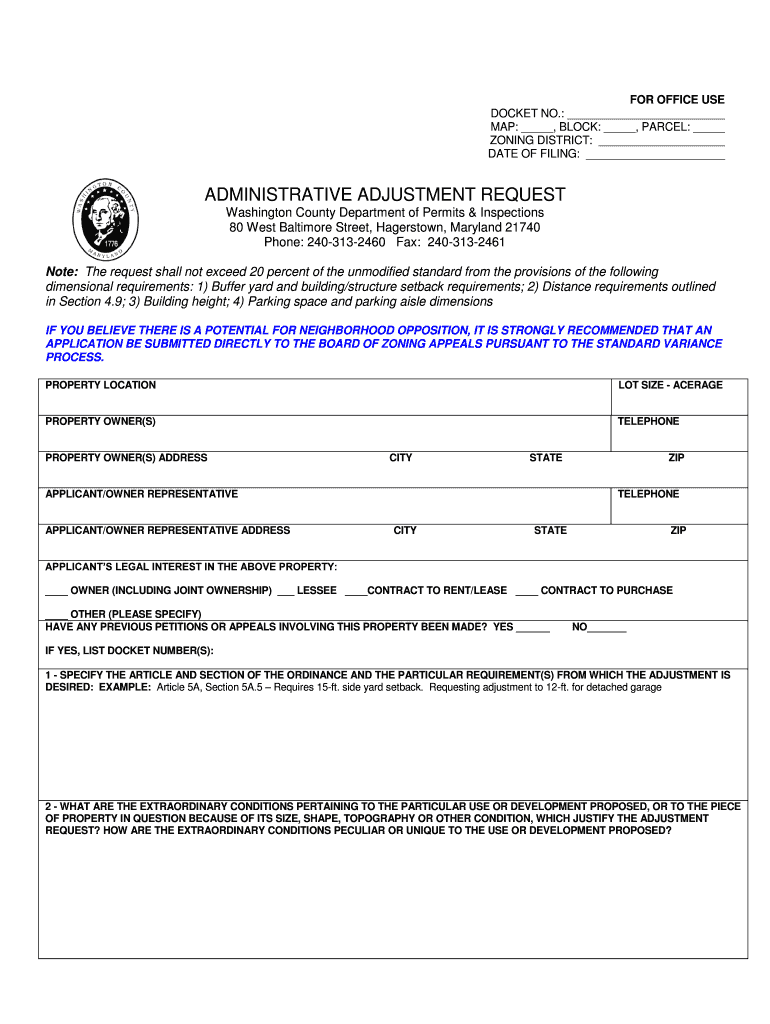

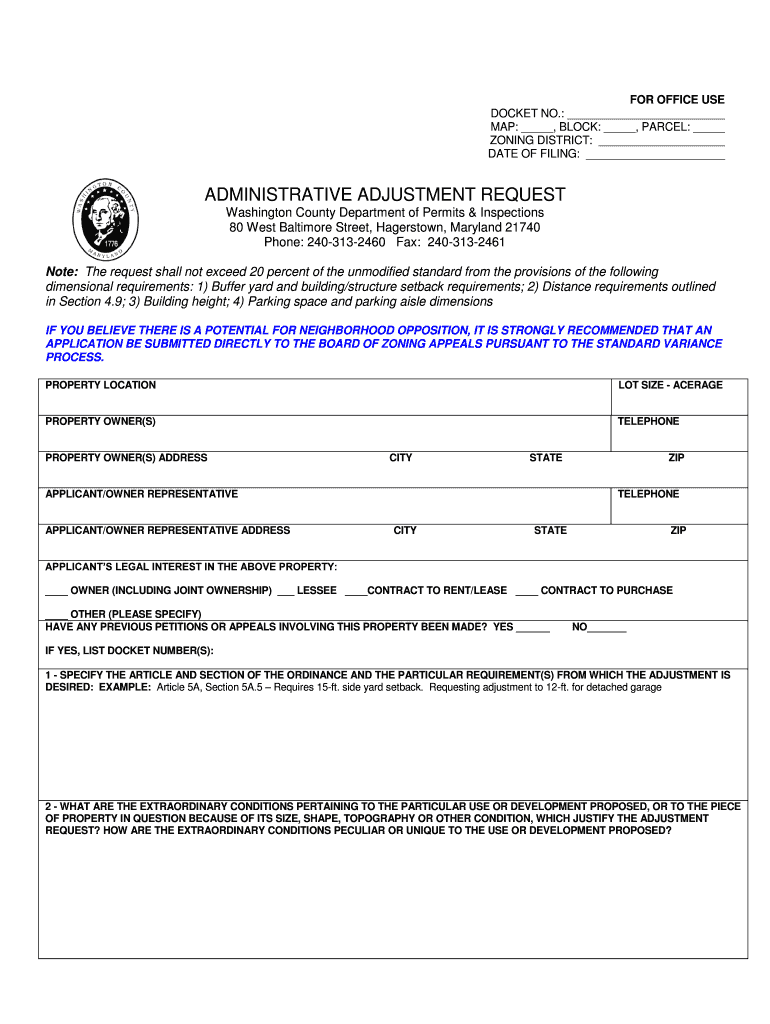

This document is used to request an administrative adjustment for property-related requirements in Washington County. It outlines necessary information such as property details, owner's information,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign administrative adjustment request

Edit your administrative adjustment request form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your administrative adjustment request form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing administrative adjustment request online

To use the services of a skilled PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit administrative adjustment request. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out administrative adjustment request

How to fill out Administrative Adjustment Request

01

Gather all necessary documentation related to the adjustment request.

02

Obtain a copy of the Administrative Adjustment Request form.

03

Fill out the personal information section, including your name, address, and contact information.

04

Provide specific details about the adjustment being requested.

05

Attach any supporting documents that are required or relevant to your request.

06

Review the completed form for accuracy and completeness.

07

Submit the form along with any attachments to the appropriate administrative office.

Who needs Administrative Adjustment Request?

01

Individuals or organizations seeking to amend or correct prior administrative decisions.

02

Persons affected by administrative decisions that impact their rights or responsibilities.

03

Businesses needing adjustments to permits, licenses, or approvals granted by governmental authorities.

Fill

form

: Try Risk Free

People Also Ask about

How does a partnership make a push-out election?

Push out process. The partnership representative may submit an election to push out the audit adjustments underlying the IU amount to its partners rather than make a payment. A push-out election may only be made if there is an IU on the FPA. The election can only be made after the FPA has been issued.

Who must file form 8082?

Partners, S corporation shareholders, beneficiaries of an estate or trust, owners of a foreign trust, or residual interest holders in a real estate mortgage investment conduit (REMIC) file this form if they wish to report items differently than the way they were reported to them on Schedule K-1, Schedule Q, or a

What is an administrative adjustment request?

An Administrative Adjustment Request (AAR) is an amended return with Form 1065X (Amended Return or Administrative Adjustment Request (AAR)) or Form 8082 (Notice of Inconsistent Treatment or Administrative Adjustment Request (AAR)) as a cover sheet. The Form 8082 is a dual purpose form.

How does the AAR work?

An AAR is a professional discussion of an event. The objective is to identify successes and failures. It is a tool that leaders, teams, crews, and units can use to get maximum learning benefit from every incident or project.

What is the difference between an AAR and an amended return?

What makes an AAR different from an amended return? In an AAR, the default treatment of a change is assessment of tax on the partnership itself. This tax is assessed at the highest individual or corporate rate, and it can apply to any item changed on the return, including non-income items.

What is the difference between an AAR and an amended return?

What makes an AAR different from an amended return? In an AAR, the default treatment of a change is assessment of tax on the partnership itself. This tax is assessed at the highest individual or corporate rate, and it can apply to any item changed on the return, including non-income items.

How does AAR work?

If a BBA partnership files an AAR and it needs to make its partners aware of their allocable share of adjustments, it will furnish to each partner of the partnership for the reviewed year a Form 8986 reflecting the partner's share of the adjustments (and should not provide amended Schedules K-1 or K-3).

What does a partner do with form 8986?

Form 8986 is used by the audited partnership to push out imputed underpayments to its partners. Form 8986 can also be used to track the flow-through of changes due to an administrative adjustment request (AAR) filed by the partnership.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Administrative Adjustment Request?

An Administrative Adjustment Request is a formal request made to correct or modify the details of a previously submitted application or document, typically in the context of regulatory or administrative procedures.

Who is required to file Administrative Adjustment Request?

Individuals or entities that have submitted an application or document that requires correction or modification are required to file an Administrative Adjustment Request.

How to fill out Administrative Adjustment Request?

To fill out an Administrative Adjustment Request, complete the required form with accurate information, including details about the original submission, the requested changes, and any supporting documentation.

What is the purpose of Administrative Adjustment Request?

The purpose of an Administrative Adjustment Request is to rectify errors or make necessary changes to a previously filed application or document to ensure compliance with regulations or to correct inaccuracies.

What information must be reported on Administrative Adjustment Request?

The information that must be reported includes the original case or application number, details of the discrepancies or issues, the desired changes, and any supporting evidence that justifies the adjustment.

Fill out your administrative adjustment request online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Administrative Adjustment Request is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.