Get the free PAYMENT OF INTEREST BY COMMERCIAL T AXES DEP ARTMENT TO

Show details

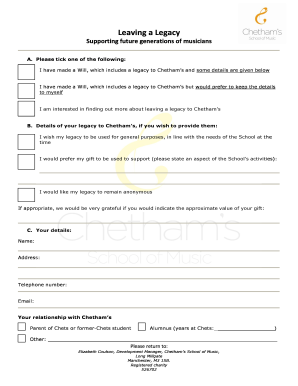

GOVERNMENT OF ANDHRA PRADESH COMMERCIAL TAXES DEPARTMENT FORM TOT 036 PAYMENT OF INTEREST in COMMERCIAL TAXES DEPARTMENT TO TOT DEALER / OTHERS Date Month 01. Tax Office Address: Year 02 GRN /OTHERS

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign payment of interest by

Edit your payment of interest by form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your payment of interest by form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing payment of interest by online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit payment of interest by. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out payment of interest by

How to fill out payment of interest by:

01

Gather the necessary information: Before filling out the payment of interest form, make sure you have all the required information readily available. This may include details such as the interest rate, the principal amount, the payment frequency, and the duration of the loan or investment.

02

Understand the payment structure: Familiarize yourself with the specific payment structure outlined in the agreement or contract. Determine whether the interest is calculated as simple interest or compound interest, and whether it is fixed or variable.

03

Calculate the interest payment: Use the provided formula or method to calculate the interest payment. This calculation generally involves multiplying the principal amount by the interest rate, and then adjusting for the payment frequency and duration.

04

Fill out the payment of interest form: Once you have the necessary calculations and information, fill out the payment of interest form accurately and completely. Pay attention to any specific instructions or fields that need to be included, such as the payment date and any additional fees or charges.

Who needs payment of interest by:

01

Borrowers: Individuals or entities who have taken out a loan or borrowed money from a lender are typically required to make payment of interest. This helps compensate the lender for the use of their funds and is a contractual obligation.

02

Investors: People who have invested their money in financial instruments such as bonds, certificates of deposit, or savings accounts also receive payment of interest. This is a way for investors to earn a return on their investment over a set period.

03

Financial institutions: Banks and other financial institutions often require borrowers to make payment of interest as a means of generating revenue. This interest income contributes to their profitability and allows them to provide loans and banking services to others.

In conclusion, filling out the payment of interest by involves gathering the necessary information, understanding the payment structure, calculating the interest payment, and completing the required form. This process is applicable to borrowers, investors, and financial institutions who have a vested interest in receiving or providing payment of interest.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify payment of interest by without leaving Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including payment of interest by, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

How can I send payment of interest by for eSignature?

To distribute your payment of interest by, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

How do I complete payment of interest by online?

pdfFiller has made filling out and eSigning payment of interest by easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

What is payment of interest by?

Payment of interest by refers to the obligation to pay interest on a loan or investment.

Who is required to file payment of interest by?

Individuals or entities who receive interest income are required to file payment of interest by.

How to fill out payment of interest by?

Payment of interest by can be filled out by providing the necessary information about the interest income received.

What is the purpose of payment of interest by?

The purpose of payment of interest by is to report the interest income earned and ensure proper taxation.

What information must be reported on payment of interest by?

Information such as the amount of interest earned, the name of the payer, and any applicable tax withholdings must be reported on payment of interest by.

Fill out your payment of interest by online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Payment Of Interest By is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.