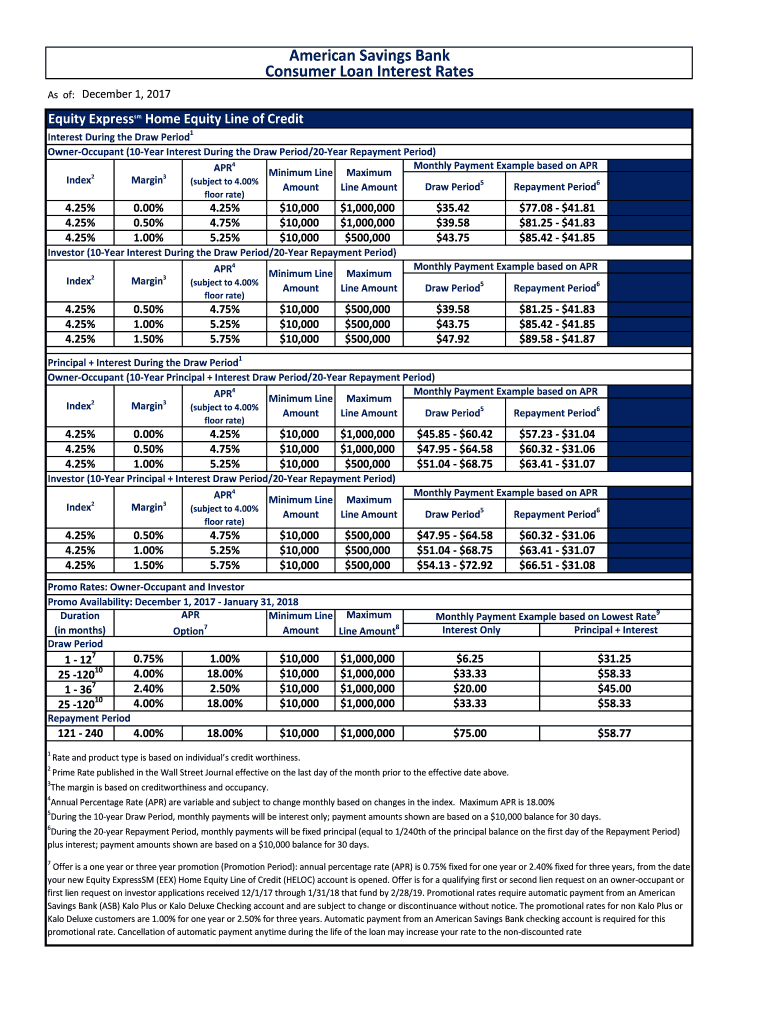

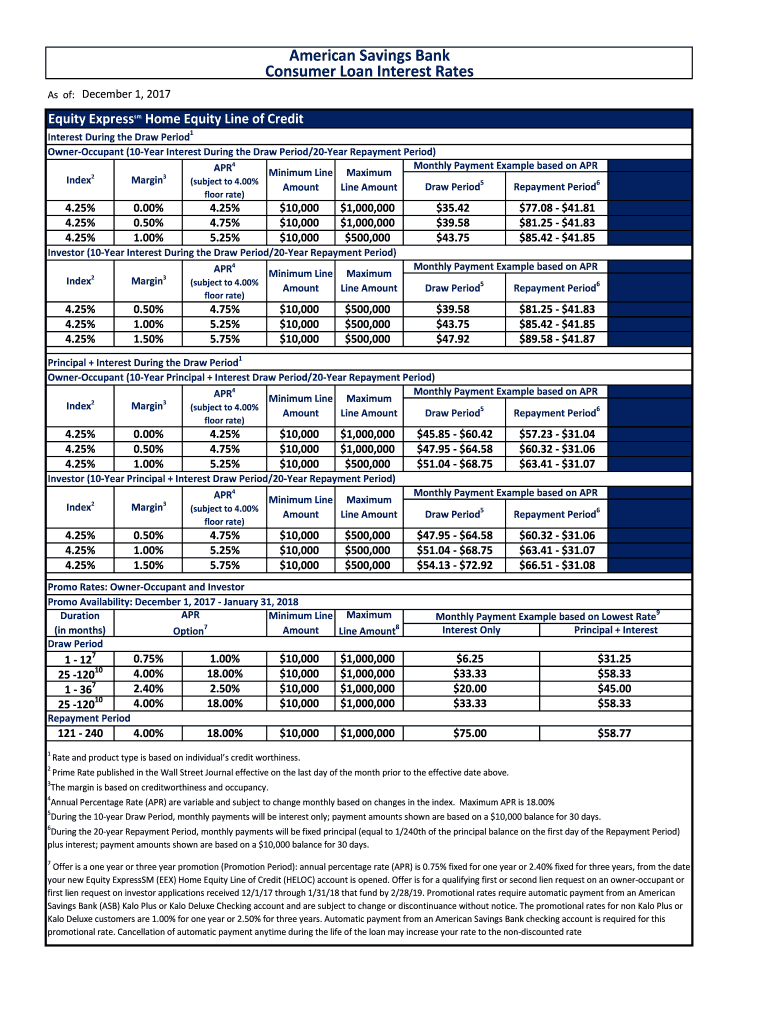

Get the free Equity Expresssm Home Equity Line of Credit

Show details

American Savings Bank

Consumer Loan Interest Rates

As of: December 1, 2017Equity Expressed Home Equity Line of Credit

Interest During the Draw Period1

OwnerOccupant (10Year Interest During the Draw

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign equity expresssm home equity

Edit your equity expresssm home equity form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your equity expresssm home equity form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing equity expresssm home equity online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit equity expresssm home equity. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out equity expresssm home equity

How to fill out Equity ExpressSM Home Equity:

01

Start by gathering all the necessary information and documents required for the application process. This may include proof of income, employment verification, proof of residence, and identification documents.

02

Visit the designated website or branch of the financial institution offering Equity ExpressSM Home Equity. If applying online, create an account or login to your existing account.

03

Navigate to the section specifically for Equity ExpressSM Home Equity and select the "Apply Now" or similar option.

04

Fill out the online application form with accurate and up-to-date information. This may include personal details such as your name, contact information, social security number, and employment details.

05

Provide all the required information regarding the property being used as collateral for the home equity loan. Include the property address, estimated value, and any existing mortgages or liens.

06

Input the desired loan amount and select the loan term or repayment period that best suits your financial needs.

07

Review the application form thoroughly before submitting. Make sure all the provided information is accurate and complete.

08

If required, attach any supporting documents electronically, such as income proof or identification documents. Ensure that all attachments are clear and legible.

09

Once you have reviewed and verified all the information, click on the "Submit" button to complete the application process.

10

After submitting the application, you may receive an instant decision or may need to wait for further evaluation by the financial institution. Be prepared to provide additional documentation or answer any follow-up questions if needed.

Who needs Equity ExpressSM Home Equity?

01

Homeowners who require additional funds for various purposes such as home renovations, debt consolidation, education expenses, or unexpected financial emergencies may consider Equity ExpressSM Home Equity.

02

Individuals with a good credit score and a stable income who are confident in their ability to repay the loan may find Equity ExpressSM Home Equity suitable for their financial needs.

03

Homeowners who have significant equity built up in their property and wish to leverage it to access a lump sum of money may benefit from Equity ExpressSM Home Equity.

04

Those who prefer a fixed interest rate and a predictable repayment structure over the life of the loan may find Equity ExpressSM Home Equity appealing.

05

Potential borrowers who appreciate the convenience of online application processes and value quick decision-making may find Equity ExpressSM Home Equity a suitable option.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find equity expresssm home equity?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific equity expresssm home equity and other forms. Find the template you want and tweak it with powerful editing tools.

How do I execute equity expresssm home equity online?

Completing and signing equity expresssm home equity online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

How do I complete equity expresssm home equity on an Android device?

On Android, use the pdfFiller mobile app to finish your equity expresssm home equity. Adding, editing, deleting text, signing, annotating, and more are all available with the app. All you need is a smartphone and internet.

What is equity expresssm home equity?

Equity Expresssm Home Equity is a service that allows homeowners to draw funds against the equity in their homes.

Who is required to file equity expresssm home equity?

Homeowners who are looking to borrow funds against the equity in their homes are required to file Equity Expresssm Home Equity.

How to fill out equity expresssm home equity?

To fill out Equity Expresssm Home Equity, homeowners need to provide information about their property, current mortgage balance, desired loan amount, and other relevant details.

What is the purpose of equity expresssm home equity?

The purpose of Equity Expresssm Home Equity is to provide homeowners with access to funds based on the equity in their homes for various financial needs.

What information must be reported on equity expresssm home equity?

Homeowners must report information about their property, mortgage details, desired loan amount, and other relevant financial information on Equity Expresssm Home Equity.

Fill out your equity expresssm home equity online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Equity Expresssm Home Equity is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.