Get the free R C H I T ECT U R A E I U O Y D - Montana Historical Society - mhs mt

Show details

E: AR R C I TEC TU H D A YO U ITS LL AROUND User Guide Provided by The Montana Historical Society Education Office In cooperation with The Montana Preservation Alliance (406) 4444789 www.montanahistoricalsociety.org

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign r c h i

Edit your r c h i form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your r c h i form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing r c h i online

Follow the guidelines below to benefit from a competent PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit r c h i. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out r c h i

How to fill out r c h i:

01

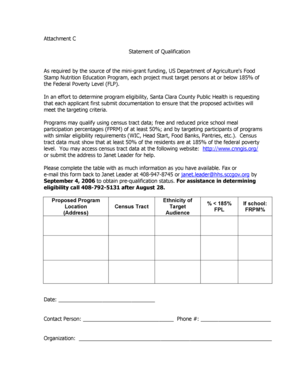

The first step in filling out r c h i is to gather all the necessary information. This may include personal details, such as name, address, and contact information, as well as any relevant identification numbers or codes.

02

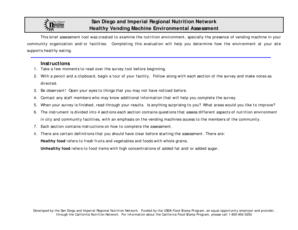

Once you have gathered all the required information, you can proceed to the next step, which is to carefully read through the instructions or guidelines provided for filling out r c h i. It is important to understand the specific requirements and any specific formatting or notation that may be required.

03

With a clear understanding of the instructions, start filling out each section of r c h i, ensuring that you provide accurate and up-to-date information. Pay attention to any mandatory fields or sections that must be completed.

04

Take your time to double-check all the information you have entered on r c h i to ensure its accuracy and completeness. Mistakes or omissions can lead to delays or complications, so it is crucial to be thorough.

05

Finally, review the completed r c h i form one last time before submitting it. Make sure that all the information is correct and that you have followed all the necessary guidelines. Once you are satisfied, submit the form as instructed.

Who needs r c h i:

01

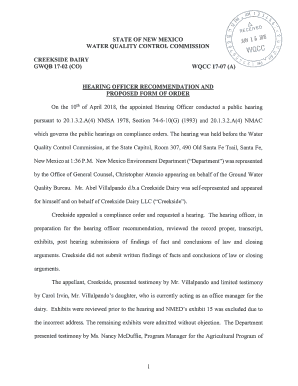

Individuals who need to fill out r c h i are typically those who are required to provide certain information to a specific organization or institution. This could include applicants for jobs, college or university admissions, government services, or any situation where personal details and relevant information are needed.

02

Companies or organizations may also require r c h i to collect data from their clients or customers. This allows them to have a comprehensive database of information that can be used for various purposes, such as marketing, customer support, or identification verification.

03

Government agencies, such as the Internal Revenue Service (IRS) or social security administration, often require individuals to fill out r c h i as part of their official processes. These forms help the government gather necessary information for taxation, benefits, or other legal purposes.

In conclusion, filling out r c h i requires gathering the necessary information, understanding the instructions, accurately completing the form, and double-checking for accuracy. Various individuals, organizations, and government agencies may require r c h i to collect data or fulfill specific requirements.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find r c h i?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the r c h i. Open it immediately and start altering it with sophisticated capabilities.

Can I create an electronic signature for the r c h i in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your r c h i in seconds.

How do I edit r c h i on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign r c h i. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

What is r c h i?

RC HI stands for Report of Cash Transactions exceeding $10,000 in a Trade or Business. It is a form required by the IRS to report cash transactions that exceed $10,000 in a single business day.

Who is required to file r c h i?

Businesses and individuals who receive cash payments exceeding $10,000 in the course of their trade or business are required to file RC HI with the IRS.

How to fill out r c h i?

RC HI can be filled out electronically using the FinCEN Form 8300 system or by paper using Form 8300. The form requires information about the individual or business making the payment, the transaction details, and the person or entity receiving the payment.

What is the purpose of r c h i?

The purpose of RC HI is to help the IRS and law enforcement agencies combat money laundering, tax evasion, and other financial crimes by tracking large cash transactions.

What information must be reported on r c h i?

RC HI requires reporting of the payer's name, address, SSN or EIN, the amount of cash received, the date of the transaction, and other details about the transaction.

Fill out your r c h i online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

R C H I is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.