Get the free Life Settlement Providers - insuranceutahgov - insurance utah

Show details

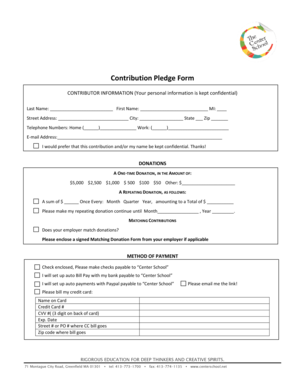

Life Settlement Providers Name Abacus Settlements LLC Berkshire Settlements, Inc. CMG Surety LLC Coventry First LLC Credit Suisse Life Settlements LLC Haber sham Funding LLC Imperial Life Settlements,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign life settlement providers

Edit your life settlement providers form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your life settlement providers form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing life settlement providers online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to your account. Click on Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit life settlement providers. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out life settlement providers

How to fill out life settlement providers:

01

Research and gather information: Begin by researching different life settlement providers and understanding their services. Look for reputable companies with a track record of success in the industry. Gather information on their requirements, documentation needed, and any additional fees involved.

02

Understand eligibility criteria: Next, familiarize yourself with the eligibility criteria set by life settlement providers. These criteria may vary but often include factors such as the insured person's age, health condition, policy type, and face value of the policy. Review if you or your loved one meet these requirements.

03

Complete the application process: Once you have chosen a life settlement provider, complete their application process. This typically involves filling out forms with personal and policy information. Some providers may require additional documentation, such as medical records or policy statements. Ensure that you provide accurate and truthful information.

04

Review and negotiate offers: After submitting the application, a life settlement provider will assess the policy and make an offer. Take the time to carefully review the offer, considering factors such as the offer amount, any remaining premiums, and any obligations after the settlement. It may be beneficial to consult with a financial advisor or lawyer to ensure the offer aligns with your financial goals.

05

Accept or decline the offer: Based on your assessment, decide whether to accept or decline the offer. If accepted, you will proceed with the closing process, which may involve signing legal documents and transferring the policy ownership to the settlement provider. If you decline the offer, you can explore other options or reconsider at a later time.

Who needs life settlement providers:

01

Seniors with unwanted or unaffordable life insurance policies: Life settlement providers can be beneficial for seniors who no longer need or can afford their life insurance policies. By selling the policy, they can receive a lump sum of cash that can be used for various purposes, such as funding retirement, paying medical bills, or covering other expenses.

02

Individuals with changing financial circumstances: Life settlement providers can help individuals facing changing financial circumstances, such as unexpected medical expenses or a need for additional retirement funds. Selling a life insurance policy can provide a financial cushion during these challenging times.

03

Policyowners who have outlived their beneficiaries: Some policyowners may find themselves in a situation where they have outlived their beneficiaries, leaving them with a policy that no longer serves its original purpose. In such cases, selling the policy through a life settlement provider can ensure that the policy does not go to waste and instead provides financial benefits.

04

Individuals seeking alternative investments: Life settlement investments can be attractive to investors looking for alternative investment opportunities. By purchasing a policy from a life settlement provider, investors can potentially earn returns based on the policy's eventual payout upon the insured person's demise.

05

Policyowners facing financial hardship: Life settlement providers can offer a solution for policyowners experiencing financial hardship. Instead of surrendering the policy for little to no value, selling it through a life settlement provider can provide a substantial cash payout that can help alleviate financial burdens.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get life settlement providers?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific life settlement providers and other forms. Find the template you need and change it using powerful tools.

How do I complete life settlement providers online?

Filling out and eSigning life settlement providers is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

How do I edit life settlement providers straight from my smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing life settlement providers.

What is life settlement providers?

Life settlement providers are companies that purchase life insurance policies from policyholders at a price lower than the death benefit but higher than the surrender value.

Who is required to file life settlement providers?

Life settlement providers are required to be filed by companies that engage in the business of purchasing life insurance policies from policyholders.

How to fill out life settlement providers?

To fill out life settlement providers, companies must provide information about their business operations, financial standing, and regulatory compliance.

What is the purpose of life settlement providers?

The purpose of life settlement providers is to provide a secondary market for life insurance policies, allowing policyholders to sell their policies for a lump sum payment.

What information must be reported on life settlement providers?

Information that must be reported on life settlement providers includes details about the policies purchased, the number of policies sold, and financial information.

Fill out your life settlement providers online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Life Settlement Providers is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.