Get the free Employee or Independent Contractor

Show details

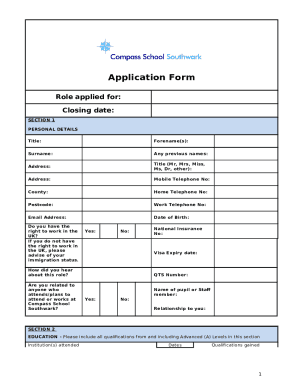

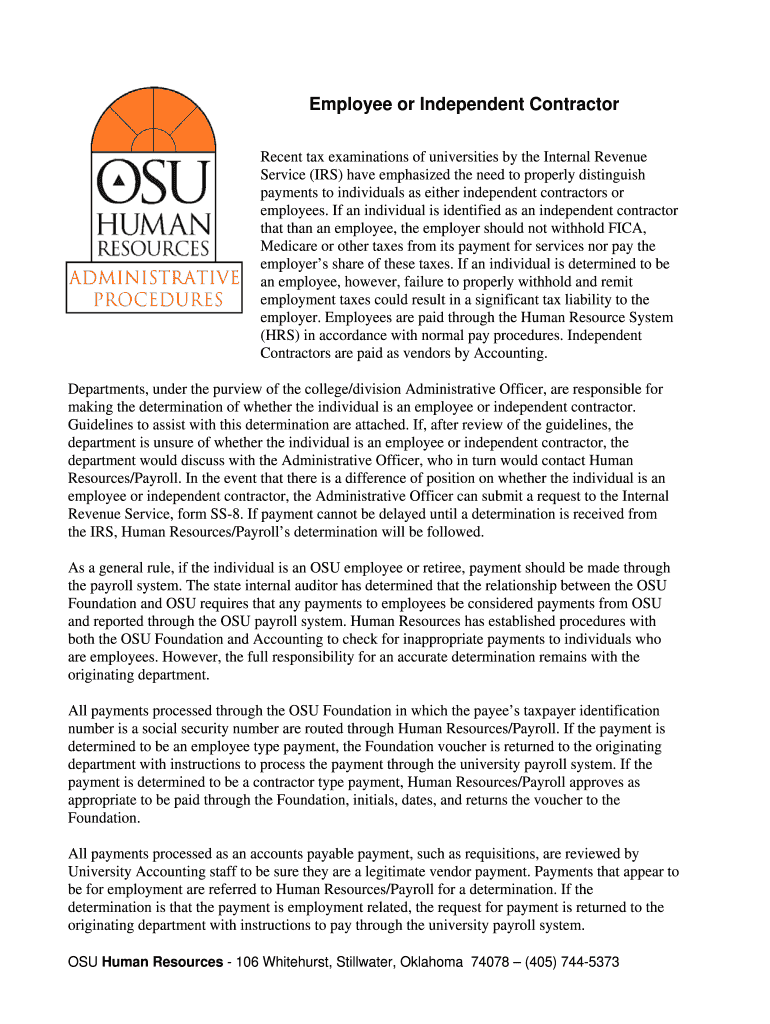

This document provides guidelines for distinguishing between employees and independent contractors, detailing the implications of each classification concerning tax liabilities and responsibilities.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign employee or independent contractor

Edit your employee or independent contractor form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your employee or independent contractor form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing employee or independent contractor online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit employee or independent contractor. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out employee or independent contractor

How to fill out Employee or Independent Contractor

01

Determine the nature of the work and relationship with the individual.

02

Gather necessary personal information from the individual (name, address, SSN, etc.).

03

Identify the payment terms and method (hourly, salary, project-based).

04

Fill out the appropriate tax forms (W-2 for employees, 1099 for independent contractors).

05

Ensure compliance with local, state, and federal labor laws.

06

Review and sign a contract or agreement outlining the terms of engagement.

Who needs Employee or Independent Contractor?

01

Businesses hiring staff for regular employment roles.

02

Freelancers seeking project-based work.

03

Companies needing specialized skills for short-term projects.

04

Startups looking for flexible workforce options.

05

Industries with fluctuating demand for labor, such as seasonal businesses.

Fill

form

: Try Risk Free

People Also Ask about

What do you call a self-employed contractor?

By either definition, independent contractors and sole proprietors are considered self-employed individuals because they're responsible for finding work, setting their own rates, and paying their own self-employment taxes.

What is another name for an independent worker?

self-employed individual. Independent contractors are self-employed, which means they act as their own boss. That's why you may hear them referred to as sole proprietors, which is another name for an independent contractor (when they do business as an individual).

What are the names for self-employed people?

Self-employed people are usually classified as a sole proprietor (or sole trader), independent contractor, or as a member of a partnership.

Am I a freelancer or independent contractor?

As a freelancer, you also have to manage invoicing and following up on payments. When you work as an independent contractor, you work on an hourly or project-based rate that may vary from client to client or job to job. If you work independently, you have control over setting and negotiating your rates.

What is another term for independent contractor?

Independent professionals go by many names: consultant, contractor, freelancer, self-employed, and small business owner may be used to accurately describe a non-employee who performs work for a company for a period of time for an agreed-upon price.

What is the difference between an employee and an independent contractor in BC?

While employees are entitled to various protections and benefits under employment law, such as minimum wage, overtime pay, vacation pay, and employment insurance, independent contractors are considered self-employed and do not receive these benefits.

What is a fancy name for an independent contractor?

Independent professionals go by many names: consultant, contractor, freelancer, self-employed, and small business owner may be used to accurately describe a non-employee who performs work for a company for a period of time for an agreed-upon price.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Employee or Independent Contractor?

An Employee is a person who is hired to provide services to a company and is subject to the company's control regarding how those services are performed. An Independent Contractor, on the other hand, is a self-employed individual who provides services to clients under terms specified in a contract, with more control over how they complete the work.

Who is required to file Employee or Independent Contractor?

Employers are required to file forms for their Employees, while businesses that hire Independent Contractors must file specific forms if they make payments exceeding a certain threshold. Tax authorities typically require documentation for both categories to ensure proper tax reporting.

How to fill out Employee or Independent Contractor?

To fill out the Employee or Independent Contractor forms, you need to provide details such as the individual's name, address, taxpayer identification number, and information about the nature of the work performed, along with payment details. Ensure accuracy to avoid tax issues.

What is the purpose of Employee or Independent Contractor?

The purpose of distinguishing between Employees and Independent Contractors is to determine the legal relationship, tax obligations, and benefits entitled to each category. This classification affects tax withholding, labor law protections, and eligibility for benefits.

What information must be reported on Employee or Independent Contractor?

Information that must be reported includes the individual's name, Social Security number or taxpayer identification number, address, total payments made during the tax year, and any applicable withholding tax amounts. This information helps tax authorities track income and ensure compliance.

Fill out your employee or independent contractor online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Employee Or Independent Contractor is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.