NM Lodgers Tax Report 2000 free printable template

Show details

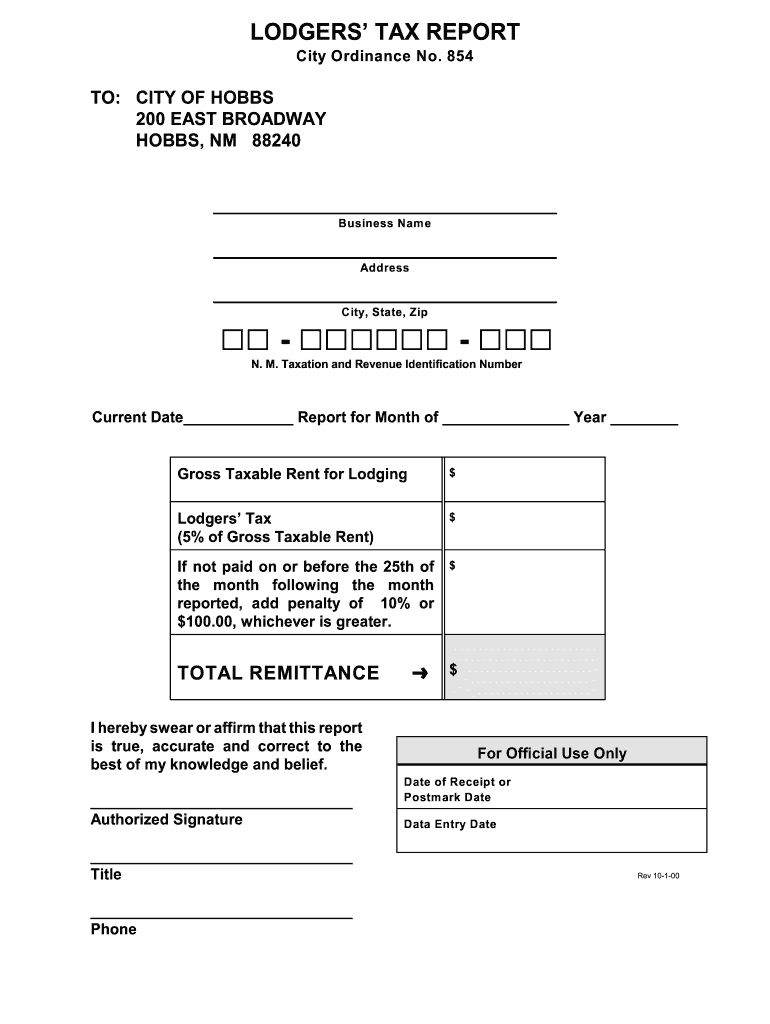

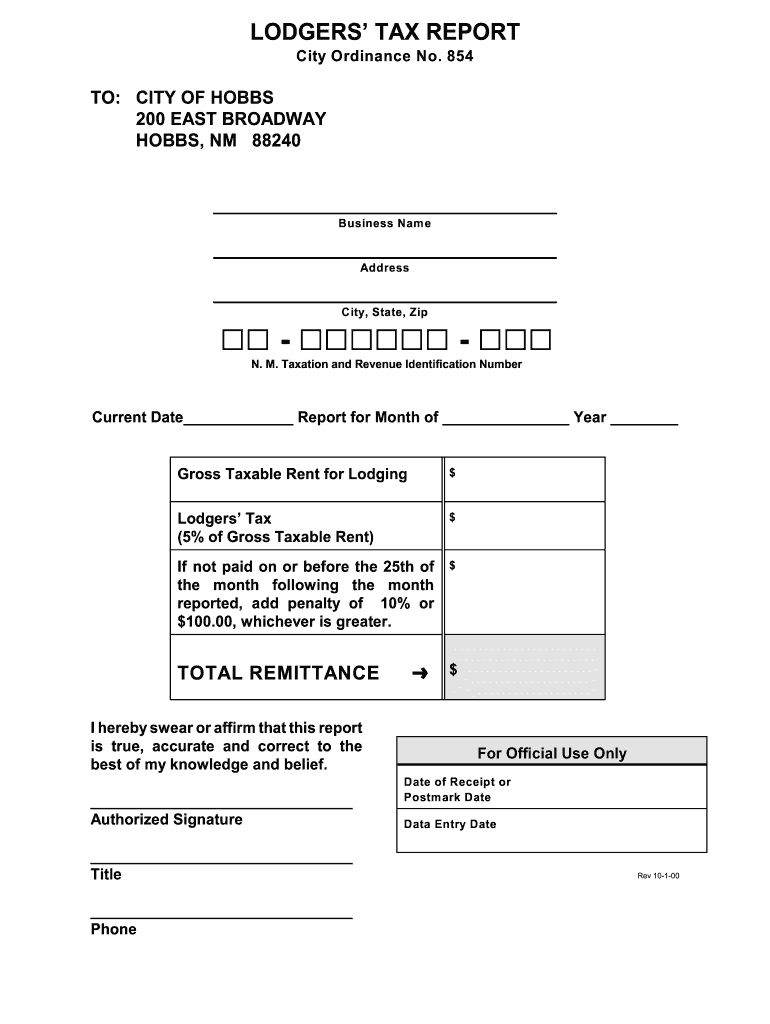

LODGERS TAX REPORT City Ordinance No. 854 TO: CITY OF HOBBS 200 EAST BROADWAY HOBBS, NM 88240 Business Nam e Address City, State, Zip GG GGG GGG GGG N. M. Taxation and Revenue Identification Number

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NM Lodgers Tax Report

Edit your NM Lodgers Tax Report form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NM Lodgers Tax Report form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing NM Lodgers Tax Report online

Use the instructions below to start using our professional PDF editor:

1

Log in to account. Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit NM Lodgers Tax Report. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NM Lodgers Tax Report Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NM Lodgers Tax Report

How to fill out NM Lodgers Tax Report

01

Gather all necessary financial documents related to your lodging business for the reporting period.

02

Visit the New Mexico Taxation and Revenue Department website to access the NM Lodgers Tax Report form.

03

Fill in the basic business information, including your business name, address, and tax identification number.

04

Enter the total gross receipts from lodging sales for the reporting period.

05

Calculate the total lodgers tax based on the applicable tax rate for your jurisdiction and the gross receipts.

06

Report any exemptions or deductions as applicable.

07

Review all the information for accuracy before submission.

08

Submit the completed Lodgers Tax Report by the specified deadline, along with any required payment.

Who needs NM Lodgers Tax Report?

01

Owners and operators of lodging establishments in New Mexico, including hotels, motels, short-term rentals, and bed and breakfasts, are required to file the NM Lodgers Tax Report.

Fill

form

: Try Risk Free

People Also Ask about

What is Carlsbad New Mexico tax?

The 2023 sales tax rate in Carlsbad is 7.52%, and consists of 5% New Mexico state sales tax and 2.52% Carlsbad city tax.

What is the sales tax rate in Carlsbad NM 2023?

The minimum combined 2023 sales tax rate for Carlsbad, New Mexico is 7.52%. This is the total of state, county and city sales tax rates.

What is Lodgers tax in Santa Fe County?

The amount of tax imposed under this chapter is 4% of gross taxable rent. The occupancy tax shall be paid by the vendor in the form of cash or check to the county clerk on or before the twenty-fifth day of each month for the previous calendar month's lodging.

What is the occupancy tax in Carlsbad CA?

It was determined after a series of public meetings and hearings that the Carlsbad City Council adopt an ordinance amending Carlsbad Municipal Code Section 3.37. 050 to increase the assessment from $1 per room night to 2% of gross revenues. The 2% assessment applies to the same revenue as Transient Occupancy Tax.

What is the city of Gallup Lodgers tax?

That information can also be found below. Lodging operators are required to report lodging receipts by the twenty-fifth day of each month on city-approved forms for the preceding calendar month, and to remit payment of the amounts due. The tax rate is 5% on the gross taxable amount paid for lodging.

What is Carlsbad Lodgers tax?

Lodgers' tax is a tax that property owners and property managers collect from renters. The new ordinance removes a previous exemption, in which Lodgers' Tax was not charged for stays longer than 30 days. The ordinance also provides additional clarifications in terms of defining temporary lodging, the news release read.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit NM Lodgers Tax Report from Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your NM Lodgers Tax Report into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How can I get NM Lodgers Tax Report?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the NM Lodgers Tax Report in a matter of seconds. Open it right away and start customizing it using advanced editing features.

How do I make edits in NM Lodgers Tax Report without leaving Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing NM Lodgers Tax Report and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

What is NM Lodgers Tax Report?

The NM Lodgers Tax Report is a document required by the state of New Mexico for reporting and collecting lodging taxes from entities that provide accommodations, such as hotels and short-term rental services.

Who is required to file NM Lodgers Tax Report?

Businesses and individuals who operate lodging facilities and collect lodgers tax from guests are required to file the NM Lodgers Tax Report, including hotels, motels, inns, and short-term rental providers.

How to fill out NM Lodgers Tax Report?

To fill out the NM Lodgers Tax Report, you must provide information such as your business name, the total amount of taxable revenue collected from lodging, the tax collected, and submit it to the appropriate state or local authority by the due date.

What is the purpose of NM Lodgers Tax Report?

The purpose of the NM Lodgers Tax Report is to ensure compliance with state tax laws regarding lodging taxes, to provide revenue for local governments, and to fund tourism-related activities.

What information must be reported on NM Lodgers Tax Report?

The NM Lodgers Tax Report must include details such as the name of the lodging provider, the address, the total revenue collected from lodging services, the amount of lodgers tax paid, and other relevant information as required by the state.

Fill out your NM Lodgers Tax Report online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NM Lodgers Tax Report is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.