Get the free REHABILITATION LOAN

Show details

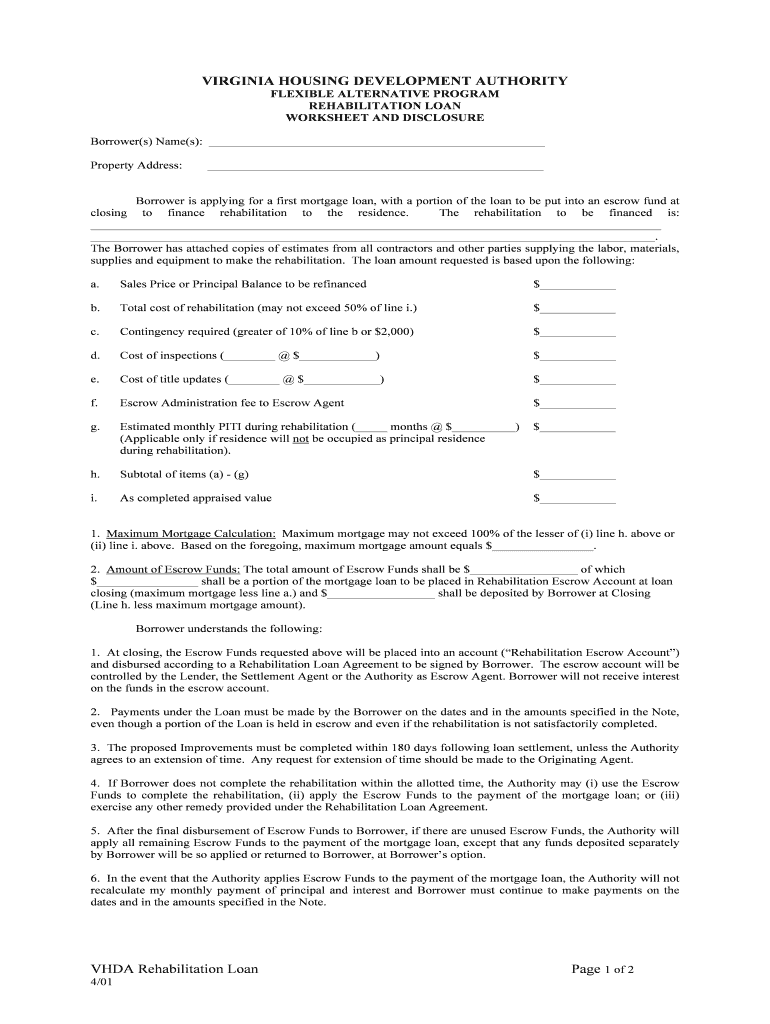

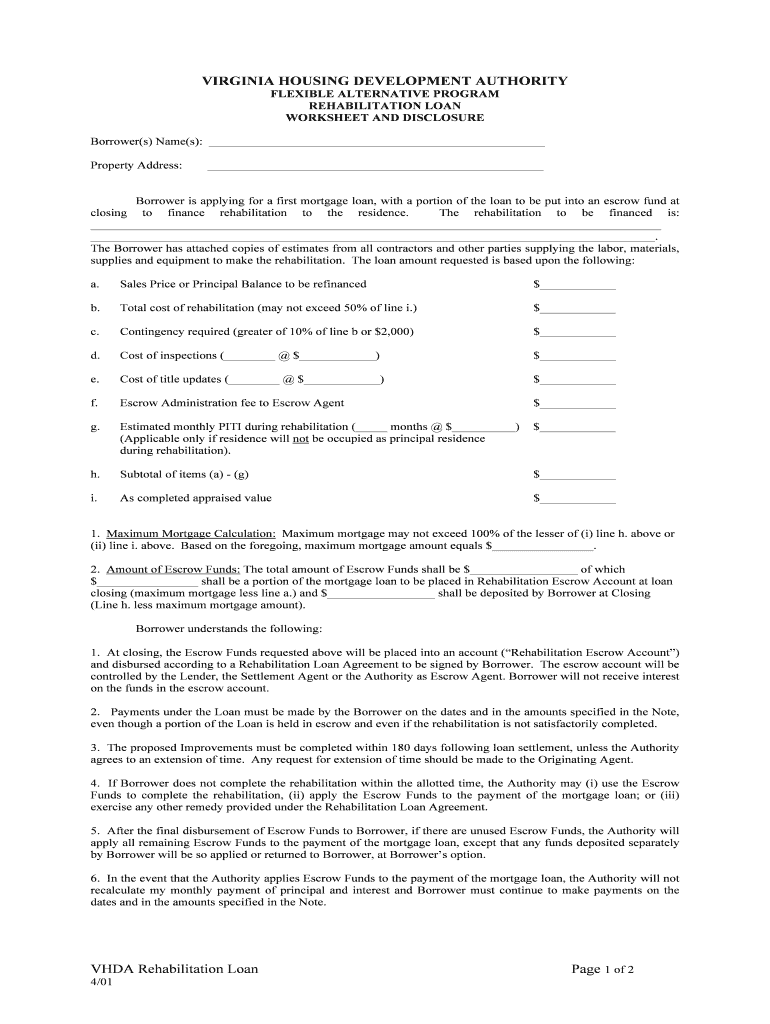

VIRGINIA HOUSING DEVELOPMENT AUTHORITY FLEXIBLE ALTERNATIVE PROGRAM REHABILITATION LOAN WORKSHEET AND DISCLOSURE Borrower(s) Name(s): Property Address: Borrower is applying for a first mortgage loan,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign rehabilitation loan

Edit your rehabilitation loan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your rehabilitation loan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit rehabilitation loan online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit rehabilitation loan. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out rehabilitation loan

How to Fill Out a Rehabilitation Loan:

01

Gather necessary documents: Start by collecting all the required documents for the rehabilitation loan application. This may include proof of income, employment verification, credit history, and any other relevant financial documents.

02

Research lenders: Look into different lenders who offer rehabilitation loans. Compare interest rates, repayment terms, and eligibility criteria to find the one that suits your needs the best.

03

Understand the loan terms: Before filling out the application, ensure that you thoroughly understand the terms and conditions of the rehabilitation loan. Familiarize yourself with the interest rate, repayment period, and any additional fees or penalties.

04

Complete the application: Fill out the rehabilitation loan application accurately and truthfully. Be prepared to provide personal information, financial details, and any supporting documents as required by the lender.

05

Provide a rehabilitation plan: In many cases, rehabilitation loans are intended for home repairs or upgrades. Outline a comprehensive plan detailing the specific renovations you intend to undertake and the estimated costs associated with each project.

06

Submit the application: Once you have filled out the application and gathered all the necessary documentation, submit the completed application to the lender.

07

Await approval: After submitting your application, the lender will review it and assess your eligibility for the rehabilitation loan. This process may take some time, so be patient and wait for their response.

08

Follow up with the lender: In case the lender requires additional information or documentation, promptly provide the requested items to expedite the loan approval process.

09

Review the loan offer: If your rehabilitation loan application is approved, carefully review the loan offer provided by the lender. Pay attention to the interest rate, repayment schedule, and any associated fees. If you have any concerns or questions, don't hesitate to seek clarification from the lender.

10

Accept the loan and begin the rehabilitation: If you are satisfied with the loan offer, accept it according to the lender's instructions. Once the funds are disbursed, you can begin the rehabilitation process as outlined in your plan.

Who Needs a Rehabilitation Loan:

01

Homeowners: Homeowners who are planning to renovate, repair, or improve their property often require a rehabilitation loan. These loans can help finance the necessary expenses associated with home rehabilitation projects.

02

Real estate investors: Investors who purchase distressed properties or fixer-uppers may opt for rehabilitation loans to fund the necessary renovations before selling the property at a higher value.

03

Individuals with low credit scores: For individuals with less-than-perfect credit, traditional loans may be hard to obtain. Rehabilitation loans can be a viable option for those who need financial assistance with home repairs but have limited borrowing options.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete rehabilitation loan online?

pdfFiller has made it easy to fill out and sign rehabilitation loan. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

How can I edit rehabilitation loan on a smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing rehabilitation loan.

How do I fill out rehabilitation loan using my mobile device?

Use the pdfFiller mobile app to fill out and sign rehabilitation loan on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

What is rehabilitation loan?

A rehabilitation loan is a type of loan designed to finance the renovation or repair of a property.

Who is required to file rehabilitation loan?

Any individual or organization seeking financial assistance for property renovation or repair may apply for a rehabilitation loan.

How to fill out rehabilitation loan?

To fill out a rehabilitation loan, applicants typically need to provide information about the property in need of renovation, desired loan amount, and details about their financial situation.

What is the purpose of rehabilitation loan?

The purpose of a rehabilitation loan is to provide financial support to individuals or organizations looking to improve the condition of a property through renovation or repair.

What information must be reported on rehabilitation loan?

Applicants must typically report details about the property in need of renovation, the scope of work to be done, estimated costs, and their ability to repay the loan.

Fill out your rehabilitation loan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Rehabilitation Loan is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.