Get the free FOREIGN COLLECTION AGENCY BOND - fidstatenvus - fid state nv

Show details

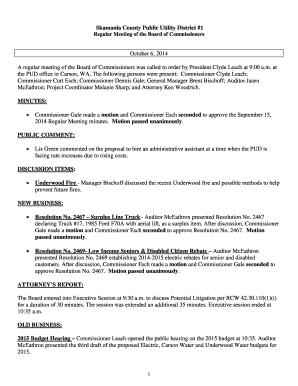

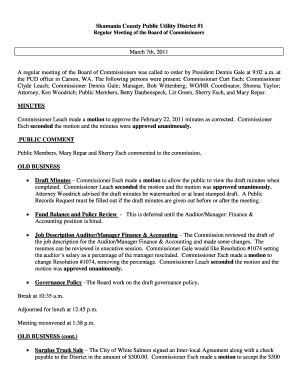

STATE OF NEVADA DEPARTMENT OF BUSINESS & INDUSTRY FINANCIAL INSTITUTIONS DIVISION FOREIGN COLLECTION AGENCY BOND Know all men by these presents: That, doing business under the firm name and style

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign foreign collection agency bond

Edit your foreign collection agency bond form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your foreign collection agency bond form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit foreign collection agency bond online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit foreign collection agency bond. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out foreign collection agency bond

01

To fill out a foreign collection agency bond, you will first need to obtain the necessary documents and information. This typically includes the bond application form, the bond amount required by the jurisdiction or country where you operate, and any supporting documentation requested by the bonding authority.

02

Once you have gathered all the required documents, carefully review the bond application form. Ensure that you correctly enter all the requested information, including your agency's name, address, contact details, and any other relevant information required.

03

Next, you will need to determine the bond amount required. This amount may vary depending on the jurisdiction or country where you operate, so it is important to research and understand the specific requirements. The bond amount is typically based on factors such as the anticipated collection activities and the potential financial risk to consumers.

04

After determining the bond amount, you will need to secure the bond from a surety company. Contact reputable surety bond providers to obtain quotes and select the one that offers the best terms and rates. The surety company will typically require you to provide financial information and may conduct a credit check before issuing the bond.

05

Once you have selected a surety company and have been approved for the bond, you will need to provide the necessary payment or collateral. The surety company will guide you through this process and provide specific instructions based on their requirements.

06

Finally, submit the completed bond application form, along with any supporting documentation, to the bonding authority or regulatory agency. This may involve mailing the documents or submitting them electronically, depending on the rules and procedures of the jurisdiction or country.

Who needs a foreign collection agency bond?

01

Foreign collection agency bonds are typically required for companies or individuals who engage in debt collection activities across international borders. These entities may operate as third-party collection agencies, debt buyers, or any other business involved in collecting debts on behalf of clients or creditors.

02

The need for a foreign collection agency bond may be determined by local or international regulatory bodies, government agencies, or licensing authorities. The bond serves as a guarantee that the collection agency will adhere to applicable laws and regulations, protect the rights of debtors, and fulfill their obligations to clients or creditors.

03

The requirement for a foreign collection agency bond helps to ensure that consumers or debtors are protected from fraudulent or abusive collection practices. It provides a form of financial security and recourse for individuals who may be subjected to unfair or unethical debt collection attempts.

In summary, filling out a foreign collection agency bond involves obtaining the necessary documents, accurately completing the bond application form, determining the required bond amount, securing the bond from a surety company, providing payment or collateral, and submitting the completed application to the bonding authority. Foreign collection agency bonds are typically required for companies or individuals involved in international debt collection activities and serve to protect consumers and ensure compliance with applicable laws and regulations.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is foreign collection agency bond?

Foreign collection agency bond is a type of surety bond that guarantees payment on behalf of a collection agency for any debts collected from debtors in foreign countries.

Who is required to file foreign collection agency bond?

Collection agencies operating in foreign countries are required to file foreign collection agency bond.

How to fill out foreign collection agency bond?

To fill out foreign collection agency bond, the agency must provide personal and business information, financial statements, and proof of surety bond coverage.

What is the purpose of foreign collection agency bond?

The purpose of foreign collection agency bond is to ensure that the collection agency will fulfill its obligations to creditors and debtors in foreign countries.

What information must be reported on foreign collection agency bond?

Information such as agency name, address, contact information, surety bond coverage amount, and bond issuer must be reported on foreign collection agency bond.

How do I execute foreign collection agency bond online?

pdfFiller has made it easy to fill out and sign foreign collection agency bond. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

Can I sign the foreign collection agency bond electronically in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your foreign collection agency bond and you'll be done in minutes.

Can I create an eSignature for the foreign collection agency bond in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your foreign collection agency bond and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

Fill out your foreign collection agency bond online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Foreign Collection Agency Bond is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.