Get the free State of Rhode Island and Providence Plantations 2015 Form T86 15112199990101 Bank D...

Show details

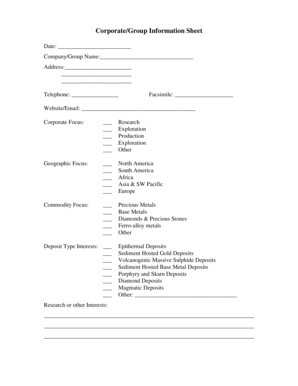

State of Rhode Island and Providence Plantations 2015 Form T86 15112199990101 Bank Deposits Tax Name January 15th Report Federal employer identification number Address June 15th Filing Amended Address

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign state of rhode island

Edit your state of rhode island form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your state of rhode island form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing state of rhode island online

Follow the guidelines below to use a professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit state of rhode island. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out state of rhode island

How to Fill Out State of Rhode Island:

01

Gather Required Information: Before filling out the state of Rhode Island, gather all the necessary information such as your personal details, including your full name, address, social security number, and contact information.

02

Choose the Appropriate Forms: Visit the official website of the Rhode Island Division of Taxation or the Department of Revenue to download the required forms. The specific forms you need to fill out will depend on the purpose, whether it is for income tax, sales tax, property tax, or other types of taxes.

03

Complete the Forms: Read the instructions carefully and fill out each field accurately and thoroughly. Double-check all the information to avoid any mistakes or errors. This may involve providing details about your income, deductions, expenses, or any other related information. If you are unsure about certain sections or have complex tax situations, consider seeking professional guidance or contacting the relevant tax authorities for clarification.

04

Attach Supporting Documents: In some cases, you may need to attach supporting documents to your tax forms. These could include W-2 forms, 1099 forms, receipts, invoices, or any other documentation required to validate your claims or deductions. Make sure to follow the guidelines provided in the instructions regarding which documents to attach and how to organize them.

05

Review and Submit: Once you have completed the forms and gathered all the necessary supporting documents, carefully review everything to ensure accuracy and completeness. Go through each section to verify the information, calculations, and any applicable signatures. When you are satisfied, make copies of all the documents for your records and submit the original paperwork as directed, whether it is through mail or electronically.

Who Needs State of Rhode Island:

01

Rhode Island Residents: Individuals who reside in the state of Rhode Island, whether they are permanent residents or temporary residents, may need to fill out various state forms for tax purposes. This includes filing income tax returns, reporting property taxes, or paying sales and use taxes.

02

Rhode Island Businesses: Businesses operating in Rhode Island or conducting any business activities within the state boundaries typically need to fill out state tax forms. This includes submitting corporate income taxes, sales and use taxes, employer withholding taxes, or any other relevant tax obligations.

03

Non-Residents with Rhode Island Income: Individuals who earn income within the state of Rhode Island, but reside elsewhere, may also need to fill out state tax forms. This could include non-resident workers, freelancers, or individuals earning rental income from properties located in Rhode Island.

It is important to note that this information serves as a general guide, and individual circumstances may vary. It is always recommended to refer to the official websites or consult with tax professionals for specific guidance relating to filling out the state of Rhode Island.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is state of rhode island?

State of Rhode Island refers to the annual report that businesses are required to file with the Rhode Island Secretary of State.

Who is required to file state of rhode island?

All businesses, including corporations, LLCs, and partnerships, registered in Rhode Island are required to file the State of Rhode Island report.

How to fill out state of rhode island?

The State of Rhode Island report can usually be filled out online through the Rhode Island Secretary of State website or submitted by mail.

What is the purpose of state of rhode island?

The purpose of the State of Rhode Island report is to update the state government on the current status and activities of businesses registered in Rhode Island.

What information must be reported on state of rhode island?

The State of Rhode Island report typically requires businesses to provide information such as their current address, ownership details, and financial status.

How can I send state of rhode island for eSignature?

When you're ready to share your state of rhode island, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

How can I get state of rhode island?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the state of rhode island in seconds. Open it immediately and begin modifying it with powerful editing options.

Can I edit state of rhode island on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share state of rhode island from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

Fill out your state of rhode island online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

State Of Rhode Island is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.