Get the free VERIFICATION WORKSHEET- UNTAXED INCOME 2015-2016 - oxy

Show details

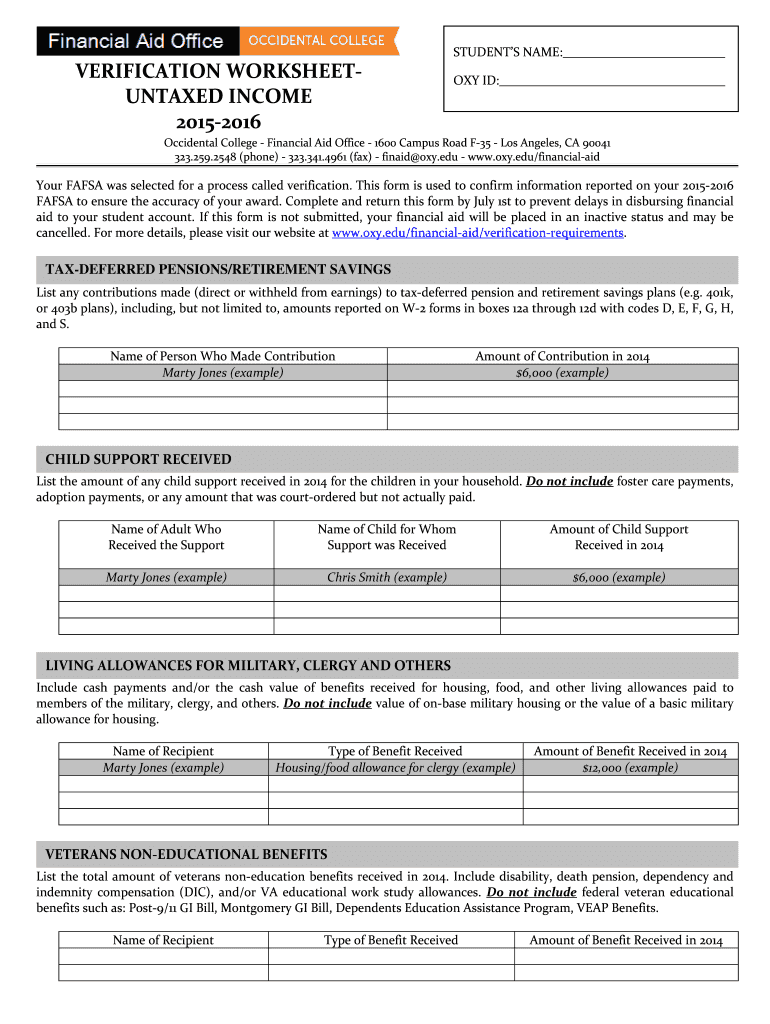

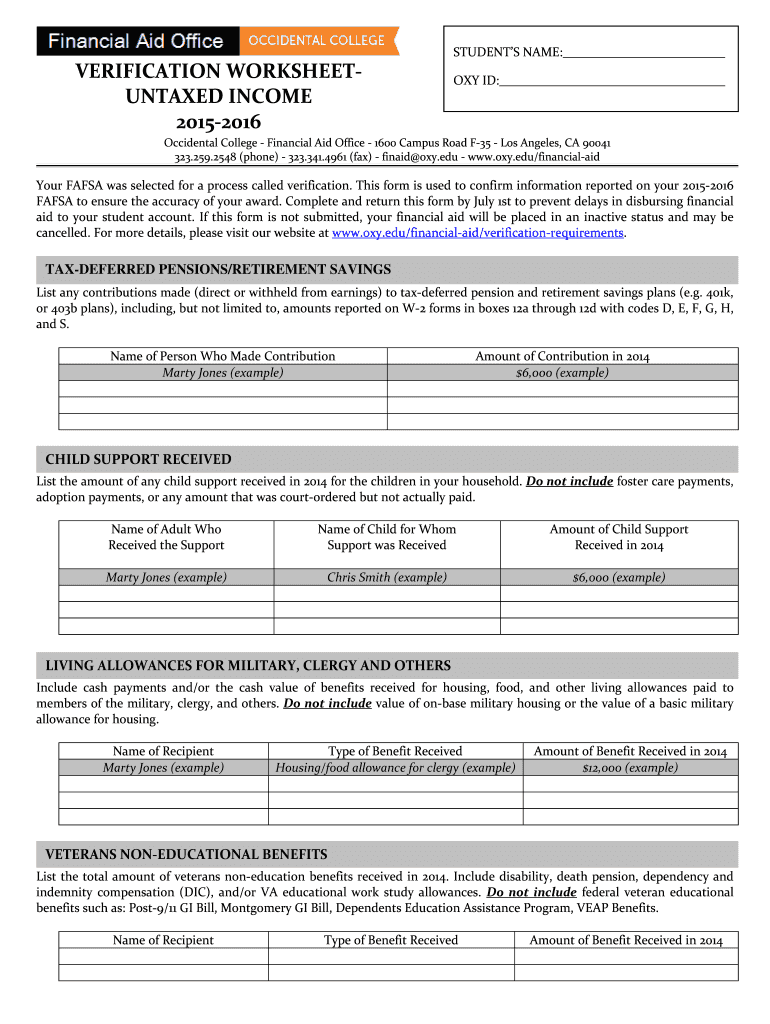

VERIFICATION WORKSHEETUNTAXED INCOME 20152016 STUDENTS NAME: OXY ID: Occidental College Financial Aid Office 1600 Campus Road F35 Los Angeles, CA 90041 323.259.2548 (phone) 323.341.4961 (fax) fin

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign verification worksheet- untaxed income

Edit your verification worksheet- untaxed income form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your verification worksheet- untaxed income form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit verification worksheet- untaxed income online

Use the instructions below to start using our professional PDF editor:

1

Log in to your account. Start Free Trial and register a profile if you don't have one yet.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit verification worksheet- untaxed income. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out verification worksheet- untaxed income

How to fill out verification worksheet- untaxed income:

01

Gather all necessary documents that show your untaxed income, such as W-2 forms, tax returns, or bank statements.

02

Start by entering your personal information at the top of the verification worksheet, including your name, social security number, and student ID.

03

Look for the section on the worksheet that asks for untaxed income information. This section is usually labeled clearly and may be divided into subsections for different types of untaxed income.

04

Begin by entering the name of the income source, such as "Child Support" or "Veteran's Benefits."

05

Provide the amount of untaxed income you receive from each source for the specified period. This may be monthly, yearly, or a certain range of dates.

06

If more than one person in your household receives untaxed income, you may need to divide the amount accordingly. Follow the instructions on the worksheet for this step.

07

Double-check all the information you have entered to ensure accuracy and completeness. Mistakes or missing information could delay the verification process.

08

Sign and date the verification worksheet to certify that the information provided is true and complete.

Page 1 of 2

Who needs verification worksheet- untaxed income?

01

Students applying for financial aid: The verification worksheet for untaxed income is typically required by colleges and universities when students apply for financial aid. It helps determine the student's eligibility for certain types of aid and ensures that the reported income aligns with the information provided on the Free Application for Federal Student Aid (FAFSA).

02

Dependent students: Dependent students, who are claimed as dependents on their parents' tax returns, may need to provide the verification worksheet for untaxed income to demonstrate their financial situation accurately.

03

Independent students: Independent students, who do not have to report their parents' income on the FAFSA, may still need to provide the verification worksheet for untaxed income to provide a complete picture of their financial circumstances.

04

Applicants with significant untaxed income: If you have untaxed income sources that are sizable or have the potential to affect your financial aid eligibility, you may be required to complete the verification worksheet for untaxed income. This helps ensure transparency and fairness in the financial aid process.

Overall, the verification worksheet for untaxed income is an essential tool to accurately evaluate a student's financial need and eligibility for various forms of financial aid.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit verification worksheet- untaxed income from Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including verification worksheet- untaxed income. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

How can I get verification worksheet- untaxed income?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the verification worksheet- untaxed income. Open it immediately and start altering it with sophisticated capabilities.

Can I edit verification worksheet- untaxed income on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute verification worksheet- untaxed income from anywhere with an internet connection. Take use of the app's mobile capabilities.

What is verification worksheet- untaxed income?

Verification worksheet- untaxed income is a form used to report any income that is not taxed such as child support, untaxed pensions, or cash support.

Who is required to file verification worksheet- untaxed income?

Students who are applying for financial aid and have untaxed income are required to file the verification worksheet- untaxed income.

How to fill out verification worksheet- untaxed income?

To fill out the verification worksheet- untaxed income, you must provide detailed information about the untaxed income sources and amounts.

What is the purpose of verification worksheet- untaxed income?

The purpose of the verification worksheet- untaxed income is to ensure that all sources of income are accurately reported for financial aid purposes.

What information must be reported on verification worksheet- untaxed income?

On the verification worksheet- untaxed income, you must report details such as child support received, untaxed pensions, and any other untaxed income sources.

Fill out your verification worksheet- untaxed income online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Verification Worksheet- Untaxed Income is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.