Get the free 2013 7004Corp Forms - tax ri

Show details

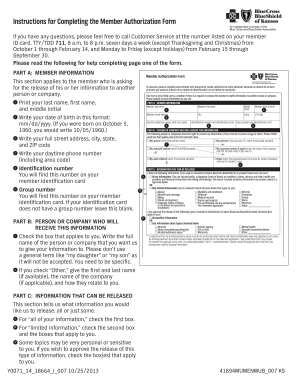

EXTENSION REQUEST INSTRUCTIONS

EXTENSION REQUEST:

To be used by a corporation, LLC or partnership for requesting an automatic six (6) month extension of time for

filing Rhode Island Form RI1120C,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 2013 7004corp forms

Edit your 2013 7004corp forms form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2013 7004corp forms form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 2013 7004corp forms online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Check your account. It's time to start your free trial.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit 2013 7004corp forms. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 2013 7004corp forms

How to fill out 2013 7004corp forms:

01

Gather all necessary information: Before starting to fill out the 2013 7004corp forms, make sure you have all the required information at hand. This includes your company's name, address, EIN (Employer Identification Number), and the tax year for which the form needs to be filed.

02

Determine the reason for filing: The 2013 7004corp form, also known as Form 7004, is used to request an extension of time to file the corporation income tax return. Determine the reason for filing this form, which is generally to request an extension beyond the original due date of the corporation's tax return.

03

Complete the header section: Begin filling out the form by completing the header section. This includes providing the legal name of the corporation, address, EIN, principal business activity code, and the tax year for which the extension is being requested.

04

Enter the estimated tax liability: In Part I of the form, you need to estimate the corporation's total tax liability for the tax year. This requires calculating the expected tax amount based on the company's income, deductions, and credits. Ensure accuracy in these calculations to avoid any discrepancies in future filings.

05

Indicate the requested extension period: In Part II, you will need to indicate the specific length of the extension being requested. Keep in mind that the maximum extension period for filing a corporation tax return is six months. Provide the necessary details regarding the requested extension period.

06

Sign and date the form: Once you have completed all the required sections of the form, sign and date it to certify the accuracy of the information provided. Remember, signing the form implies that you are authorized to file it on behalf of the corporation.

Who needs 2013 7004corp forms:

01

Corporations filing for an extension: The 2013 7004corp forms are specifically designed for corporations that need additional time to file their income tax return. If your corporation is unable to complete its tax return within the original due date, you may need to file Form 7004 to request an extension.

02

Corporations facing time constraints: Various factors, such as complex financial statements, unavailable tax documents, or unexpected circumstances, can cause corporations to face time constraints when filing their tax return. In such cases, filing Form 7004 allows them to extend the filing deadline and avoid penalties for late submission.

03

Corporations seeking compliance: Filing 2013 7004corp forms is essential for corporations striving to maintain compliance with IRS regulations. By properly filing for an extension, corporations demonstrate their commitment to fulfilling their tax obligations accurately and on time.

Note: It is important to consult with a tax professional or refer to the IRS instructions for Form 7004 to ensure you are filling out the form correctly and meeting all the necessary requirements.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit 2013 7004corp forms from Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your 2013 7004corp forms into a dynamic fillable form that you can manage and eSign from anywhere.

How do I edit 2013 7004corp forms online?

With pdfFiller, it's easy to make changes. Open your 2013 7004corp forms in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

Can I create an eSignature for the 2013 7004corp forms in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your 2013 7004corp forms right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

What is 7004corp forms - tax?

7004corp forms - tax is a form used by corporations to request an automatic extension of time to file their tax return.

Who is required to file 7004corp forms - tax?

Corporations that need additional time to file their tax return are required to file 7004corp forms.

How to fill out 7004corp forms - tax?

To fill out 7004corp forms, corporations need to provide basic information about their business, estimate their total tax liability, and explain why they need an extension.

What is the purpose of 7004corp forms - tax?

The purpose of 7004corps forms is to request an extension of time to file a corporation's tax return.

What information must be reported on 7004corp forms - tax?

Corporations must report basic information about their business, estimated total tax liability, and the reason for needing an extension.

Fill out your 2013 7004corp forms online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2013 7004corp Forms is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.