Get the free Credit Card Agreement regulated by the Consumer Credit Act

Show details

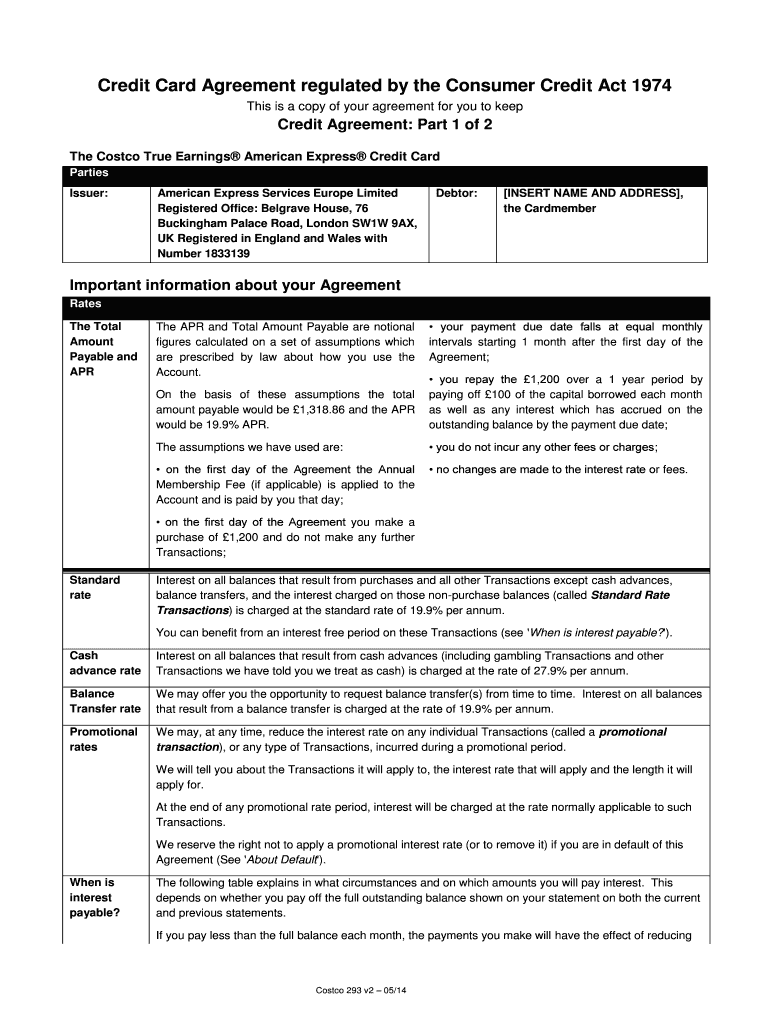

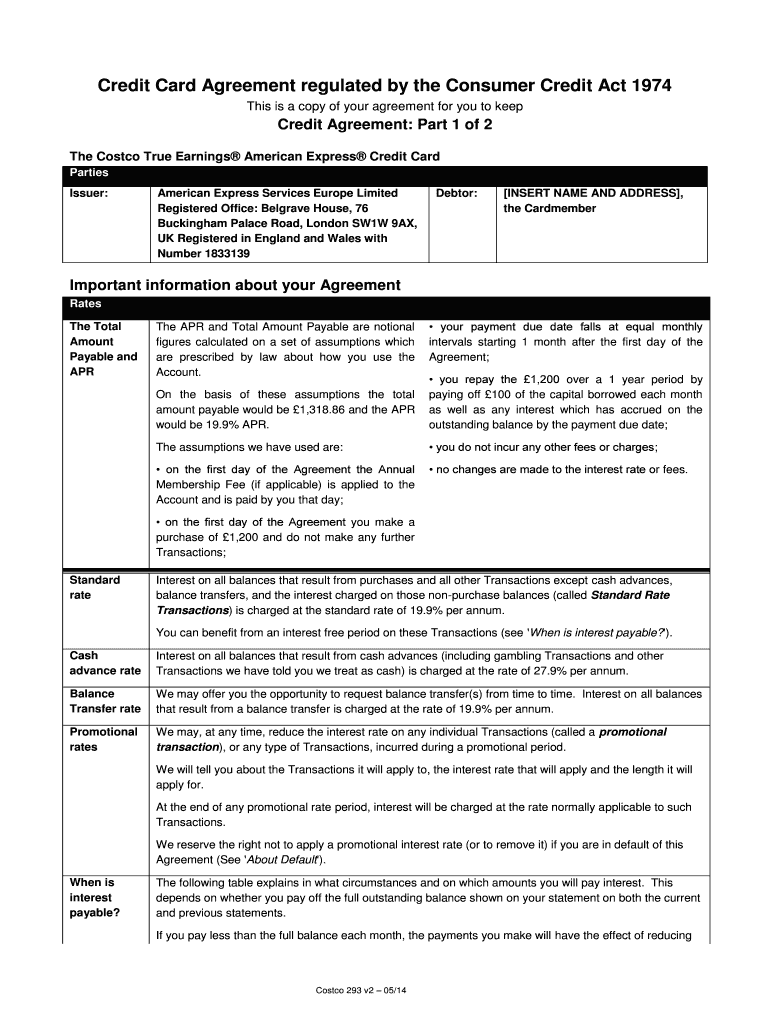

Credit Card Agreement regulated by the Consumer Credit Act 1974 This is a copy of your agreement for you to keep Credit Agreement: Part 1 of 2 The Costco True Earnings American Express Credit Card

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign credit card agreement regulated

Edit your credit card agreement regulated form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your credit card agreement regulated form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing credit card agreement regulated online

In order to make advantage of the professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit credit card agreement regulated. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out credit card agreement regulated

How to fill out a credit card agreement regulated?

01

Read the agreement thoroughly: Start by carefully reading through the credit card agreement. It is essential to understand the terms, fees, interest rates, and any other important information mentioned in the document.

02

Provide accurate personal information: Fill in your personal details accurately, including your full name, address, contact information, and social security number. Make sure all the information provided is correct and up to date.

03

Understand the credit limit and fees: The credit card agreement will specify your credit limit, which is the maximum amount you can borrow on the card. Additionally, it will outline the various fees associated with the card, such as annual fees, late payment fees, and cash advance fees. Take note of these fees to avoid any surprises.

04

Review the interest rates and APR: Pay attention to the interest rates and Annual Percentage Rate (APR) mentioned in the agreement. These determine the cost of borrowing money on the card. Understand how the interest is calculated and whether there are any promotional or introductory rates.

05

Familiarize yourself with the payment terms: The credit card agreement will explain how and when you need to make payments. It may specify the minimum payment due each month and the grace period for avoiding interest charges. Make sure you understand these terms to avoid late payment fees and interest charges.

06

Be aware of the credit card benefits and rewards: Many credit cards offer perks, such as cashback, airline miles, or rewards points. The agreement will outline these benefits and how you can earn and redeem them. Familiarize yourself with the program so you can take full advantage of the rewards offered.

Who needs a credit card agreement regulated?

01

Individuals applying for a credit card: Anyone applying for a credit card should have a regulated credit card agreement that protects their rights and outlines the terms of the credit card usage.

02

Credit card issuers and banks: Credit card issuers and banks also need regulated credit card agreements to ensure they are compliant with financial regulations and establish a clear understanding with their customers.

03

Financial regulatory bodies: Regulatory bodies responsible for overseeing the financial industry need regulated credit card agreements to enforce compliance, protect consumers' interests, and maintain the stability of the financial system.

In conclusion, it is crucial to fill out a credit card agreement regulated by following the provided steps and ensuring accurate personal information, understanding credit limits and fees, reviewing interest rates and APR, familiarizing yourself with payment terms, and being aware of the card's benefits and rewards. This agreement is essential for both individuals applying for a credit card and the credit card issuers, while regulatory bodies rely on regulated agreements to enforce compliance and protect consumers' interests.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send credit card agreement regulated to be eSigned by others?

When your credit card agreement regulated is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

How do I execute credit card agreement regulated online?

Filling out and eSigning credit card agreement regulated is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

How can I fill out credit card agreement regulated on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your credit card agreement regulated, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

What is credit card agreement regulated?

Credit card agreements are regulated by federal laws and regulations to ensure transparency and fairness for consumers.

Who is required to file credit card agreement regulated?

Credit card issuers are required to file credit card agreements with the appropriate regulatory authorities.

How to fill out credit card agreement regulated?

Credit card agreements can be filled out by following the guidelines provided by regulatory authorities and ensuring all relevant information is included.

What is the purpose of credit card agreement regulated?

The purpose of regulating credit card agreements is to protect consumers from unfair practices and ensure clear disclosure of terms and conditions.

What information must be reported on credit card agreement regulated?

Credit card agreements must include information on interest rates, fees, terms and conditions, and other important details related to the card.

Fill out your credit card agreement regulated online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Credit Card Agreement Regulated is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.