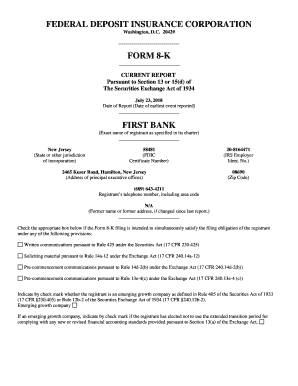

Get the free SBA Business Loan Application - HomeStreet Bank

Show details

Business Banking SBA Business Loan Application SBA 7(A) Loans SBA 504 Loans www.homestreet.com/business/sbalending 18885183090 Homestead Bank SBA Loan Application Company Name: Telephone: () Email

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign sba business loan application

Edit your sba business loan application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your sba business loan application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing sba business loan application online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit sba business loan application. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out sba business loan application

How to fill out an SBA business loan application:

01

Gather all necessary documents: Before you begin filling out the application, make sure you have all the required documents, such as financial statements, tax returns, business licenses, and personal identification.

02

Review the application instructions: Read through the application instructions provided by the Small Business Administration (SBA) carefully. Familiarize yourself with the sections and requirements of the application.

03

Provide business information: Start by entering basic details about your business, including its legal name, address, phone number, and industry classification. Be accurate and provide up-to-date information.

04

Describe your business activities: Provide a brief description of your business activities, including the products or services you offer, target market, and any unique aspects of your business.

05

Outline ownership and management structure: Detail the ownership structure of your business, including percentages owned by each individual or entity. Describe the role and responsibilities of key management personnel.

06

Provide financial information: Fill out the financial information section, including details about your revenue, expenses, assets, and liabilities. Be prepared to provide historical financial statements and projections.

07

Demonstrate loan purpose: Clearly explain the purpose of the loan and how it will be used to benefit your business. Provide a detailed breakdown of how the loan funds will be allocated.

08

Complete personal financial statements: If you are a sole proprietorship or have significant ownership in the business, you may need to submit personal financial statements along with the application. Provide accurate information about your personal assets, liabilities, and income.

09

Answer applicable questions: The application may include various questions regarding your business operations, legal matters, and eligibility criteria. Answer all questions truthfully and provide any necessary supporting documentation.

10

Review and submit: Before submitting the application, review all the information provided to ensure accuracy and completeness. Double-check for any missing or incomplete sections. Once you are confident, submit the application as instructed by the SBA.

Who needs an SBA business loan application?

01

Small business owners: The SBA business loan application is designed for small business owners in need of financing to start, expand, or support their business operations.

02

Entrepreneurs: Individuals who are starting a new business venture and require funding can benefit from the SBA business loan application.

03

Established businesses: Businesses that have been operating for some time but need additional capital to grow, purchase equipment, hire employees, or cover other expenses can utilize the SBA business loan application.

04

Businesses facing financial difficulties: If a business is facing financial challenges or requires assistance to stabilize its operations, the SBA business loan application can be a helpful resource.

05

Minority-owned or disadvantaged businesses: The SBA offers loan programs specifically designed to support minority-owned or disadvantaged businesses, making the application relevant for these individuals or entities.

06

Businesses affected by natural disasters or emergencies: When businesses experience losses or damages due to natural disasters or emergencies, the SBA provides loan programs to help with recovery. In such cases, the SBA business loan application may be necessary.

Note: Eligibility criteria, loan programs, and requirements can vary, so it is crucial to review the specific details provided by the SBA and consult with an expert or lending institution for personalized guidance.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find sba business loan application?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific sba business loan application and other forms. Find the template you need and change it using powerful tools.

Can I sign the sba business loan application electronically in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your sba business loan application.

How do I fill out sba business loan application on an Android device?

Complete your sba business loan application and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

What is sba business loan application?

SBA business loan application is the process of applying for a loan through the Small Business Administration to help small businesses access financing.

Who is required to file sba business loan application?

Small business owners looking for financing to start or grow their business are required to file an SBA business loan application.

How to fill out sba business loan application?

To fill out an SBA business loan application, you need to provide detailed information about your business, finances, and credit history.

What is the purpose of sba business loan application?

The purpose of an SBA business loan application is to help small businesses access affordable financing to support their growth and expansion.

What information must be reported on sba business loan application?

Information such as business financial statements, personal financial statements, business plan, credit history, and collateral may need to be reported on an SBA business loan application.

Fill out your sba business loan application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Sba Business Loan Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.