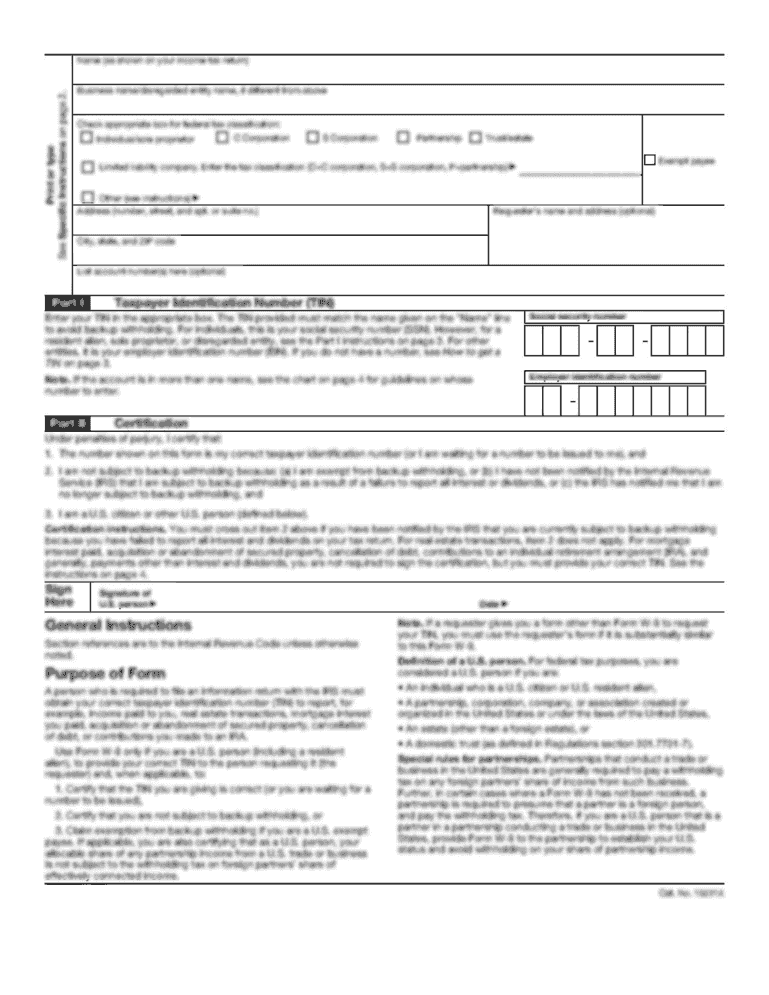

Get the free We pay overdrafts at our discretion, which means we do not guarantee that we will al...

Show details

What fees will I be charged if Scott Valley Bank pays my overdraft? ... What if I want Scott Valley Bank to authorize and pay overdrafts on my ATM & every day ...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign we pay overdrafts at

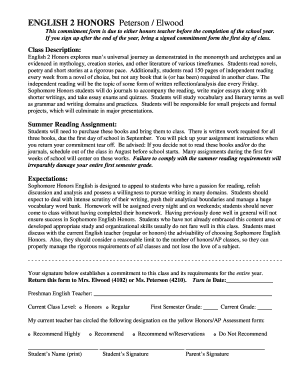

Edit your we pay overdrafts at form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your we pay overdrafts at form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit we pay overdrafts at online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit we pay overdrafts at. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out we pay overdrafts at

How to fill out we pay overdrafts at:

01

Gather all necessary financial information: Start by collecting all relevant financial information, such as your bank account details, overdraft limit, and any outstanding balances.

02

Understand the terms and conditions: Familiarize yourself with the terms and conditions associated with the "we pay overdrafts" feature offered by your bank. This will help you understand the requirements and responsibilities involved.

03

Review your overdraft limit: Determine your overdraft limit, which is the maximum amount you can borrow through this feature. Make sure you are aware of any fees or interest rates associated with using this facility.

04

Assess your financial needs: Determine whether you actually need to use the "we pay overdrafts" feature. Consider your current financial situation and assess whether it is the most suitable option for your needs.

05

Fill out the necessary forms: Once you have decided to utilize the "we pay overdrafts" feature, you may need to fill out specific forms provided by your bank. These forms typically ask for your personal and financial details, as well as your agreement to the terms and conditions.

06

Submit the forms and wait for approval: After completing the forms, submit them to your bank for review. The approval process may take some time, so be patient while waiting for their response. It is advisable to keep a copy of the submitted forms for your records.

07

Familiarize yourself with repayment terms: If your "we pay overdrafts" application is approved, make sure you understand the repayment terms. This includes any interest charges, repayment periods, and any other obligations you have towards the overdraft facility.

08

Monitor your account regularly: Once you have successfully filled out the "we pay overdrafts" application, it is important to monitor your bank account regularly. Keep track of your transactions, repayments, and any changes in your overdraft status. This will help you manage your finances effectively and avoid any unexpected fees or issues.

Who needs we pay overdrafts at:

01

Individuals with fluctuating cash flows: "We pay overdrafts" can be beneficial for individuals who experience irregular income streams. It can provide a safety net during times when expenses exceed available funds.

02

People with unexpected expenses: Anyone who may face unexpected expenses, such as medical bills or home repairs, can benefit from utilizing the "we pay overdrafts" feature. It allows them to cover these unforeseen costs without disrupting their normal financial flow.

03

Individuals without emergency savings: For those who do not have a well-established emergency fund, "we pay overdrafts" can offer temporary relief during financial emergencies. However, it is still important to establish an emergency savings account for long-term financial stability.

04

Those who prefer convenience: The "we pay overdrafts" feature can be attractive to individuals who appreciate the convenience of having the bank cover overdrafts instead of facing declined transactions or incurring fees.

05

Individuals seeking short-term borrowing options: Instead of resorting to high-interest payday loans or credit cards, people can use "we pay overdrafts" as a short-term borrowing method. It can provide a more affordable alternative for those in need of immediate funds.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my we pay overdrafts at directly from Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign we pay overdrafts at and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How do I fill out the we pay overdrafts at form on my smartphone?

On your mobile device, use the pdfFiller mobile app to complete and sign we pay overdrafts at. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to discover more about our mobile applications, the features you'll have access to, and how to get started.

How do I fill out we pay overdrafts at on an Android device?

Complete we pay overdrafts at and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

What is we pay overdrafts at?

We pay overdrafts at a fee determined by the financial institution.

Who is required to file we pay overdrafts at?

Customers who have opted in for overdraft protection may have their overdrafts paid by the bank.

How to fill out we pay overdrafts at?

To fill out we pay overdrafts, customers need to review their account statements and see the fees charged for overdraft protection.

What is the purpose of we pay overdrafts at?

The purpose of we pay overdrafts is to prevent declined transactions and returned checks due to insufficient funds.

What information must be reported on we pay overdifts at?

Customers need to report their account details, the amount of overdraft, and any fees associated with the overdraft protection service.

Fill out your we pay overdrafts at online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

We Pay Overdrafts At is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.