Get the free Rental Income Expense Worksheet - Tax Preparation

Show details

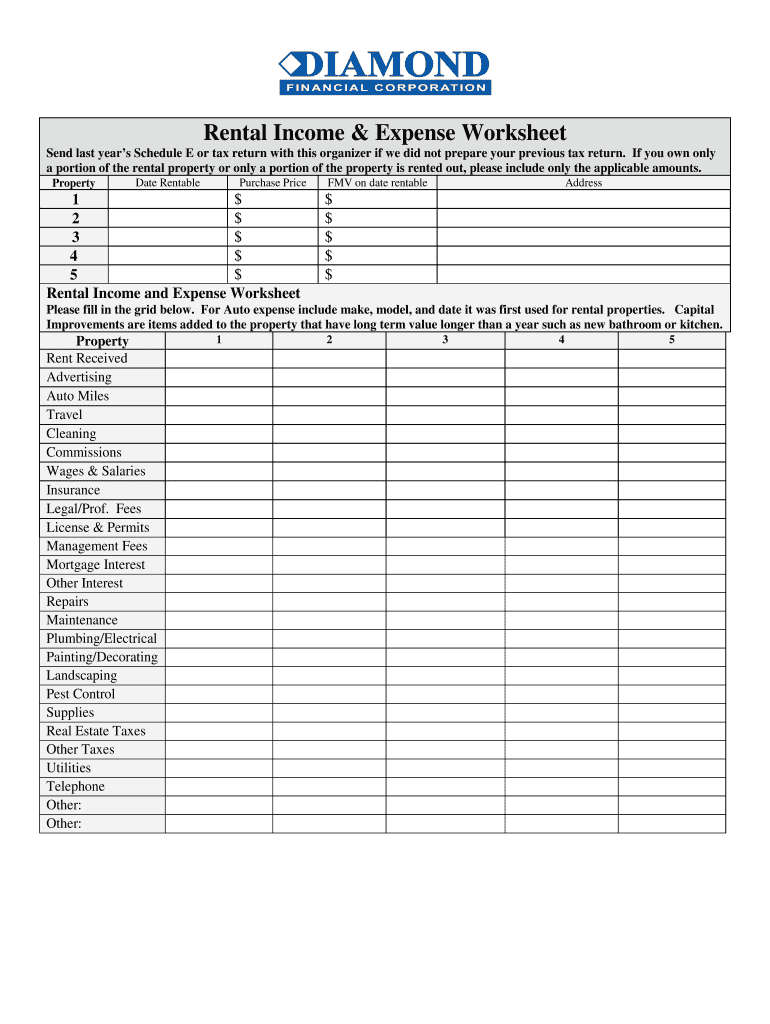

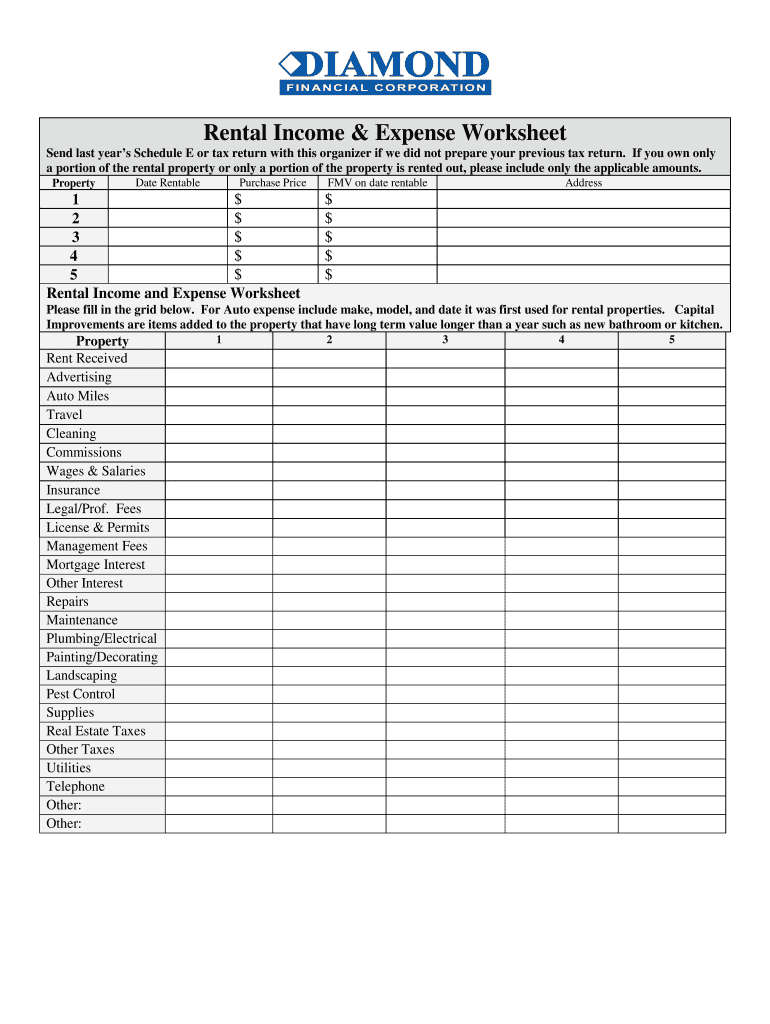

Rental Income & Expense Worksheet Send last year's Schedule E or tax return with this organizer if we did not prepare your previous tax return. If you own only a portion of the rental property or

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign rental income expense worksheet

Edit your rental income expense worksheet form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your rental income expense worksheet form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit rental income expense worksheet online

Use the instructions below to start using our professional PDF editor:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit rental income expense worksheet. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out rental income expense worksheet

How to fill out a rental income expense worksheet:

01

Gather all necessary information: Before filling out the rental income expense worksheet, gather all relevant documents and information related to your rental property. This includes records of rental income, expenses, and any other financial transactions.

02

Input rental income: Begin by entering the rental income you received during the specified timeframe into the worksheet. This can include rent payments, late fees, or any other income generated from your rental property.

03

Record expenses: Next, list all the expenses associated with your rental property. This can include mortgage payments, property taxes, insurance premiums, repairs and maintenance costs, utilities, property management fees, advertising expenses, and any other relevant expenses.

04

Categorize expenses: Categorize your expenses into appropriate categories such as repairs and maintenance, utilities, insurance, property management, etc. This helps in organizing the information and provides a clear overview of your expenses.

05

Calculate totals: Once you have entered all the income and expenses, calculate the totals for both. This will give you a clear picture of your rental income and expenses for the specified timeframe.

06

Consider deductions: Depending on your country's tax laws, you may be eligible for certain deductions related to your rental property. These can include depreciation expenses, travel expenses, or home office deductions. Consult with a tax professional or refer to tax guidelines to determine which deductions you can claim.

07

Review for accuracy: Before finalizing the rental income expense worksheet, review all the entered information for accuracy. Double-check the numbers and ensure that all income and expenses are properly accounted for.

08

Update regularly: It is important to keep your rental income expense worksheet up to date. Update it regularly to reflect any changes in rental income or expenses. This helps to monitor the financial performance of your rental property and facilitates accurate tax reporting.

Who needs a rental income expense worksheet?

01

Landlords: Landlords who own residential or commercial rental properties can benefit from using a rental income expense worksheet. It provides a systematic way to track income and expenses related to their rental property.

02

Property managers: Property managers responsible for managing multiple rental properties can also utilize a rental income expense worksheet. It helps them keep track of the financial aspects of each property, ensuring accurate record-keeping and financial management.

03

Accountants and tax professionals: Accountants and tax professionals who work with clients who own rental properties can use a rental income expense worksheet to help their clients accurately report income and expenses for tax purposes.

Note: It is always advisable to consult with a tax professional or accountant for personalized advice and guidance regarding the use of a rental income expense worksheet and how to accurately report rental income and expenses for tax purposes.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify rental income expense worksheet without leaving Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your rental income expense worksheet into a dynamic fillable form that can be managed and signed using any internet-connected device.

How do I fill out the rental income expense worksheet form on my smartphone?

On your mobile device, use the pdfFiller mobile app to complete and sign rental income expense worksheet. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to discover more about our mobile applications, the features you'll have access to, and how to get started.

How do I edit rental income expense worksheet on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share rental income expense worksheet on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

What is rental income expense worksheet?

The rental income expense worksheet is a detailed document used to track and report the income and expenses related to rental properties.

Who is required to file rental income expense worksheet?

Landlords or property managers who earn rental income from properties are required to file a rental income expense worksheet.

How to fill out rental income expense worksheet?

To fill out a rental income expense worksheet, you need to gather all income and expense information related to the rental property and enter it into the designated sections of the worksheet.

What is the purpose of rental income expense worksheet?

The purpose of a rental income expense worksheet is to accurately track and report the financial aspects of operating a rental property.

What information must be reported on rental income expense worksheet?

On a rental income expense worksheet, you must report rental income received, expenses incurred (such as maintenance, repairs, and taxes), and any additional details related to the property.

Fill out your rental income expense worksheet online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Rental Income Expense Worksheet is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.