Get the free Checking Account Application - wctfcucom

Show details

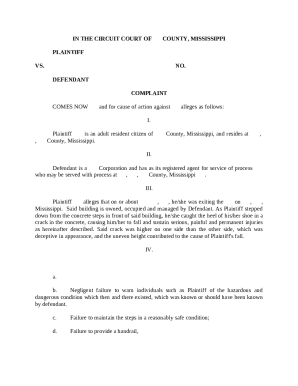

Checking Account Application Please select the FREE checking account you'd like: A+ Checking; Intune Checking; Reg Checking S 2037589500; 8009922226 www.wctfcu.com Share Account Number: Primary Name:

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign checking account application

Edit your checking account application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your checking account application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing checking account application online

Use the instructions below to start using our professional PDF editor:

1

Log in to account. Click Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit checking account application. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out checking account application

How to fill out a checking account application:

01

Gather necessary information: Before starting the application, make sure you have all the required documents and information. This may include your Social Security number, government-issued ID, proof of address, employment details, and any other relevant financial information.

02

Choose the bank: Research different banks and compare their checking account options. Consider factors such as monthly fees, minimum balance requirements, ATM access, and interest rates. Once you have decided on a bank, visit their website or branch to get a copy of the checking account application.

03

Personal Information: Start filling out the application form by providing your personal details accurately. This typically includes your full name, date of birth, contact information, and Social Security number.

04

Employment Information: Provide details about your current employment situation or source of income. This may include your employer's name, address, occupation, and the length of time you have been employed.

05

Financial Information: Next, provide information about your financial status. This may include details about your income, monthly expenses, other accounts you may have, and any outstanding loans or debts.

06

Identification: You may need to provide identification documents such as a driver's license or passport. Make sure to have copies of these documents ready for submission along with your application.

07

Terms and Agreements: Read through the terms and agreements section carefully before signing the application. Make sure you understand the fees, interest rates, and other conditions associated with the checking account. If you have any questions or concerns, don't hesitate to ask a representative from the bank for clarification.

Who needs a checking account application:

01

Individuals: Checking account applications are commonly filled out by individuals who need a convenient and secure way to manage their day-to-day finances. Having a checking account allows you to deposit paychecks, withdraw cash, pay bills, and make electronic transactions.

02

Students: Many students find it beneficial to open a checking account while attending school. It provides them with a safe place to store and manage their money, and some banks offer student-specific accounts with features like low or no monthly fees.

03

Businesses: In addition to individuals, small and large businesses also need checking accounts. These accounts are essential for managing business finances, paying employees, receiving payments from customers, and keeping track of expenses.

04

Organizations: Non-profit organizations, clubs, and other groups may also require a checking account to handle their finances. This allows them to receive donations, pay expenses, and maintain financial transparency.

Overall, anyone who needs a secure and convenient method to handle their finances should consider filling out a checking account application. It offers numerous benefits such as easy access to funds, online banking features, and the ability to track transactions efficiently.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify checking account application without leaving Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your checking account application into a dynamic fillable form that can be managed and signed using any internet-connected device.

Can I sign the checking account application electronically in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your checking account application in minutes.

How do I edit checking account application on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as checking account application. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

What is checking account application?

A checking account application is a form that individuals or businesses fill out to open a new checking account at a bank or financial institution.

Who is required to file checking account application?

Anyone who wants to open a new checking account at a bank or financial institution is required to file a checking account application.

How to fill out checking account application?

To fill out a checking account application, individuals need to provide personal information such as their name, address, social security number, and financial information such as income and employment details.

What is the purpose of checking account application?

The purpose of a checking account application is to gather necessary information from individuals looking to open a checking account and to determine their eligibility for the account.

What information must be reported on checking account application?

Information such as name, address, social security number, income, and employment details must be reported on a checking account application.

Fill out your checking account application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Checking Account Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.